In stark contrast to 2022, the stock market in 2023 staged a remarkable comeback. Major indexes like the S&P 500 surged, with the benchmark index closing the year up over 24%. This strong performance reflected a combination of a resilient U.S. economy, easing inflation, and the prospect of lower interest rates. The latter half of the year saw a particularly strong rally, fueled by a December forecast from the Federal Reserve hinting at potential rate cuts in 2024.

Technology stocks were a major driver of the 2023 rally, with the Nasdaq soaring an impressive 43%. This sector benefited from continued strong demand for technology products and services, along with renewed investor confidence. Beyond tech, other sectors also saw significant gains, with communication services companies like Alphabet, Meta, and Netflix experiencing impressive growth. This broad-based rally indicated a more optimistic outlook from investors across the market.

The positive performance in 2023 marked a significant shift from the previous year’s downturn. It highlighted the market’s ability to rebound under favorable economic conditions and shifting investor sentiment.

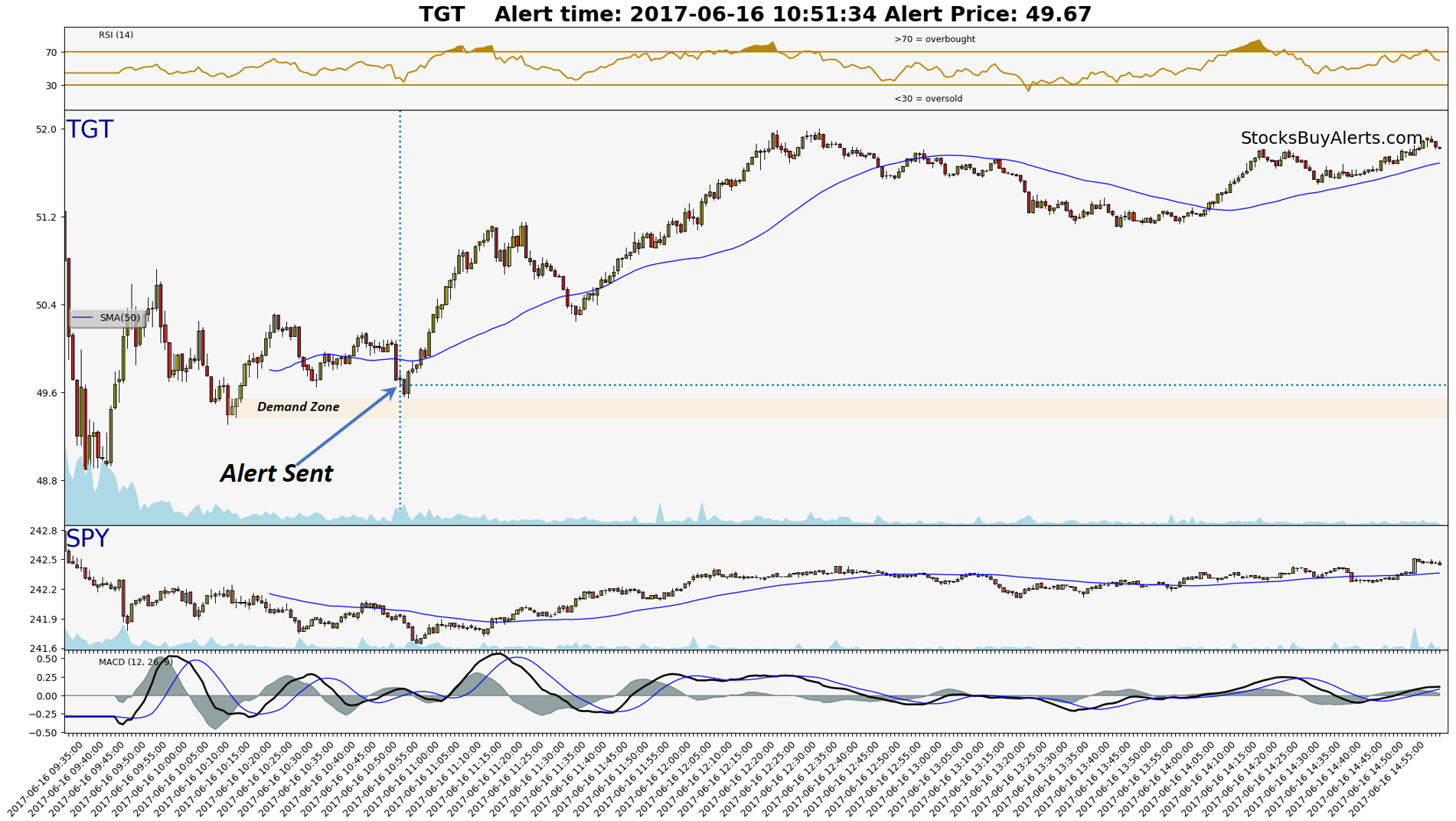

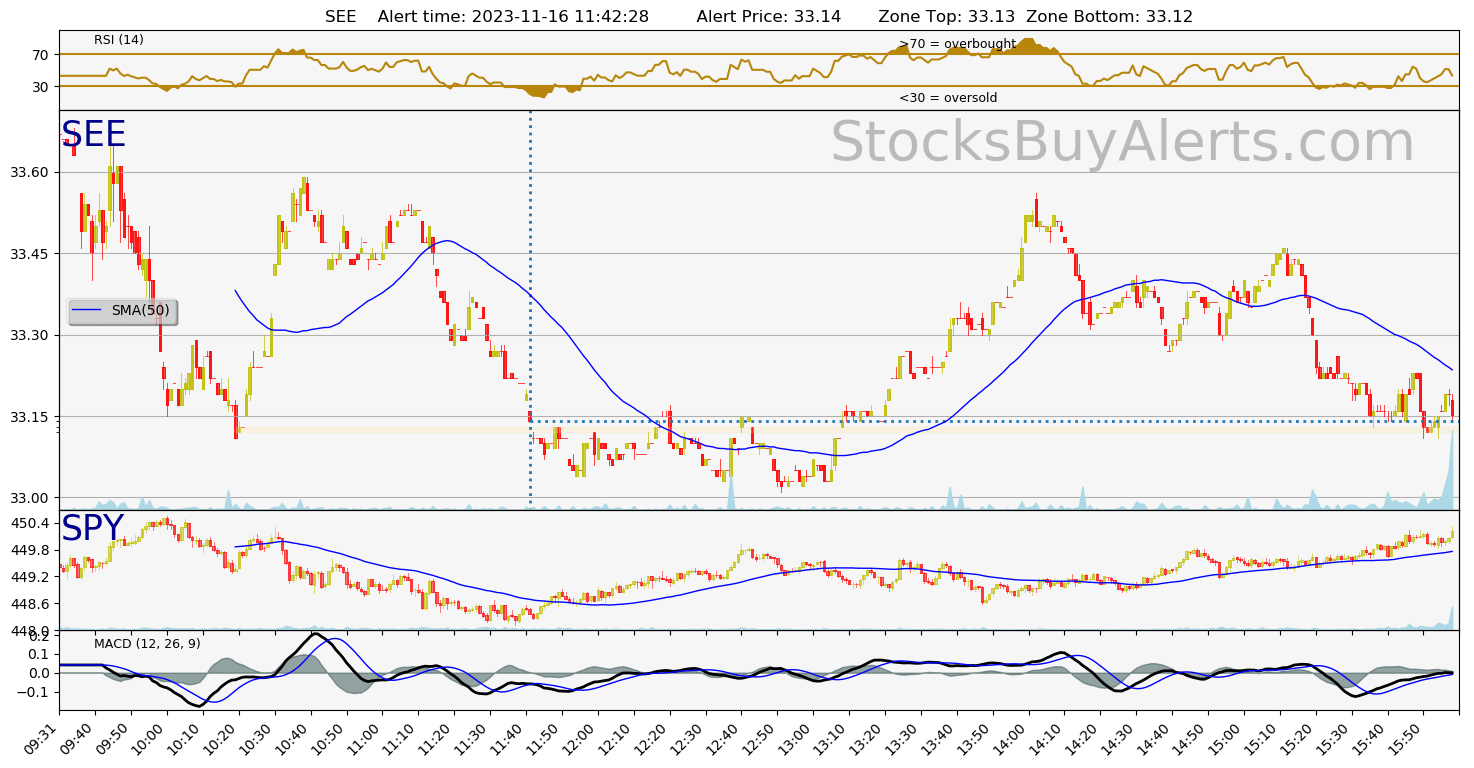

How to read day trading alerts charts

- On the top, you can see the Symbol, Alert Time, Alert price.

- The first chart form the top is RSI index.

- Second, is the price chart of the stock. I decided not to display the price after 3 PM in order to make the charts more readable.

- The third is the SPY price chart for the same timeframe to give you an idea on the market conditions.

- And the last one is MACD for the original symbol.

- Vertical blue dotted line shows the time when a trading alert was sent

- Horizontal blue dotted line shows the price at the moment when the stock trading alert was sent

Day trading alerts of 2023

LRCX on Wednesday, January 04, 2023

| Alert Time: | 2023-01-04 13:02:22 |

| Symbol | LRCX |

| Alert price: | 422.46 |

| Demand zone range: | 421.89 – 421.89 |

| Demand zone time (when it formed): | 2023-01-04 11:25:00 |

| Peak price since zone was formed: | 426.08 (0.86% growth) |

| Day Range: | 416.47 – 428.27 |

| 52wk Range: | 299.59 – 731.85 |

| Prev Close: | 414.3 |

| Open: | 421.64 |

| Bid: | 421.95 |

| Ask: | 422.46 |

Open interactive stock chart for LRCX

RRC on Thursday, January 05, 2023

| Alert Time: | 2023-01-05 12:38:37 |

| Symbol | RRC |

| Alert price: | 23.36 |

| Demand zone range: | 23.315 – 23.33 |

| Demand zone time (when it formed): | 2023-01-05 12:15:00 |

| Peak price since zone was formed: | 23.515 (0.66% growth) |

| Day Range: | 23.3 – 24.39 |

| 52wk Range: | 16.71 – 37.44 |

| Prev Close: | 24.37 |

| Open: | 23.99 |

| Bid: | 23.35 |

| Ask: | 23.36 |

Open interactive stock chart for RRC

SRE on Friday, January 06, 2023

| Alert Time: | 2023-01-06 11:35:59 |

| Symbol | SRE |

| Alert price: | 155.05 |

| Demand zone range: | 154.79 – 154.84 |

| Demand zone time (when it formed): | 2023-01-06 10:03:00 |

| Peak price since zone was formed: | 156.36 (0.84% growth) |

| Day Range: | 154.33 – 156.36 |

| 52wk Range: | 129.69 – 176.47 |

| Prev Close: | 152.48 |

| Open: | 154.33 |

| Bid: | 154.94 |

| Ask: | 155.05 |

Open interactive stock chart for SRE

FLS on Monday, January 09, 2023

| Alert Time: | 2023-01-09 14:05:44 |

| Symbol | FLS |

| Alert price: | 32.12 |

| Demand zone range: | 32.1 – 32.11 |

| Demand zone time (when it formed): | 2023-01-09 11:27:00 |

| Peak price since zone was formed: | 32.46 (1.06% growth) |

| Day Range: | 31.43 – 32.46 |

| 52wk Range: | 23.89 – 37.59 |

| Prev Close: | 31.51 |

| Open: | 31.63 |

| Bid: | 32.08 |

| Ask: | 32.12 |

Open interactive stock chart for FLS

TSLA on Tuesday, January 10, 2023

| Alert Time: | 2023-01-10 12:00:58 |

| Symbol | TSLA |

| Alert price: | 115.78 |

| Demand zone range: | 115.44 – 115.73 |

| Demand zone time (when it formed): | 2023-01-10 11:00:00 |

| Peak price since zone was formed: | 117.08 (1.12% growth) |

| Day Range: | 114.92 – 122.76 |

| 52wk Range: | 101.81 – 384.29 |

| Prev Close: | 119.77 |

| Open: | 121.07 |

| Bid: | 115.76 |

| Ask: | 115.78 |

Open interactive stock chart for TSLA

PKI on Wednesday, January 11, 2023

| Alert Time: | 2023-01-11 11:12:15 |

| Symbol | PKI |

| Alert price: | 135.3 |

| Demand zone range: | 134.99 – 135.1 |

| Demand zone time (when it formed): | 2023-01-11 10:06:00 |

| Peak price since zone was formed: | 137.72 (1.79% growth) |

| Day Range: | 128.91 – 137.79 |

| 52wk Range: | 113.46 – 190.56 |

| Prev Close: | 133.4 |

| Open: | 134.27 |

| Bid: | 135.16 |

| Ask: | 135.3 |

Open interactive stock chart for PKI

KMX on Thursday, January 12, 2023

| Alert Time: | 2023-01-12 11:01:33 |

| Symbol | KMX |

| Alert price: | 65.86 |

| Demand zone range: | 65.62 – 65.78 |

| Demand zone time (when it formed): | 2023-01-12 10:45:00 |

| Peak price since zone was formed: | 66.25 (0.59% growth) |

| Day Range: | 65.53 – 68.27 |

| 52wk Range: | 52.1 – 120.58 |

| Prev Close: | 67.43 |

| Open: | 68.06 |

| Bid: | 65.78 |

| Ask: | 65.86 |

Open interactive stock chart for KMX

JWN on Friday, January 13, 2023

| Alert Time: | 2023-01-13 14:43:04 |

| Symbol | JWN |

| Alert price: | 17.7 |

| Demand zone range: | 17.66 – 17.68 |

| Demand zone time (when it formed): | 2023-01-13 11:35:00 |

| Peak price since zone was formed: | 17.88 (1.02% growth) |

| Day Range: | 17.2 – 17.88 |

| 52wk Range: | 15.53 – 29.59 |

| Prev Close: | 17.52 |

| Open: | 17.23 |

| Bid: | 17.69 |

| Ask: | 17.7 |

Open interactive stock chart for JWN

M on Wednesday, January 18, 2023

| Alert Time: | 2023-01-18 11:43:07 |

| Symbol | M |

| Alert price: | 23.13 |

| Demand zone range: | 23.09 – 23.1 |

| Demand zone time (when it formed): | 2023-01-18 11:10:00 |

| Peak price since zone was formed: | 23.29 (0.69% growth) |

| Day Range: | 23.09 – 23.72 |

| 52wk Range: | 15.1 – 28.21 |

| Prev Close: | 22.9 |

| Open: | 23.16 |

| Bid: | 23.12 |

| Ask: | 23.13 |

Open interactive stock chart for M

IRM on Thursday, January 19, 2023

| Alert Time: | 2023-01-19 13:28:04 |

| Symbol | IRM |

| Alert price: | 51.34 |

| Demand zone range: | 51.25 – 51.27 |

| Demand zone time (when it formed): | 2023-01-19 11:51:00 |

| Peak price since zone was formed: | 51.87 (1.03% growth) |

| Day Range: | 51.23 – 52.11 |

| 52wk Range: | 41.67 – 58.61 |

| Prev Close: | 52.07 |

| Open: | 51.74 |

| Bid: | 51.28 |

| Ask: | 51.34 |

Open interactive stock chart for IRM

ITW on Monday, January 23, 2023

| Alert Time: | 2023-01-23 14:40:12 |

| Symbol | ITW |

| Alert price: | 228.22 |

| Demand zone range: | 227.91 – 227.91 |

| Demand zone time (when it formed): | 2023-01-23 10:50:00 |

| Peak price since zone was formed: | 230.35 (0.93% growth) |

| Day Range: | 225.2 – 230.32 |

| 52wk Range: | 173.52 – 247 |

| Prev Close: | 226.28 |

| Open: | 226.14 |

| Bid: | 228.14 |

| Ask: | 228.22 |

Open interactive stock chart for ITW

MKC on Thursday, January 26, 2023

| Alert Time: | 2023-01-26 10:56:42 |

| Symbol | MKC |

| Alert price: | 72.72 |

| Demand zone range: | 72.44 – 72.63 |

| Demand zone time (when it formed): | 2023-01-26 10:41:00 |

| Peak price since zone was formed: | 73.33 (0.84% growth) |

| Day Range: | 72.25 – 74.9 |

| 52wk Range: | 71.19 – 107.35 |

| Prev Close: | 77.98 |

| Open: | 73.55 |

| Bid: | 72.6 |

| Ask: | 72.72 |

Open interactive stock chart for MKC

KLAC on Friday, January 27, 2023

| Alert Time: | 2023-01-27 13:17:39 |

| Symbol | KLAC |

| Alert price: | 405.42 |

| Demand zone range: | 404.02 – 404.88 |

| Demand zone time (when it formed): | 2023-01-27 11:08:00 |

| Peak price since zone was formed: | 409.4 (0.98% growth) |

| Day Range: | 395.29 – 410.42 |

| 52wk Range: | 250.2 – 429.46 |

| Prev Close: | 428.76 |

| Open: | 405.1 |

| Bid: | 405 |

| Ask: | 405.42 |

Open interactive stock chart for KLAC

MRO on Monday, January 30, 2023

| Alert Time: | 2023-01-30 11:41:07 |

| Symbol | MRO |

| Alert price: | 27.74 |

| Demand zone range: | 27.65 – 27.71 |

| Demand zone time (when it formed): | 2023-01-30 09:58:00 |

| Peak price since zone was formed: | 28.08 (1.23% growth) |

| Day Range: | 27.65 – 28.08 |

| 52wk Range: | 19.11 – 33.42 |

| Prev Close: | 28.31 |

| Open: | 27.91 |

| Bid: | 27.73 |

| Ask: | 27.74 |

Open interactive stock chart for MRO

HES on Tuesday, January 31, 2023

| Alert Time: | 2023-01-31 12:21:02 |

| Symbol | HES |

| Alert price: | 150.52 |

| Demand zone range: | 149.93 – 150.3 |

| Demand zone time (when it formed): | 2023-01-31 10:09:00 |

| Peak price since zone was formed: | 152.81 (1.52% growth) |

| Day Range: | 149.75 – 152.88 |

| 52wk Range: | 88.86 – 160.52 |

| Prev Close: | 151.77 |

| Open: | 150.87 |

| Bid: | 150.42 |

| Ask: | 150.52 |

Open interactive stock chart for HES

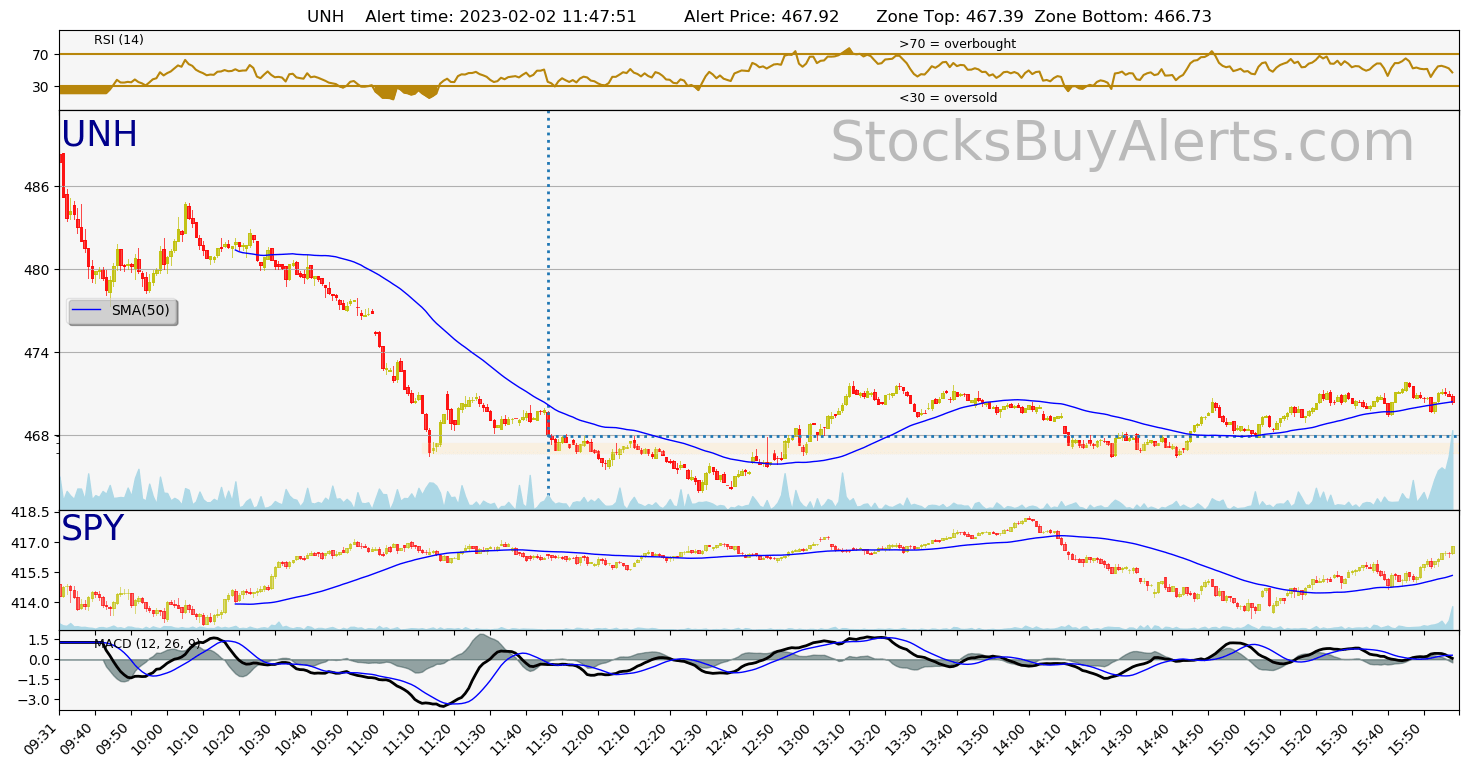

UNH on Thursday, February 02, 2023

| Alert Time: | 2023-02-02 11:47:51 |

| Symbol | UNH |

| Alert price: | 468.09 |

| Demand zone range: | 466.73 – 467.39 |

| Demand zone time (when it formed): | 2023-02-02 11:12:00 |

| Peak price since zone was formed: | 471.16 (0.66% growth) |

| Day Range: | 466.51 – 495 |

| 52wk Range: | 445.74 – 558.1 |

| Prev Close: | 497 |

| Open: | 493.13 |

| Bid: | 468 |

| Ask: | 468.09 |

Open interactive stock chart for UNH

CCI on Friday, February 03, 2023

| Alert Time: | 2023-02-03 10:23:58 |

| Symbol | CCI |

| Alert price: | 146.22 |

| Demand zone range: | 145.75 – 146.02 |

| Demand zone time (when it formed): | 2023-02-03 10:05:00 |

| Peak price since zone was formed: | 147.17 (0.65% growth) |

| Day Range: | 145.75 – 150.63 |

| 52wk Range: | 121.71 – 199.97 |

| Prev Close: | 152.54 |

| Open: | 150.19 |

| Bid: | 146.08 |

| Ask: | 146.22 |

Open interactive stock chart for CCI

FSLR on Tuesday, February 07, 2023

| Alert Time: | 2023-02-07 10:44:01 |

| Symbol | FSLR |

| Alert price: | 162.93 |

| Demand zone range: | 162.36 – 162.76 |

| Demand zone time (when it formed): | 2023-02-07 10:27:00 |

| Peak price since zone was formed: | 163.91 (0.6% growth) |

| Day Range: | 162.36 – 168.39 |

| 52wk Range: | 59.6 – 185.28 |

| Prev Close: | 167.47 |

| Open: | 168.38 |

| Bid: | 162.8 |

| Ask: | 162.93 |

Open interactive stock chart for FSLR

PAYC on Wednesday, February 08, 2023

| Alert Time: | 2023-02-08 11:04:15 |

| Symbol | PAYC |

| Alert price: | 314.34 |

| Demand zone range: | 312.88 – 313.88 |

| Demand zone time (when it formed): | 2023-02-08 10:32:00 |

| Peak price since zone was formed: | 317.56 (1.02% growth) |

| Day Range: | 312.45 – 330.71 |

| 52wk Range: | 255.82 – 402.78 |

| Prev Close: | 344.52 |

| Open: | 330.01 |

| Bid: | 313.74 |

| Ask: | 314.34 |

Open interactive stock chart for PAYC

EFX on Thursday, February 09, 2023

| Alert Time: | 2023-02-09 12:41:51 |

| Symbol | EFX |

| Alert price: | 207.49 |

| Demand zone range: | 206.86 – 207.18 |

| Demand zone time (when it formed): | 2023-02-09 11:32:00 |

| Peak price since zone was formed: | 209.38 (0.91% growth) |

| Day Range: | 206.83 – 218.84 |

| 52wk Range: | 145.98 – 243.79 |

| Prev Close: | 220.2 |

| Open: | 209.96 |

| Bid: | 207.29 |

| Ask: | 207.49 |

Open interactive stock chart for EFX

HP on Friday, February 10, 2023

| Alert Time: | 2023-02-10 10:51:20 |

| Symbol | HP |

| Alert price: | 44.15 |

| Demand zone range: | 43.9 – 44.09 |

| Demand zone time (when it formed): | 2023-02-10 10:02:00 |

| Peak price since zone was formed: | 44.86 (1.61% growth) |

| Day Range: | 43.46 – 44.86 |

| 52wk Range: | 31.99 – 54.45 |

| Prev Close: | 43.06 |

| Open: | 43.51 |

| Bid: | 44.1 |

| Ask: | 44.15 |

Open interactive stock chart for HP

RIG on Wednesday, February 22, 2023

| Alert Time: | 2023-02-22 14:15:35 |

| Symbol | RIG |

| Alert price: | 6.06 |

| Demand zone range: | 6.06 – 6.07 |

| Demand zone time (when it formed): | 2023-02-22 14:04:00 |

| Peak price since zone was formed: | 6.1 (0.66% growth) |

| Day Range: | 5.63 – 6.5 |

| 52wk Range: | 2.32 – 7.69 |

| Prev Close: | 6.84 |

| Open: | 6.4 |

| Bid: | 6.05 |

| Ask: | 6.06 |

Open interactive stock chart for RIG

ETSY on Friday, February 24, 2023

| Alert Time: | 2023-02-24 12:20:16 |

| Symbol | ETSY |

| Alert price: | 125.21 |

| Demand zone range: | 124.94 – 125.09 |

| Demand zone time (when it formed): | 2023-02-24 11:21:00 |

| Peak price since zone was formed: | 127.13 (1.53% growth) |

| Day Range: | 123.6 – 129.05 |

| 52wk Range: | 67.01 – 163.84 |

| Prev Close: | 131.58 |

| Open: | 127.89 |

| Bid: | 125.04 |

| Ask: | 125.21 |

Open interactive stock chart for ETSY

UHS on Wednesday, March 01, 2023

| Alert Time: | 2023-03-01 11:09:11 |

| Symbol | UHS |

| Alert price: | 129.69 |

| Demand zone range: | 129.49 – 129.53 |

| Demand zone time (when it formed): | 2023-03-01 10:52:00 |

| Peak price since zone was formed: | 130.43 (0.57% growth) |

| Day Range: | 127.25 – 131.67 |

| 52wk Range: | 82.5 – 158.28 |

| Prev Close: | 133.57 |

| Open: | 131.22 |

| Bid: | 129.55 |

| Ask: | 129.69 |

Open interactive stock chart for UHS

ALB on Wednesday, March 01, 2023

| Alert Time: | 2023-03-01 14:19:39 |

| Symbol | ALB |

| Alert price: | 251.28 |

| Demand zone range: | 250.81 – 250.92 |

| Demand zone time (when it formed): | 2023-03-01 12:41:00 |

| Peak price since zone was formed: | 253.17 (0.75% growth) |

| Day Range: | 249.81 – 256.27 |

| 52wk Range: | 170.01 – 334.55 |

| Prev Close: | 254.31 |

| Open: | 255.66 |

| Bid: | 251.11 |

| Ask: | 251.28 |

Open interactive stock chart for ALB

DISH on Thursday, March 02, 2023

| Alert Time: | 2023-03-02 13:24:31 |

| Symbol | DISH |

| Alert price: | 10.67 |

| Demand zone range: | 10.64 – 10.66 |

| Demand zone time (when it formed): | 2023-03-02 12:57:00 |

| Peak price since zone was formed: | 10.74 (0.66% growth) |

| Day Range: | 10.64 – 11.13 |

| 52wk Range: | 10.64 – 33.74 |

| Prev Close: | 11.18 |

| Open: | 11.05 |

| Bid: | 10.66 |

| Ask: | 10.67 |

Open interactive stock chart for DISH

ETSY on Monday, March 13, 2023

| Alert Time: | 2023-03-13 12:51:33 |

| Symbol | ETSY |

| Alert price: | 104.46 |

| Demand zone range: | 104 – 104.31 |

| Demand zone time (when it formed): | 2023-03-13 11:25:00 |

| Peak price since zone was formed: | 106.37 (1.83% growth) |

| Day Range: | 99.31 – 106.37 |

| 52wk Range: | 67.01 – 151.5 |

| Prev Close: | 105.98 |

| Open: | 103.11 |

| Bid: | 104.33 |

| Ask: | 104.46 |

Open interactive stock chart for ETSY

USB on Tuesday, March 14, 2023

| Alert Time: | 2023-03-14 10:57:37 |

| Symbol | USB |

| Alert price: | 37.35 |

| Demand zone range: | 37.2 – 37.3 |

| Demand zone time (when it formed): | 2023-03-14 10:19:00 |

| Peak price since zone was formed: | 37.9 (1.47% growth) |

| Day Range: | 37.2 – 39.67 |

| 52wk Range: | 36.13 – 57.92 |

| Prev Close: | 36.54 |

| Open: | 39.11 |

| Bid: | 37.34 |

| Ask: | 37.35 |

Open interactive stock chart for USB

LEN on Wednesday, March 15, 2023

| Alert Time: | 2023-03-15 12:14:07 |

| Symbol | LEN |

| Alert price: | 100.24 |

| Demand zone range: | 99.86 – 100.09 |

| Demand zone time (when it formed): | 2023-03-15 11:37:00 |

| Peak price since zone was formed: | 100.95 (0.71% growth) |

| Day Range: | 99.85 – 103.98 |

| 52wk Range: | 62.54 – 109.28 |

| Prev Close: | 100.77 |

| Open: | 102.28 |

| Bid: | 100.1 |

| Ask: | 100.24 |

Open interactive stock chart for LEN

KSS on Thursday, March 16, 2023

| Alert Time: | 2023-03-16 13:49:54 |

| Symbol | KSS |

| Alert price: | 23.28 |

| Demand zone range: | 23.22 – 23.25 |

| Demand zone time (when it formed): | 2023-03-16 11:31:00 |

| Peak price since zone was formed: | 23.74 (1.98% growth) |

| Day Range: | 22.65 – 23.74 |

| 52wk Range: | 21.47 – 63.74 |

| Prev Close: | 23.19 |

| Open: | 22.98 |

| Bid: | 23.27 |

| Ask: | 23.28 |

Open interactive stock chart for KSS

CTLT on Friday, March 17, 2023

| Alert Time: | 2023-03-17 10:40:49 |

| Symbol | CTLT |

| Alert price: | 67.58 |

| Demand zone range: | 67.38 – 67.5 |

| Demand zone time (when it formed): | 2023-03-17 10:14:00 |

| Peak price since zone was formed: | 67.94 (0.53% growth) |

| Day Range: | 67.38 – 69.5 |

| 52wk Range: | 40.69 – 115.34 |

| Prev Close: | 71.2 |

| Open: | 69.5 |

| Bid: | 67.51 |

| Ask: | 67.58 |

Open interactive stock chart for CTLT

KSS on Monday, March 20, 2023

| Alert Time: | 2023-03-20 11:42:58 |

| Symbol | KSS |

| Alert price: | 23.34 |

| Demand zone range: | 23.28 – 23.31 |

| Demand zone time (when it formed): | 2023-03-20 10:19:00 |

| Peak price since zone was formed: | 23.64 (1.29% growth) |

| Day Range: | 23.27 – 23.85 |

| 52wk Range: | 21.47 – 63.4 |

| Prev Close: | 23.23 |

| Open: | 23.27 |

| Bid: | 23.33 |

| Ask: | 23.34 |

Open interactive stock chart for KSS

JKHY on Tuesday, March 21, 2023

| Alert Time: | 2023-03-21 13:01:40 |

| Symbol | JKHY |

| Alert price: | 151.62 |

| Demand zone range: | 151.04 – 151.43 |

| Demand zone time (when it formed): | 2023-03-21 10:54:00 |

| Peak price since zone was formed: | 152.82 (0.79% growth) |

| Day Range: | 151.04 – 153.94 |

| 52wk Range: | 139.28 – 212.62 |

| Prev Close: | 152.01 |

| Open: | 153.24 |

| Bid: | 151.54 |

| Ask: | 151.62 |

Open interactive stock chart for JKHY

FRC on Thursday, March 23, 2023

| Alert Time: | 2023-03-23 14:07:40 |

| Symbol | FRC |

| Alert price: | 12.08 |

| Demand zone range: | 12 – 12.07 |

| Demand zone time (when it formed): | 2023-03-23 12:13:00 |

| Peak price since zone was formed: | 12.69 (5.05% growth) |

| Day Range: | 12 – 14.65 |

| 52wk Range: | 11.52 – 173.99 |

| Prev Close: | 13.33 |

| Open: | 14.17 |

| Bid: | 12.07 |

| Ask: | 12.08 |

Open interactive stock chart for FRC

RCL on Monday, March 27, 2023

| Alert Time: | 2023-03-27 10:59:56 |

| Symbol | RCL |

| Alert price: | 60.85 |

| Demand zone range: | 60.65 – 60.76 |

| Demand zone time (when it formed): | 2023-03-27 10:42:00 |

| Peak price since zone was formed: | 61.17 (0.53% growth) |

| Day Range: | 60.57 – 63.5 |

| 52wk Range: | 31.09 – 87.68 |

| Prev Close: | 60.85 |

| Open: | 62.21 |

| Bid: | 60.79 |

| Ask: | 60.85 |

Open interactive stock chart for RCL

DVN on Tuesday, March 28, 2023

| Alert Time: | 2023-03-28 14:24:47 |

| Symbol | DVN |

| Alert price: | 48.45 |

| Demand zone range: | 48.32 – 48.38 |

| Demand zone time (when it formed): | 2023-03-28 10:53:00 |

| Peak price since zone was formed: | 49.22 (1.59% growth) |

| Day Range: | 47.68 – 49.22 |

| 52wk Range: | 44.03 – 79.4 |

| Prev Close: | 48.08 |

| Open: | 47.7 |

| Bid: | 48.44 |

| Ask: | 48.45 |

Open interactive stock chart for DVN

FRC on Wednesday, March 29, 2023

| Alert Time: | 2023-03-29 11:07:55 |

| Symbol | FRC |

| Alert price: | 13.98 |

| Demand zone range: | 13.9 – 13.96 |

| Demand zone time (when it formed): | 2023-03-29 10:51:00 |

| Peak price since zone was formed: | 14.12 (1% growth) |

| Day Range: | 13.19 – 14.93 |

| 52wk Range: | 11.52 – 173.99 |

| Prev Close: | 13.5 |

| Open: | 13.22 |

| Bid: | 13.96 |

| Ask: | 13.98 |

Open interactive stock chart for FRC

CCL on Thursday, March 30, 2023

| Alert Time: | 2023-03-30 12:58:41 |

| Symbol | CCL |

| Alert price: | 10.15 |

| Demand zone range: | 10.12 – 10.14 |

| Demand zone time (when it formed): | 2023-03-30 11:13:00 |

| Peak price since zone was formed: | 10.29 (1.38% growth) |

| Day Range: | 10.06 – 10.3 |

| 52wk Range: | 6.11 – 21.5 |

| Prev Close: | 9.89 |

| Open: | 10.13 |

| Bid: | 10.14 |

| Ask: | 10.15 |

Open interactive stock chart for CCL

VNO on Monday, April 03, 2023

| Alert Time: | 2023-04-03 11:25:36 |

| Symbol | VNO |

| Alert price: | 15.58 |

| Demand zone range: | 15.58 – 15.6 |

| Demand zone time (when it formed): | 2023-04-03 11:15:00 |

| Peak price since zone was formed: | 15.66 (0.51% growth) |

| Day Range: | 15.53 – 16.3 |

| 52wk Range: | 12.53 – 45.25 |

| Prev Close: | 15.37 |

| Open: | 15.8 |

| Bid: | 15.57 |

| Ask: | 15.58 |

Open interactive stock chart for VNO

ZION on Wednesday, April 05, 2023

| Alert Time: | 2023-04-05 10:28:54 |

| Symbol | ZION |

| Alert price: | 27.2 |

| Demand zone range: | 27.12 – 27.17 |

| Demand zone time (when it formed): | 2023-04-05 10:17:00 |

| Peak price since zone was formed: | 27.46 (0.96% growth) |

| Day Range: | 26.93 – 28.01 |

| 52wk Range: | 22.55 – 66.9 |

| Prev Close: | 27.71 |

| Open: | 27.72 |

| Bid: | 27.19 |

| Ask: | 27.2 |

Open interactive stock chart for ZION

URBN on Thursday, April 06, 2023

| Alert Time: | 2023-04-06 13:56:05 |

| Symbol | URBN |

| Alert price: | 26.36 |

| Demand zone range: | 26.33 – 26.33 |

| Demand zone time (when it formed): | 2023-04-06 10:42:00 |

| Peak price since zone was formed: | 26.68 (1.21% growth) |

| Day Range: | 26.33 – 26.73 |

| 52wk Range: | 17.81 – 29.74 |

| Prev Close: | 26.72 |

| Open: | 26.6 |

| Bid: | 26.35 |

| Ask: | 26.36 |

Open interactive stock chart for URBN

FRC on Monday, April 10, 2023

| Alert Time: | 2023-04-10 11:18:13 |

| Symbol | FRC |

| Alert price: | 13.83 |

| Demand zone range: | 13.76 – 13.82 |

| Demand zone time (when it formed): | 2023-04-10 10:26:00 |

| Peak price since zone was formed: | 14.05 (1.59% growth) |

| Day Range: | 13.44 – 14.05 |

| 52wk Range: | 11.52 – 171.09 |

| Prev Close: | 14.03 |

| Open: | 13.5 |

| Bid: | 13.81 |

| Ask: | 13.83 |

Open interactive stock chart for FRC

VTR on Tuesday, April 11, 2023

| Alert Time: | 2023-04-11 11:18:37 |

| Symbol | VTR |

| Alert price: | 44.61 |

| Demand zone range: | 44.47 – 44.55 |

| Demand zone time (when it formed): | 2023-04-11 10:00:00 |

| Peak price since zone was formed: | 45.11 (1.12% growth) |

| Day Range: | 43.9 – 45.11 |

| 52wk Range: | 35.33 – 62.07 |

| Prev Close: | 43.88 |

| Open: | 44.06 |

| Bid: | 44.6 |

| Ask: | 44.61 |

Open interactive stock chart for VTR

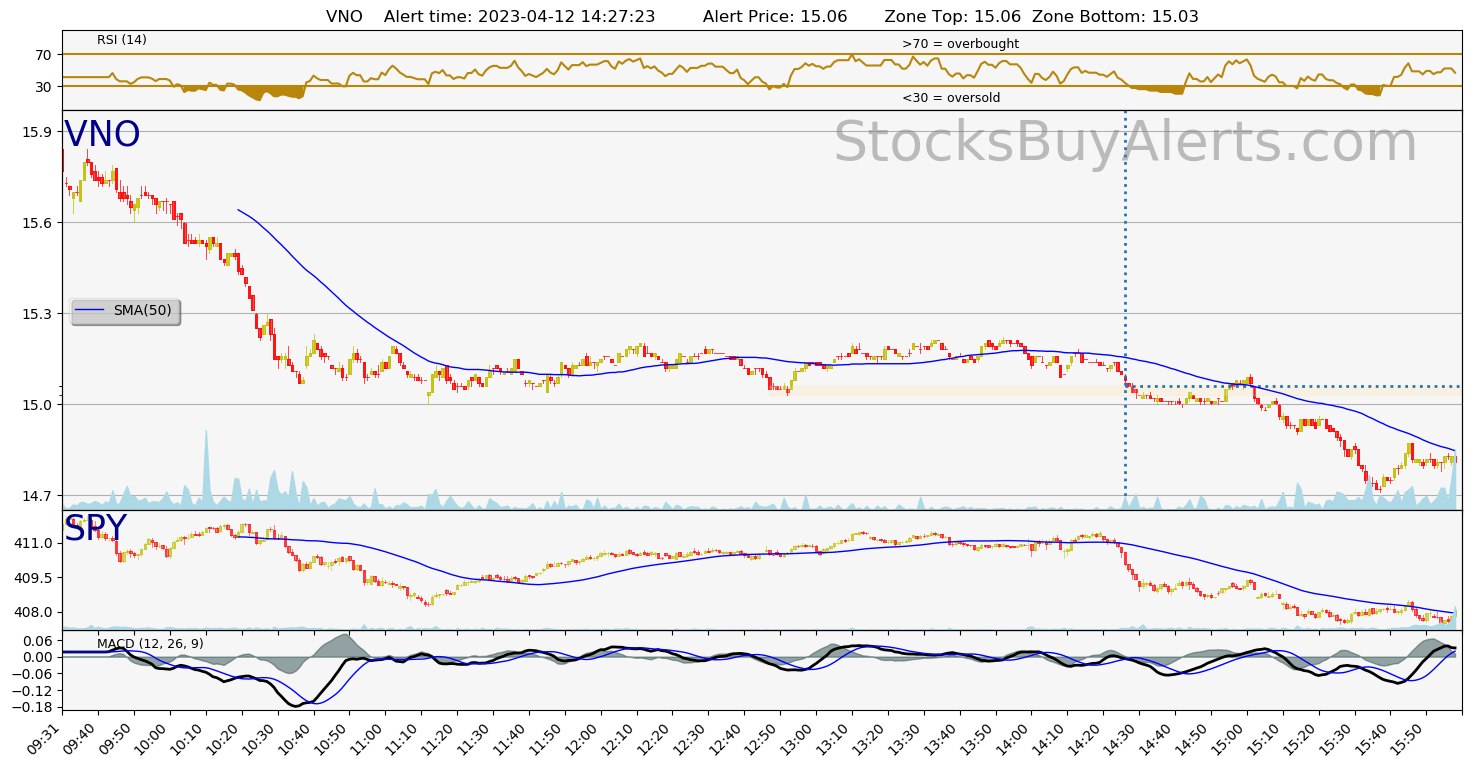

VNO on Wednesday, April 12, 2023

| Alert Time: | 2023-04-12 14:27:23 |

| Symbol | VNO |

| Alert price: | 15.08 |

| Demand zone range: | 15.03 – 15.06 |

| Demand zone time (when it formed): | 2023-04-12 12:48:00 |

| Peak price since zone was formed: | 15.22 (0.93% growth) |

| Day Range: | 15.01 – 15.92 |

| 52wk Range: | 12.53 – 42.68 |

| Prev Close: | 15.66 |

| Open: | 15.92 |

| Bid: | 15.07 |

| Ask: | 15.08 |

Open interactive stock chart for VNO

WDC on Thursday, April 13, 2023

| Alert Time: | 2023-04-13 13:23:50 |

| Symbol | WDC |

| Alert price: | 37.2 |

| Demand zone range: | 37.18 – 37.22 |

| Demand zone time (when it formed): | 2023-04-13 10:28:00 |

| Peak price since zone was formed: | 37.78 (1.56% growth) |

| Day Range: | 37.1 – 38.19 |

| 52wk Range: | 29.73 – 63.26 |

| Prev Close: | 38 |

| Open: | 37.96 |

| Bid: | 37.19 |

| Ask: | 37.2 |

Open interactive stock chart for WDC

AAP on Monday, April 17, 2023

| Alert Time: | 2023-04-17 13:52:29 |

| Symbol | AAP |

| Alert price: | 126.01 |

| Demand zone range: | 125.66 – 125.83 |

| Demand zone time (when it formed): | 2023-04-17 11:42:00 |

| Peak price since zone was formed: | 127 (0.79% growth) |

| Day Range: | 123.81 – 126.99 |

| 52wk Range: | 109.05 – 231.43 |

| Prev Close: | 123.6 |

| Open: | 123.83 |

| Bid: | 125.95 |

| Ask: | 126.01 |

Open interactive stock chart for AAP

BK on Tuesday, April 18, 2023

| Alert Time: | 2023-04-18 12:21:01 |

| Symbol | BK |

| Alert price: | 44.16 |

| Demand zone range: | 44.05 – 44.13 |

| Demand zone time (when it formed): | 2023-04-18 11:52:00 |

| Peak price since zone was formed: | 44.39 (0.52% growth) |

| Day Range: | 42.73 – 44.89 |

| 52wk Range: | 36.22 – 52.26 |

| Prev Close: | 44.23 |

| Open: | 43.92 |

| Bid: | 44.14 |

| Ask: | 44.16 |

Open interactive stock chart for BK

AN on Thursday, April 20, 2023

| Alert Time: | 2023-04-20 12:06:01 |

| Symbol | AN |

| Alert price: | 132.14 |

| Demand zone range: | 131.59 – 131.97 |

| Demand zone time (when it formed): | 2023-04-20 11:25:00 |

| Peak price since zone was formed: | 133 (0.65% growth) |

| Day Range: | 131.02 – 137.28 |

| 52wk Range: | 94.92 – 158.3 |

| Prev Close: | 136.32 |

| Open: | 136.73 |

| Bid: | 131.99 |

| Ask: | 132.14 |

Open interactive stock chart for AN

WHR on Tuesday, April 25, 2023

| Alert Time: | 2023-04-25 10:21:37 |

| Symbol | WHR |

| Alert price: | 136.89 |

| Demand zone range: | 136.6 – 136.9 |

| Demand zone time (when it formed): | 2023-04-25 10:10:00 |

| Peak price since zone was formed: | 137.8 (0.66% growth) |

| Day Range: | 135.53 – 144 |

| 52wk Range: | 124.1 – 199.07 |

| Prev Close: | 140.7 |

| Open: | 143.5 |

| Bid: | 136.54 |

| Ask: | 136.89 |

Open interactive stock chart for WHR

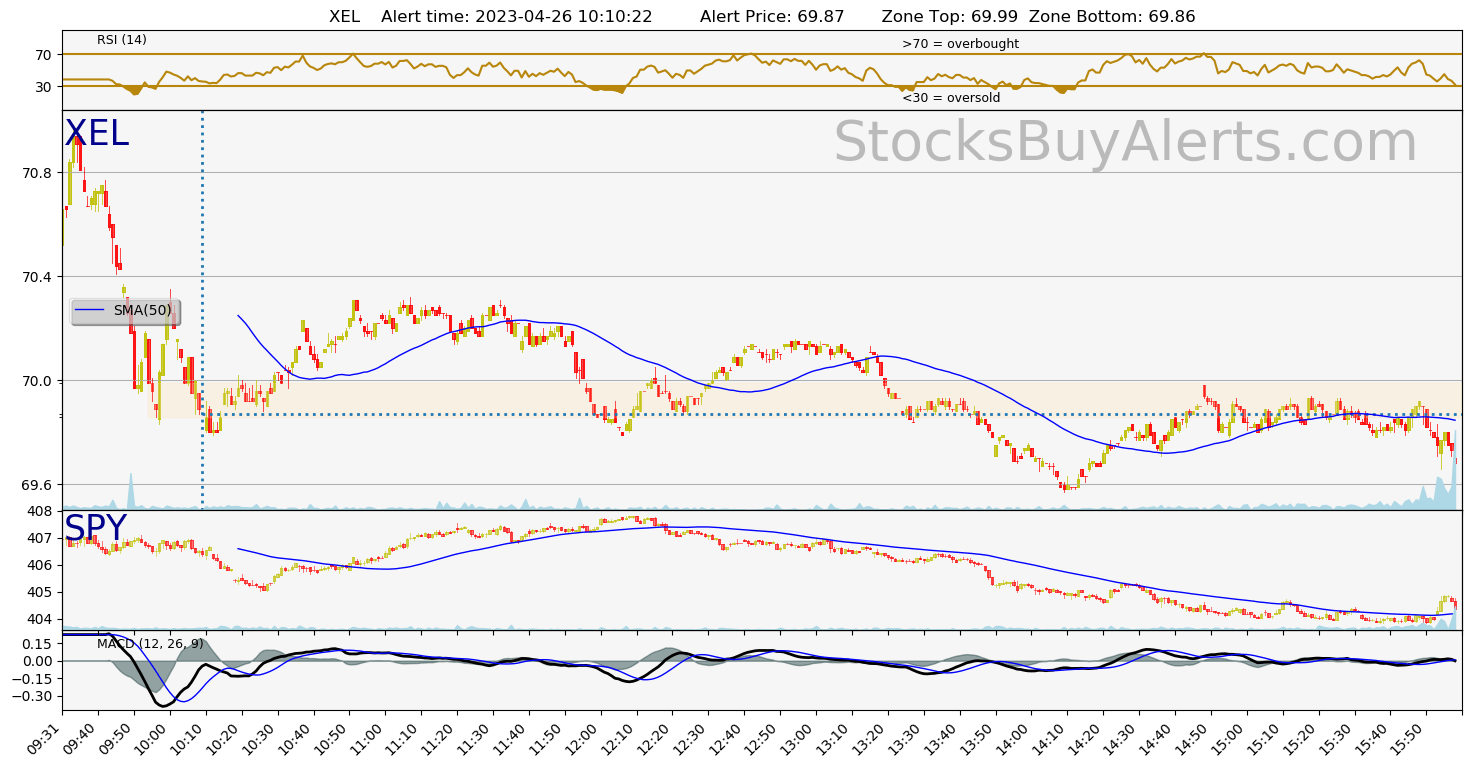

XEL on Wednesday, April 26, 2023

| Alert Time: | 2023-04-26 10:10:22 |

| Symbol | XEL |

| Alert price: | 69.9 |

| Demand zone range: | 69.86 – 69.99 |

| Demand zone time (when it formed): | 2023-04-26 09:55:00 |

| Peak price since zone was formed: | 70.35 (0.64% growth) |

| Day Range: | 69.84 – 70.95 |

| 52wk Range: | 56.89 – 77.66 |

| Prev Close: | 71.18 |

| Open: | 70.69 |

| Bid: | 69.89 |

| Ask: | 69.9 |

Open interactive stock chart for XEL

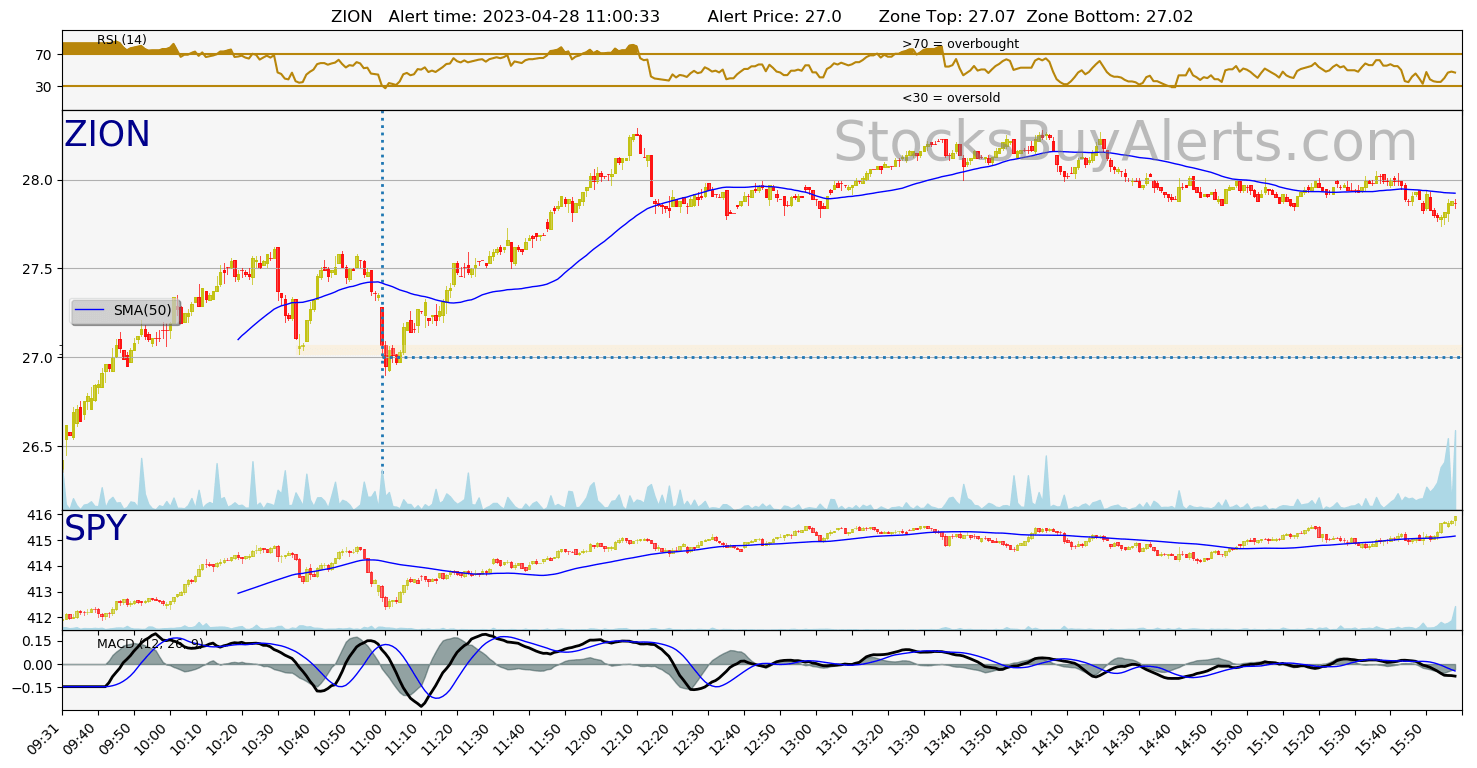

ZION on Friday, April 28, 2023

| Alert Time: | 2023-04-28 11:00:33 |

| Symbol | ZION |

| Alert price: | 27.09 |

| Demand zone range: | 27.02 – 27.07 |

| Demand zone time (when it formed): | 2023-04-28 10:36:00 |

| Peak price since zone was formed: | 27.6 (1.88% growth) |

| Day Range: | 26.24 – 27.62 |

| 52wk Range: | 22.55 – 59.75 |

| Prev Close: | 26.58 |

| Open: | 26.39 |

| Bid: | 27.06 |

| Ask: | 27.09 |

Open interactive stock chart for ZION

PNC on Monday, May 01, 2023

| Alert Time: | 2023-05-01 13:32:58 |

| Symbol | PNC |

| Alert price: | 122.72 |

| Demand zone range: | 122.45 – 122.54 |

| Demand zone time (when it formed): | 2023-05-01 11:31:00 |

| Peak price since zone was formed: | 124.54 (1.48% growth) |

| Day Range: | 121.67 – 126.77 |

| 52wk Range: | 117.51 – 176.47 |

| Prev Close: | 130.25 |

| Open: | 126.64 |

| Bid: | 122.68 |

| Ask: | 122.72 |

Open interactive stock chart for PNC

ZION on Tuesday, May 02, 2023

| Alert Time: | 2023-05-02 10:29:38 |

| Symbol | ZION |

| Alert price: | 24.04 |

| Demand zone range: | 23.89 – 24.02 |

| Demand zone time (when it formed): | 2023-05-02 10:18:00 |

| Peak price since zone was formed: | 24.49 (1.87% growth) |

| Day Range: | 23.85 – 26.66 |

| 52wk Range: | 22.55 – 59.75 |

| Prev Close: | 26.82 |

| Open: | 26.66 |

| Bid: | 24 |

| Ask: | 24.04 |

Open interactive stock chart for ZION

VNO on Wednesday, May 03, 2023

| Alert Time: | 2023-05-03 15:10:09 |

| Symbol | VNO |

| Alert price: | 13.68 |

| Demand zone range: | 13.64 – 13.66 |

| Demand zone time (when it formed): | 2023-05-03 10:42:00 |

| Peak price since zone was formed: | 14.02 (2.49% growth) |

| Day Range: | 13.61 – 14.25 |

| 52wk Range: | 12.53 – 39.08 |

| Prev Close: | 13.93 |

| Open: | 13.93 |

| Bid: | 13.67 |

| Ask: | 13.68 |

Open interactive stock chart for VNO

ZTS on Thursday, May 04, 2023

| Alert Time: | 2023-05-04 14:22:11 |

| Symbol | ZTS |

| Alert price: | 178.87 |

| Demand zone range: | 178.01 – 178.63 |

| Demand zone time (when it formed): | 2023-05-04 10:30:00 |

| Peak price since zone was formed: | 182.76 (2.17% growth) |

| Day Range: | 167.53 – 182.76 |

| 52wk Range: | 124.15 – 183.81 |

| Prev Close: | 177.73 |

| Open: | 170.19 |

| Bid: | 178.77 |

| Ask: | 178.87 |

Open interactive stock chart for ZTS

NCLH on Friday, May 05, 2023

| Alert Time: | 2023-05-05 10:53:32 |

| Symbol | NCLH |

| Alert price: | 14.06 |

| Demand zone range: | 14.01 – 14.04 |

| Demand zone time (when it formed): | 2023-05-05 10:42:00 |

| Peak price since zone was formed: | 14.14 (0.57% growth) |

| Day Range: | 13.88 – 14.35 |

| 52wk Range: | 10.31 – 20.32 |

| Prev Close: | 13.75 |

| Open: | 14.02 |

| Bid: | 14.05 |

| Ask: | 14.06 |

Open interactive stock chart for NCLH

UAL on Monday, May 08, 2023

| Alert Time: | 2023-05-08 13:58:07 |

| Symbol | UAL |

| Alert price: | 45.47 |

| Demand zone range: | 45.38 – 45.41 |

| Demand zone time (when it formed): | 2023-05-08 11:38:00 |

| Peak price since zone was formed: | 46.01 (1.19% growth) |

| Day Range: | 45.23 – 46.24 |

| 52wk Range: | 31.58 – 55.04 |

| Prev Close: | 44.81 |

| Open: | 45.31 |

| Bid: | 45.46 |

| Ask: | 45.47 |

Open interactive stock chart for UAL

SWKS on Tuesday, May 09, 2023

| Alert Time: | 2023-05-09 13:27:55 |

| Symbol | SWKS |

| Alert price: | 98.49 |

| Demand zone range: | 98.17 – 98.39 |

| Demand zone time (when it formed): | 2023-05-09 10:52:00 |

| Peak price since zone was formed: | 100.54 (2.08% growth) |

| Day Range: | 92.07 – 100.9 |

| 52wk Range: | 76.16 – 123.69 |

| Prev Close: | 105.24 |

| Open: | 92.09 |

| Bid: | 98.48 |

| Ask: | 98.49 |

Open interactive stock chart for SWKS

WDC on Tuesday, May 16, 2023

| Alert Time: | 2023-05-16 10:23:22 |

| Symbol | WDC |

| Alert price: | 36.03 |

| Demand zone range: | 35.92 – 35.98 |

| Demand zone time (when it formed): | 2023-05-16 10:12:00 |

| Peak price since zone was formed: | 36.23 (0.56% growth) |

| Day Range: | 35.87 – 37.08 |

| 52wk Range: | 29.73 – 63 |

| Prev Close: | 36.75 |

| Open: | 36.75 |

| Bid: | 36.02 |

| Ask: | 36.03 |

Open interactive stock chart for WDC

RRC on Wednesday, May 17, 2023

| Alert Time: | 2023-05-17 14:26:14 |

| Symbol | RRC |

| Alert price: | 27.41 |

| Demand zone range: | 27.345 – 27.37 |

| Demand zone time (when it formed): | 2023-05-17 12:29:00 |

| Peak price since zone was formed: | 27.65 (0.88% growth) |

| Day Range: | 27.09 – 27.68 |

| 52wk Range: | 22.61 – 37.44 |

| Prev Close: | 27.19 |

| Open: | 27.49 |

| Bid: | 27.39 |

| Ask: | 27.41 |

Open interactive stock chart for RRC

JBHT on Thursday, May 18, 2023

| Alert Time: | 2023-05-18 11:57:01 |

| Symbol | JBHT |

| Alert price: | 169.36 |

| Demand zone range: | 168.86 – 169.13 |

| Demand zone time (when it formed): | 2023-05-18 11:40:00 |

| Peak price since zone was formed: | 170.5 (0.67% growth) |

| Day Range: | 168.64 – 174.45 |

| 52wk Range: | 153.92 – 200.64 |

| Prev Close: | 172.12 |

| Open: | 172.13 |

| Bid: | 169.02 |

| Ask: | 169.36 |

Open interactive stock chart for JBHT

FL on Friday, May 19, 2023

| Alert Time: | 2023-05-19 10:49:40 |

| Symbol | FL |

| Alert price: | 30.7 |

| Demand zone range: | 30.6 – 30.71 |

| Demand zone time (when it formed): | 2023-05-19 10:23:00 |

| Peak price since zone was formed: | 31.17 (1.53% growth) |

| Day Range: | 30.25 – 31.96 |

| 52wk Range: | 23.85 – 47.22 |

| Prev Close: | 41.52 |

| Open: | 30.7 |

| Bid: | 30.69 |

| Ask: | 30.7 |

Open interactive stock chart for FL

RIG on Tuesday, May 23, 2023

| Alert Time: | 2023-05-23 13:32:40 |

| Symbol | RIG |

| Alert price: | 6.41 |

| Demand zone range: | 6.4 – 6.41 |

| Demand zone time (when it formed): | 2023-05-23 10:56:00 |

| Peak price since zone was formed: | 6.55 (2.18% growth) |

| Day Range: | 6.25 – 6.55 |

| 52wk Range: | 2.32 – 7.74 |

| Prev Close: | 6.33 |

| Open: | 6.38 |

| Bid: | 6.4 |

| Ask: | 6.41 |

Open interactive stock chart for RIG

KEY on Tuesday, May 30, 2023

| Alert Time: | 2023-05-30 11:25:22 |

| Symbol | KEY |

| Alert price: | 9.89 |

| Demand zone range: | 9.86 – 9.88 |

| Demand zone time (when it formed): | 2023-05-30 10:33:00 |

| Peak price since zone was formed: | 10.06 (1.72% growth) |

| Day Range: | 9.7 – 10.09 |

| 52wk Range: | 8.54 – 20.3 |

| Prev Close: | 9.89 |

| Open: | 9.98 |

| Bid: | 9.88 |

| Ask: | 9.89 |

Open interactive stock chart for KEY

PWR on Wednesday, May 31, 2023

| Alert Time: | 2023-05-31 14:51:33 |

| Symbol | PWR |

| Alert price: | 177.04 |

| Demand zone range: | 176.65 – 176.81 |

| Demand zone time (when it formed): | 2023-05-31 11:39:00 |

| Peak price since zone was formed: | 178.63 (0.9% growth) |

| Day Range: | 176.69 – 180.86 |

| 52wk Range: | 112.86 – 181.83 |

| Prev Close: | 181.17 |

| Open: | 178.82 |

| Bid: | 176.78 |

| Ask: | 177.04 |

Open interactive stock chart for PWR

FLS on Monday, June 05, 2023

| Alert Time: | 2023-06-05 13:28:14 |

| Symbol | FLS |

| Alert price: | 34.83 |

| Demand zone range: | 34.75 – 34.78 |

| Demand zone time (when it formed): | 2023-06-05 10:25:00 |

| Peak price since zone was formed: | 35.26 (1.23% growth) |

| Day Range: | 34.59 – 35.47 |

| 52wk Range: | 23.89 – 38.86 |

| Prev Close: | 35.64 |

| Open: | 35.47 |

| Bid: | 34.8 |

| Ask: | 34.83 |

Open interactive stock chart for FLS

LRCX on Wednesday, June 07, 2023

| Alert Time: | 2023-06-07 13:04:36 |

| Symbol | LRCX |

| Alert price: | 610.81 |

| Demand zone range: | 609.96 – 610.1 |

| Demand zone time (when it formed): | 2023-06-07 11:12:00 |

| Peak price since zone was formed: | 620.98 (1.67% growth) |

| Day Range: | 609.16 – 621.23 |

| 52wk Range: | 299.59 – 644.6 |

| Prev Close: | 612.2 |

| Open: | 612.92 |

| Bid: | 610.34 |

| Ask: | 610.81 |

Open interactive stock chart for LRCX

HOG on Thursday, June 08, 2023

| Alert Time: | 2023-06-08 14:10:37 |

| Symbol | HOG |

| Alert price: | 35.06 |

| Demand zone range: | 34.99 – 35.02 |

| Demand zone time (when it formed): | 2023-06-08 12:18:00 |

| Peak price since zone was formed: | 35.43 (1.06% growth) |

| Day Range: | 34.83 – 35.54 |

| 52wk Range: | 29.8 – 51.77 |

| Prev Close: | 35.33 |

| Open: | 35.32 |

| Bid: | 35.03 |

| Ask: | 35.06 |

Open interactive stock chart for HOG

VFC on Wednesday, June 14, 2023

| Alert Time: | 2023-06-14 12:42:22 |

| Symbol | VFC |

| Alert price: | 19.46 |

| Demand zone range: | 19.41 – 19.44 |

| Demand zone time (when it formed): | 2023-06-14 10:53:00 |

| Peak price since zone was formed: | 19.65 (0.98% growth) |

| Day Range: | 19.11 – 19.65 |

| 52wk Range: | 16.77 – 48.63 |

| Prev Close: | 19.06 |

| Open: | 19.23 |

| Bid: | 19.45 |

| Ask: | 19.46 |

Open interactive stock chart for VFC

ADBE on Friday, June 16, 2023

| Alert Time: | 2023-06-16 13:28:58 |

| Symbol | ADBE |

| Alert price: | 501.52 |

| Demand zone range: | 500.31 – 500.87 |

| Demand zone time (when it formed): | 2023-06-16 11:48:00 |

| Peak price since zone was formed: | 506.73 (1.04% growth) |

| Day Range: | 499 – 518.74 |

| 52wk Range: | 274.73 – 518.74 |

| Prev Close: | 490.91 |

| Open: | 518.49 |

| Bid: | 501.36 |

| Ask: | 501.52 |

Open interactive stock chart for ADBE

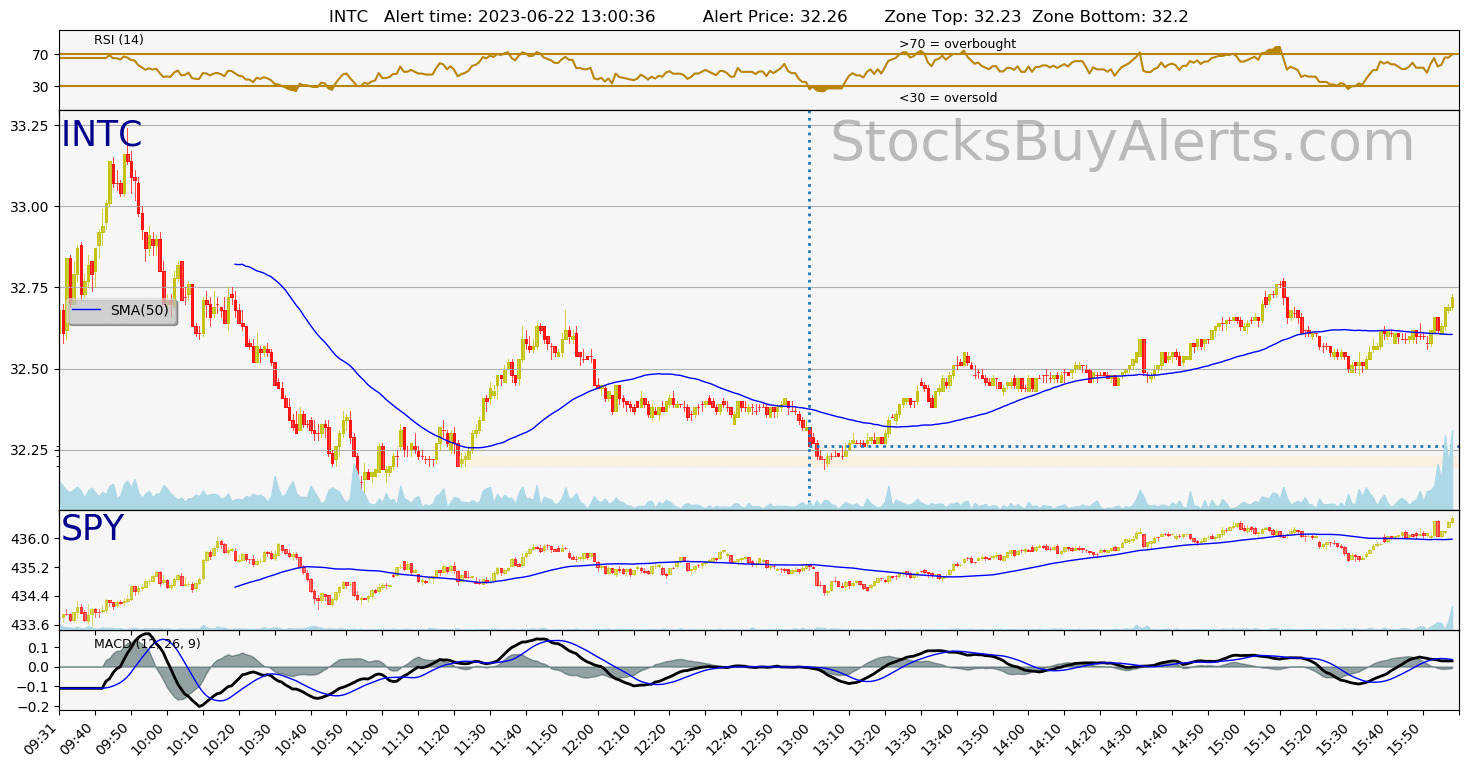

INTC on Thursday, June 22, 2023

| Alert Time: | 2023-06-22 13:00:36 |

| Symbol | INTC |

| Alert price: | 32.27 |

| Demand zone range: | 32.2 – 32.23 |

| Demand zone time (when it formed): | 2023-06-22 11:22:00 |

| Peak price since zone was formed: | 32.64 (1.15% growth) |

| Day Range: | 32.13 – 33.24 |

| 52wk Range: | 24.59 – 40.73 |

| Prev Close: | 32.9 |

| Open: | 32.71 |

| Bid: | 32.26 |

| Ask: | 32.27 |

Open interactive stock chart for INTC

CCL on Friday, June 23, 2023

| Alert Time: | 2023-06-23 14:53:25 |

| Symbol | CCL |

| Alert price: | 15.83 |

| Demand zone range: | 15.78 – 15.81 |

| Demand zone time (when it formed): | 2023-06-23 12:53:00 |

| Peak price since zone was formed: | 16 (1.07% growth) |

| Day Range: | 15.43 – 16 |

| 52wk Range: | 6.11 – 16.4 |

| Prev Close: | 15.76 |

| Open: | 15.5 |

| Bid: | 15.82 |

| Ask: | 15.83 |

Open interactive stock chart for CCL

NCLH on Monday, June 26, 2023

| Alert Time: | 2023-06-26 11:27:49 |

| Symbol | NCLH |

| Alert price: | 18.25 |

| Demand zone range: | 18.16 – 18.23 |

| Demand zone time (when it formed): | 2023-06-26 11:09:00 |

| Peak price since zone was formed: | 18.4 (0.82% growth) |

| Day Range: | 18.16 – 19.1 |

| 52wk Range: | 10.47 – 19.77 |

| Prev Close: | 19.4 |

| Open: | 18.72 |

| Bid: | 18.24 |

| Ask: | 18.25 |

Open interactive stock chart for NCLH

KEY on Thursday, July 20, 2023

| Alert Time: | 2023-07-20 11:47:18 |

| Symbol | KEY |

| Alert price: | 11.66 |

| Demand zone range: | 11.62 – 11.65 |

| Demand zone time (when it formed): | 2023-07-20 11:09:00 |

| Peak price since zone was formed: | 11.87 (1.8% growth) |

| Day Range: | 10.85 – 11.87 |

| 52wk Range: | 8.54 – 20.3 |

| Prev Close: | 11.41 |

| Open: | 11.07 |

| Bid: | 11.65 |

| Ask: | 11.66 |

Open interactive stock chart for KEY

NVDA on Friday, July 21, 2023

| Alert Time: | 2023-07-21 15:00:09 |

| Symbol | NVDA |

| Alert price: | 446.35 |

| Demand zone range: | 445.4 – 445.72 |

| Demand zone time (when it formed): | 2023-07-21 12:55:00 |

| Peak price since zone was formed: | 454.13 (1.74% growth) |

| Day Range: | 444.52 – 458.66 |

| 52wk Range: | 108.13 – 480.88 |

| Prev Close: | 455.2 |

| Open: | 457.88 |

| Bid: | 446.23 |

| Ask: | 446.35 |

Open interactive stock chart for NVDA

OXY on Monday, July 24, 2023

| Alert Time: | 2023-07-24 15:08:24 |

| Symbol | OXY |

| Alert price: | 62.25 |

| Demand zone range: | 62.13 – 62.16 |

| Demand zone time (when it formed): | 2023-07-24 11:15:00 |

| Peak price since zone was formed: | 63.04 (1.27% growth) |

| Day Range: | 61.06 – 63.04 |

| 52wk Range: | 55.51 – 77.13 |

| Prev Close: | 60.74 |

| Open: | 61.11 |

| Bid: | 62.24 |

| Ask: | 62.25 |

Open interactive stock chart for OXY

PCAR on Tuesday, July 25, 2023

| Alert Time: | 2023-07-25 12:07:18 |

| Symbol | PCAR |

| Alert price: | 84.62 |

| Demand zone range: | 84.49 – 84.5 |

| Demand zone time (when it formed): | 2023-07-25 11:15:00 |

| Peak price since zone was formed: | 85.64 (1.21% growth) |

| Day Range: | 81.18 – 86.3 |

| 52wk Range: | 54.64 – 90.05 |

| Prev Close: | 88.7 |

| Open: | 83.32 |

| Bid: | 84.54 |

| Ask: | 84.62 |

Open interactive stock chart for PCAR

AMG on Wednesday, July 26, 2023

| Alert Time: | 2023-07-26 12:45:42 |

| Symbol | AMG |

| Alert price: | 137.79 |

| Demand zone range: | 137.74 – 137.87 |

| Demand zone time (when it formed): | 2023-07-26 12:35:00 |

| Peak price since zone was formed: | 138.55 (0.55% growth) |

| Day Range: | 137.74 – 150.63 |

| 52wk Range: | 108.12 – 180.63 |

| Prev Close: | 161.57 |

| Open: | 150.31 |

| Bid: | 137.45 |

| Ask: | 137.79 |

Open interactive stock chart for AMG

WU on Thursday, July 27, 2023

| Alert Time: | 2023-07-27 10:48:26 |

| Symbol | WU |

| Alert price: | 12.78 |

| Demand zone range: | 12.73 – 12.77 |

| Demand zone time (when it formed): | 2023-07-27 10:21:00 |

| Peak price since zone was formed: | 12.94 (1.25% growth) |

| Day Range: | 12.71 – 13.34 |

| 52wk Range: | 10.07 – 17.42 |

| Prev Close: | 12.44 |

| Open: | 12.84 |

| Bid: | 12.77 |

| Ask: | 12.78 |

Open interactive stock chart for WU

AVY on Friday, July 28, 2023

| Alert Time: | 2023-07-28 13:40:10 |

| Symbol | AVY |

| Alert price: | 184.25 |

| Demand zone range: | 184.04 – 184.06 |

| Demand zone time (when it formed): | 2023-07-28 10:36:00 |

| Peak price since zone was formed: | 187.39 (1.7% growth) |

| Day Range: | 183.5 – 187.39 |

| 52wk Range: | 157.28 – 204.37 |

| Prev Close: | 183.48 |

| Open: | 185.5 |

| Bid: | 184.13 |

| Ask: | 184.25 |

Open interactive stock chart for AVY

JWN on Wednesday, August 02, 2023

| Alert Time: | 2023-08-02 14:44:55 |

| Symbol | JWN |

| Alert price: | 23.17 |

| Demand zone range: | 23.14 – 23.14 |

| Demand zone time (when it formed): | 2023-08-02 12:52:00 |

| Peak price since zone was formed: | 23.4 (0.99% growth) |

| Day Range: | 22.77 – 23.4 |

| 52wk Range: | 14.03 – 27.43 |

| Prev Close: | 23.3 |

| Open: | 22.92 |

| Bid: | 23.16 |

| Ask: | 23.17 |

Open interactive stock chart for JWN

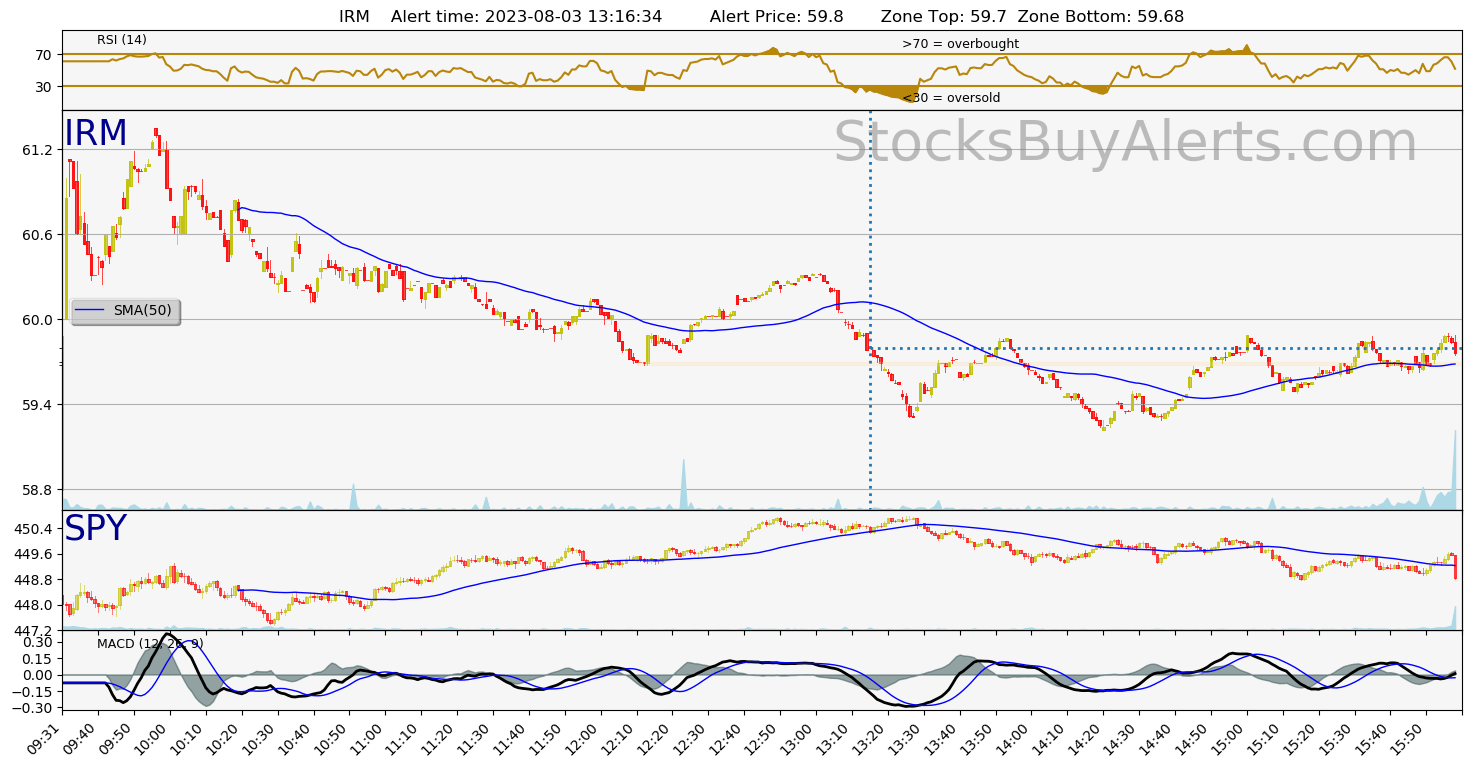

IRM on Thursday, August 03, 2023

| Alert Time: | 2023-08-03 13:16:34 |

| Symbol | IRM |

| Alert price: | 59.77 |

| Demand zone range: | 59.68 – 59.7 |

| Demand zone time (when it formed): | 2023-08-03 12:11:00 |

| Peak price since zone was formed: | 60.33 (0.94% growth) |

| Day Range: | 58.31 – 61.35 |

| 52wk Range: | 43.33 – 62.88 |

| Prev Close: | 61.64 |

| Open: | 59.59 |

| Bid: | 59.74 |

| Ask: | 59.77 |

Open interactive stock chart for IRM

LRCX on Friday, August 04, 2023

| Alert Time: | 2023-08-04 14:02:05 |

| Symbol | LRCX |

| Alert price: | 694.7 |

| Demand zone range: | 693.74 – 693.74 |

| Demand zone time (when it formed): | 2023-08-04 11:39:00 |

| Peak price since zone was formed: | 702.63 (1.14% growth) |

| Day Range: | 686.6 – 702.63 |

| 52wk Range: | 299.59 – 726.53 |

| Prev Close: | 693.36 |

| Open: | 693.36 |

| Bid: | 694 |

| Ask: | 694.7 |

Open interactive stock chart for LRCX

RL on Thursday, August 10, 2023

| Alert Time: | 2023-08-10 12:12:27 |

| Symbol | RL |

| Alert price: | 124.37 |

| Demand zone range: | 124.23 – 124.23 |

| Demand zone time (when it formed): | 2023-08-10 11:54:00 |

| Peak price since zone was formed: | 125.18 (0.65% growth) |

| Day Range: | 123 – 129.11 |

| 52wk Range: | 82.23 – 135.76 |

| Prev Close: | 128.49 |

| Open: | 123.57 |

| Bid: | 124.29 |

| Ask: | 124.37 |

Open interactive stock chart for RL

TRIP on Monday, August 14, 2023

| Alert Time: | 2023-08-14 13:50:38 |

| Symbol | TRIP |

| Alert price: | 15.94 |

| Demand zone range: | 15.9 – 15.92 |

| Demand zone time (when it formed): | 2023-08-14 11:23:00 |

| Peak price since zone was formed: | 16.13 (1.19% growth) |

| Day Range: | 15.87 – 16.22 |

| 52wk Range: | 14.39 – 28.05 |

| Prev Close: | 16.39 |

| Open: | 16.18 |

| Bid: | 15.93 |

| Ask: | 15.94 |

Open interactive stock chart for TRIP

LNC on Tuesday, August 15, 2023

| Alert Time: | 2023-08-15 12:43:05 |

| Symbol | LNC |

| Alert price: | 25.99 |

| Demand zone range: | 25.94 – 25.96 |

| Demand zone time (when it formed): | 2023-08-15 10:46:00 |

| Peak price since zone was formed: | 26.29 (1.15% growth) |

| Day Range: | 25.78 – 26.29 |

| 52wk Range: | 18.5 – 54.59 |

| Prev Close: | 26.62 |

| Open: | 26.21 |

| Bid: | 25.98 |

| Ask: | 25.99 |

Open interactive stock chart for LNC

BBY on Tuesday, August 22, 2023

| Alert Time: | 2023-08-22 13:37:28 |

| Symbol | BBY |

| Alert price: | 74.66 |

| Demand zone range: | 74.4 – 74.56 |

| Demand zone time (when it formed): | 2023-08-22 11:05:00 |

| Peak price since zone was formed: | 75.45 (1.06% growth) |

| Day Range: | 74.22 – 77.57 |

| 52wk Range: | 60.79 – 93.32 |

| Prev Close: | 78.88 |

| Open: | 77.26 |

| Bid: | 74.63 |

| Ask: | 74.66 |

Open interactive stock chart for BBY

URBN on Wednesday, August 23, 2023

| Alert Time: | 2023-08-23 14:24:11 |

| Symbol | URBN |

| Alert price: | 34.61 |

| Demand zone range: | 34.52 – 34.56 |

| Demand zone time (when it formed): | 2023-08-23 12:04:00 |

| Peak price since zone was formed: | 34.93 (0.92% growth) |

| Day Range: | 34.14 – 35.99 |

| 52wk Range: | 18.75 – 37.82 |

| Prev Close: | 34.09 |

| Open: | 35.55 |

| Bid: | 34.6 |

| Ask: | 34.61 |

Open interactive stock chart for URBN

AAP on Thursday, August 24, 2023

| Alert Time: | 2023-08-24 13:07:07 |

| Symbol | AAP |

| Alert price: | 68.81 |

| Demand zone range: | 68.7 – 68.75 |

| Demand zone time (when it formed): | 2023-08-24 11:45:00 |

| Peak price since zone was formed: | 69.56 (1.09% growth) |

| Day Range: | 68.23 – 71.39 |

| 52wk Range: | 63.56 – 194.35 |

| Prev Close: | 69.44 |

| Open: | 69.59 |

| Bid: | 68.77 |

| Ask: | 68.81 |

Open interactive stock chart for AAP

JWN on Friday, August 25, 2023

| Alert Time: | 2023-08-25 10:44:08 |

| Symbol | JWN |

| Alert price: | 15.04 |

| Demand zone range: | 15 – 15.04 |

| Demand zone time (when it formed): | 2023-08-25 10:36:00 |

| Peak price since zone was formed: | 15.16 (0.8% growth) |

| Day Range: | 15 – 17.39 |

| 52wk Range: | 14.03 – 27.15 |

| Prev Close: | 16.82 |

| Open: | 16.79 |

| Bid: | 15.03 |

| Ask: | 15.04 |

Open interactive stock chart for JWN

FL on Wednesday, August 30, 2023

| Alert Time: | 2023-08-30 13:56:38 |

| Symbol | FL |

| Alert price: | 18.34 |

| Demand zone range: | 18.31 – 18.32 |

| Demand zone time (when it formed): | 2023-08-30 11:40:00 |

| Peak price since zone was formed: | 18.5 (0.87% growth) |

| Day Range: | 17.88 – 18.5 |

| 52wk Range: | 14.84 – 47.22 |

| Prev Close: | 18.32 |

| Open: | 18.32 |

| Bid: | 18.33 |

| Ask: | 18.34 |

Open interactive stock chart for FL

MKTX on Tuesday, September 05, 2023

| Alert Time: | 2023-09-05 12:30:57 |

| Symbol | MKTX |

| Alert price: | 243.14 |

| Demand zone range: | 242.78 – 242.78 |

| Demand zone time (when it formed): | 2023-09-05 10:08:00 |

| Peak price since zone was formed: | 246.4 (1.34% growth) |

| Day Range: | 237.78 – 246.4 |

| 52wk Range: | 217.44 – 399.78 |

| Prev Close: | 238.84 |

| Open: | 237.78 |

| Bid: | 242.96 |

| Ask: | 243.14 |

Open interactive stock chart for MKTX

GPS on Wednesday, September 06, 2023

| Alert Time: | 2023-09-06 10:29:20 |

| Symbol | GPS |

| Alert price: | 11.23 |

| Demand zone range: | 11.21 – 11.22 |

| Demand zone time (when it formed): | 2023-09-06 10:13:00 |

| Peak price since zone was formed: | 11.31 (0.71% growth) |

| Day Range: | 11.19 – 11.45 |

| 52wk Range: | 7.22 – 15.49 |

| Prev Close: | 11.43 |

| Open: | 11.34 |

| Bid: | 11.22 |

| Ask: | 11.23 |

Open interactive stock chart for GPS

FMC on Thursday, September 07, 2023

| Alert Time: | 2023-09-07 12:43:37 |

| Symbol | FMC |

| Alert price: | 75.42 |

| Demand zone range: | 75.19 – 75.31 |

| Demand zone time (when it formed): | 2023-09-07 11:41:00 |

| Peak price since zone was formed: | 76.55 (1.5% growth) |

| Day Range: | 75.19 – 81.5 |

| 52wk Range: | 75.19 – 134.38 |

| Prev Close: | 82.19 |

| Open: | 81.41 |

| Bid: | 75.37 |

| Ask: | 75.42 |

Open interactive stock chart for FMC

NCLH on Friday, September 08, 2023

| Alert Time: | 2023-09-08 10:38:15 |

| Symbol | NCLH |

| Alert price: | 16.54 |

| Demand zone range: | 16.5 – 16.52 |

| Demand zone time (when it formed): | 2023-09-08 09:56:00 |

| Peak price since zone was formed: | 16.74 (1.21% growth) |

| Day Range: | 16.37 – 16.74 |

| 52wk Range: | 10.83 – 22.75 |

| Prev Close: | 16.49 |

| Open: | 16.41 |

| Bid: | 16.53 |

| Ask: | 16.54 |

Open interactive stock chart for NCLH

NWL on Monday, September 11, 2023

| Alert Time: | 2023-09-11 10:37:00 |

| Symbol | NWL |

| Alert price: | 9.53 |

| Demand zone range: | 9.5 – 9.52 |

| Demand zone time (when it formed): | 2023-09-11 10:23:00 |

| Peak price since zone was formed: | 9.59 (0.63% growth) |

| Day Range: | 9.47 – 9.99 |

| 52wk Range: | 7.8 – 18.54 |

| Prev Close: | 9.94 |

| Open: | 9.93 |

| Bid: | 9.52 |

| Ask: | 9.53 |

Open interactive stock chart for NWL

AAP on Tuesday, September 12, 2023

| Alert Time: | 2023-09-12 11:13:09 |

| Symbol | AAP |

| Alert price: | 58.61 |

| Demand zone range: | 58.52 – 58.62 |

| Demand zone time (when it formed): | 2023-09-12 11:05:00 |

| Peak price since zone was formed: | 58.95 (0.58% growth) |

| Day Range: | 58.52 – 61.48 |

| 52wk Range: | 58.52 – 194.35 |

| Prev Close: | 62.54 |

| Open: | 60.43 |

| Bid: | 58.56 |

| Ask: | 58.61 |

Open interactive stock chart for AAP

BXP on Wednesday, September 13, 2023

| Alert Time: | 2023-09-13 12:01:21 |

| Symbol | BXP |

| Alert price: | 64.98 |

| Demand zone range: | 64.87 – 64.94 |

| Demand zone time (when it formed): | 2023-09-13 10:16:00 |

| Peak price since zone was formed: | 65.76 (1.2% growth) |

| Day Range: | 64.64 – 66.06 |

| 52wk Range: | 46.18 – 85.75 |

| Prev Close: | 65.95 |

| Open: | 66.06 |

| Bid: | 64.96 |

| Ask: | 64.98 |

Open interactive stock chart for BXP

SEE on Friday, September 15, 2023

| Alert Time: | 2023-09-15 12:31:10 |

| Symbol | SEE |

| Alert price: | 35.36 |

| Demand zone range: | 35.3 – 35.31 |

| Demand zone time (when it formed): | 2023-09-15 11:00:00 |

| Peak price since zone was formed: | 35.65 (0.82% growth) |

| Day Range: | 35.31 – 35.65 |

| 52wk Range: | 33.45 – 56.43 |

| Prev Close: | 35.41 |

| Open: | 35.38 |

| Bid: | 35.35 |

| Ask: | 35.36 |

Open interactive stock chart for SEE

AAP on Monday, September 18, 2023

| Alert Time: | 2023-09-18 14:54:45 |

| Symbol | AAP |

| Alert price: | 58.42 |

| Demand zone range: | 58.3 – 58.34 |

| Demand zone time (when it formed): | 2023-09-18 11:22:00 |

| Peak price since zone was formed: | 59.08 (1.13% growth) |

| Day Range: | 57.52 – 59.45 |

| 52wk Range: | 56.4 – 194.35 |

| Prev Close: | 59.82 |

| Open: | 59.45 |

| Bid: | 58.4 |

| Ask: | 58.42 |

Open interactive stock chart for AAP

ENPH on Wednesday, September 20, 2023

| Alert Time: | 2023-09-20 14:00:10 |

| Symbol | ENPH |

| Alert price: | 125.83 |

| Demand zone range: | 125.64 – 125.68 |

| Demand zone time (when it formed): | 2023-09-20 12:08:00 |

| Peak price since zone was formed: | 127.47 (1.3% growth) |

| Day Range: | 121.12 – 127.47 |

| 52wk Range: | 116.86 – 339.92 |

| Prev Close: | 122.09 |

| Open: | 122.28 |

| Bid: | 125.62 |

| Ask: | 125.83 |

Open interactive stock chart for ENPH

CRL on Thursday, September 21, 2023

| Alert Time: | 2023-09-21 12:06:40 |

| Symbol | CRL |

| Alert price: | 194.66 |

| Demand zone range: | 194.27 – 194.57 |

| Demand zone time (when it formed): | 2023-09-21 10:27:00 |

| Peak price since zone was formed: | 196.74 (1.07% growth) |

| Day Range: | 194.27 – 204 |

| 52wk Range: | 181.22 – 262 |

| Prev Close: | 208.63 |

| Open: | 204 |

| Bid: | 194.17 |

| Ask: | 194.66 |

Open interactive stock chart for CRL

AAPL on Friday, September 22, 2023

| Alert Time: | 2023-09-22 13:38:06 |

| Symbol | AAPL |

| Alert price: | 175.43 |

| Demand zone range: | 175.05 – 175.17 |

| Demand zone time (when it formed): | 2023-09-22 10:26:00 |

| Peak price since zone was formed: | 177.08 (0.94% growth) |

| Day Range: | 174.06 – 177.08 |

| 52wk Range: | 124.17 – 198.23 |

| Prev Close: | 173.93 |

| Open: | 174.61 |

| Bid: | 175.42 |

| Ask: | 175.43 |

Open interactive stock chart for AAPL

NVDA on Tuesday, September 26, 2023

| Alert Time: | 2023-09-26 11:32:25 |

| Symbol | NVDA |

| Alert price: | 420.89 |

| Demand zone range: | 419.57 – 420.27 |

| Demand zone time (when it formed): | 2023-09-26 10:18:00 |

| Peak price since zone was formed: | 428.2 (1.74% growth) |

| Day Range: | 416.55 – 428.2 |

| 52wk Range: | 108.13 – 502.66 |

| Prev Close: | 422.22 |

| Open: | 420 |

| Bid: | 420.81 |

| Ask: | 420.89 |

Open interactive stock chart for NVDA

SBAC on Wednesday, September 27, 2023

| Alert Time: | 2023-09-27 13:18:17 |

| Symbol | SBAC |

| Alert price: | 193.8 |

| Demand zone range: | 193.47 – 193.52 |

| Demand zone time (when it formed): | 2023-09-27 12:10:00 |

| Peak price since zone was formed: | 195.34 (0.79% growth) |

| Day Range: | 192.88 – 200.57 |

| 52wk Range: | 192.88 – 312.34 |

| Prev Close: | 200.1 |

| Open: | 199.74 |

| Bid: | 193.59 |

| Ask: | 193.8 |

Open interactive stock chart for SBAC

MU on Thursday, September 28, 2023

| Alert Time: | 2023-09-28 12:37:00 |

| Symbol | MU |

| Alert price: | 66.04 |

| Demand zone range: | 65.87 – 65.95 |

| Demand zone time (when it formed): | 2023-09-28 11:03:00 |

| Peak price since zone was formed: | 67.09 (1.59% growth) |

| Day Range: | 63.83 – 67.09 |

| 52wk Range: | 48.43 – 74.77 |

| Prev Close: | 68.21 |

| Open: | 66 |

| Bid: | 66.03 |

| Ask: | 66.04 |

Open interactive stock chart for MU

EXC on Friday, September 29, 2023

| Alert Time: | 2023-09-29 11:39:34 |

| Symbol | EXC |

| Alert price: | 37.7 |

| Demand zone range: | 37.62 – 37.66 |

| Demand zone time (when it formed): | 2023-09-29 10:29:00 |

| Peak price since zone was formed: | 38.02 (0.85% growth) |

| Day Range: | 37.63 – 38.4 |

| 52wk Range: | 35.19 – 44.37 |

| Prev Close: | 37.88 |

| Open: | 38.08 |

| Bid: | 37.69 |

| Ask: | 37.7 |

Open interactive stock chart for EXC

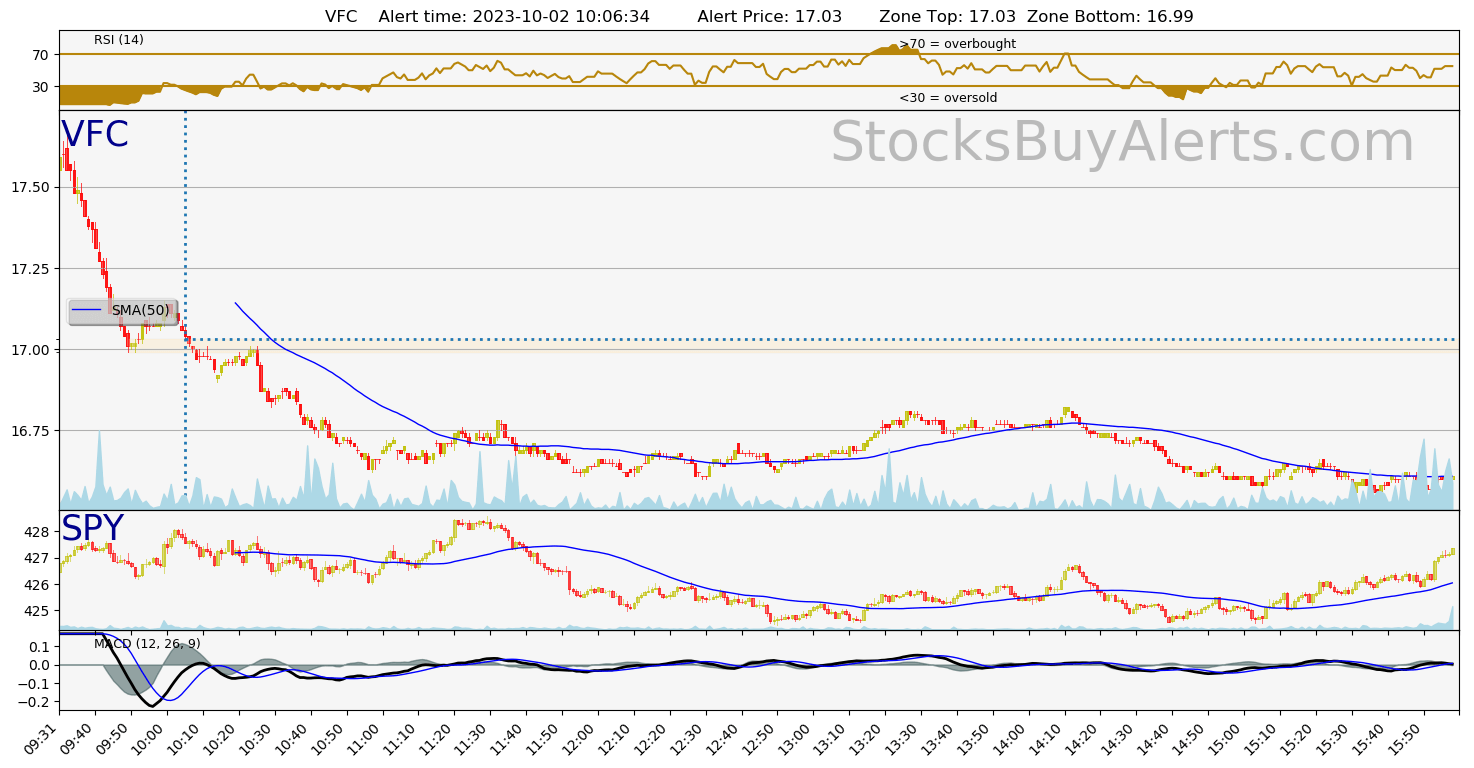

VFC on Monday, October 02, 2023

| Alert Time: | 2023-10-02 10:06:34 |

| Symbol | VFC |

| Alert price: | 17.05 |

| Demand zone range: | 16.99 – 17.03 |

| Demand zone time (when it formed): | 2023-10-02 09:50:00 |

| Peak price since zone was formed: | 17.15 (0.59% growth) |

| Day Range: | 16.99 – 17.68 |

| 52wk Range: | 16.36 – 34.9 |

| Prev Close: | 17.67 |

| Open: | 17.68 |

| Bid: | 17.04 |

| Ask: | 17.05 |

Open interactive stock chart for VFC

MPWR on Monday, October 02, 2023

| Alert Time: | 2023-10-02 12:07:45 |

| Symbol | MPWR |

| Alert price: | 457.22 |

| Demand zone range: | 456.83 – 456.85 |

| Demand zone time (when it formed): | 2023-10-02 10:53:00 |

| Peak price since zone was formed: | 463.18 (1.3% growth) |

| Day Range: | 454.39 – 464.86 |

| 52wk Range: | 301.69 – 595.98 |

| Prev Close: | 462 |

| Open: | 461.37 |

| Bid: | 456.25 |

| Ask: | 457.22 |

Open interactive stock chart for MPWR

GT on Tuesday, October 03, 2023

| Alert Time: | 2023-10-03 11:00:40 |

| Symbol | GT |

| Alert price: | 12.05 |

| Demand zone range: | 12.03 – 12.04 |

| Demand zone time (when it formed): | 2023-10-03 10:51:00 |

| Peak price since zone was formed: | 12.12 (0.58% growth) |

| Day Range: | 12.03 – 12.46 |

| 52wk Range: | 9.66 – 16.51 |

| Prev Close: | 12.57 |

| Open: | 12.42 |

| Bid: | 12.04 |

| Ask: | 12.05 |

Open interactive stock chart for GT

PDCO on Wednesday, October 04, 2023

| Alert Time: | 2023-10-04 13:12:54 |

| Symbol | PDCO |

| Alert price: | 30.03 |

| Demand zone range: | 30 – 30 |

| Demand zone time (when it formed): | 2023-10-04 10:15:00 |

| Peak price since zone was formed: | 30.27 (0.8% growth) |

| Day Range: | 29.76 – 30.28 |

| 52wk Range: | 24.96 – 34.53 |

| Prev Close: | 29.84 |

| Open: | 29.82 |

| Bid: | 30.01 |

| Ask: | 30.03 |

Open interactive stock chart for PDCO

PXD on Thursday, October 05, 2023

| Alert Time: | 2023-10-05 12:03:43 |

| Symbol | PXD |

| Alert price: | 214.4 |

| Demand zone range: | 213.89 – 214.19 |

| Demand zone time (when it formed): | 2023-10-05 10:04:00 |

| Peak price since zone was formed: | 216.49 (0.97% growth) |

| Day Range: | 211.95 – 216.49 |

| 52wk Range: | 177.27 – 274.7 |

| Prev Close: | 215.32 |

| Open: | 213.38 |

| Bid: | 214.22 |

| Ask: | 214.4 |

Open interactive stock chart for PXD

WELL on Monday, October 09, 2023

| Alert Time: | 2023-10-09 12:44:42 |

| Symbol | WELL |

| Alert price: | 81.58 |

| Demand zone range: | 81.4 – 81.46 |

| Demand zone time (when it formed): | 2023-10-09 10:50:00 |

| Peak price since zone was formed: | 82.4 (1.01% growth) |

| Day Range: | 80.8 – 82.37 |

| 52wk Range: | 56.5 – 86.72 |

| Prev Close: | 81.48 |

| Open: | 81.06 |

| Bid: | 81.55 |

| Ask: | 81.58 |

Open interactive stock chart for WELL

FSLR on Thursday, October 12, 2023

| Alert Time: | 2023-10-12 10:17:20 |

| Symbol | FSLR |

| Alert price: | 152.32 |

| Demand zone range: | 151.65 – 152.17 |

| Demand zone time (when it formed): | 2023-10-12 09:44:00 |

| Peak price since zone was formed: | 154.19 (1.23% growth) |

| Day Range: | 151.66 – 156.78 |

| 52wk Range: | 115.66 – 232 |

| Prev Close: | 151.5 |

| Open: | 156.34 |

| Bid: | 152.12 |

| Ask: | 152.32 |

Open interactive stock chart for FSLR

LRCX on Friday, October 13, 2023

| Alert Time: | 2023-10-13 13:28:48 |

| Symbol | LRCX |

| Alert price: | 646.7 |

| Demand zone range: | 645.13 – 645.74 |

| Demand zone time (when it formed): | 2023-10-13 11:59:00 |

| Peak price since zone was formed: | 652.79 (0.94% growth) |

| Day Range: | 643.04 – 664.39 |

| 52wk Range: | 299.59 – 726.53 |

| Prev Close: | 654.96 |

| Open: | 661 |

| Bid: | 646.18 |

| Ask: | 646.7 |

Open interactive stock chart for LRCX

DXCM on Tuesday, October 17, 2023

| Alert Time: | 2023-10-17 12:32:39 |

| Symbol | DXCM |

| Alert price: | 81.6 |

| Demand zone range: | 81.52 – 81.59 |

| Demand zone time (when it formed): | 2023-10-17 11:06:00 |

| Peak price since zone was formed: | 82.48 (1.08% growth) |

| Day Range: | 76.81 – 82.56 |

| 52wk Range: | 74.75 – 139.55 |

| Prev Close: | 78.95 |

| Open: | 77.32 |

| Bid: | 81.56 |

| Ask: | 81.6 |

Open interactive stock chart for DXCM

URI on Wednesday, October 18, 2023

| Alert Time: | 2023-10-18 10:26:14 |

| Symbol | URI |

| Alert price: | 434.21 |

| Demand zone range: | 433.41 – 434.5 |

| Demand zone time (when it formed): | 2023-10-18 10:15:00 |

| Peak price since zone was formed: | 437 (0.64% growth) |

| Day Range: | 433.14 – 449.16 |

| 52wk Range: | 271.05 – 492.33 |

| Prev Close: | 453.04 |

| Open: | 449.16 |

| Bid: | 433.5 |

| Ask: | 434.21 |

Open interactive stock chart for URI

KMB on Thursday, October 19, 2023

| Alert Time: | 2023-10-19 12:28:05 |

| Symbol | KMB |

| Alert price: | 122.55 |

| Demand zone range: | 122.37 – 122.42 |

| Demand zone time (when it formed): | 2023-10-19 11:19:00 |

| Peak price since zone was formed: | 123.37 (0.67% growth) |

| Day Range: | 122.25 – 124.21 |

| 52wk Range: | 111.85 – 147.87 |

| Prev Close: | 123.43 |

| Open: | 123.76 |

| Bid: | 122.49 |

| Ask: | 122.55 |

Open interactive stock chart for KMB

GNRC on Friday, October 20, 2023

| Alert Time: | 2023-10-20 14:04:11 |

| Symbol | GNRC |

| Alert price: | 89.42 |

| Demand zone range: | 89.22 – 89.34 |

| Demand zone time (when it formed): | 2023-10-20 13:08:00 |

| Peak price since zone was formed: | 90.75 (1.49% growth) |

| Day Range: | 88.32 – 92.32 |

| 52wk Range: | 86.29 – 156.95 |

| Prev Close: | 93.96 |

| Open: | 90.3 |

| Bid: | 89.32 |

| Ask: | 89.42 |

Open interactive stock chart for GNRC

FIS on Monday, October 23, 2023

| Alert Time: | 2023-10-23 12:19:16 |

| Symbol | FIS |

| Alert price: | 50.18 |

| Demand zone range: | 50.06 – 50.11 |

| Demand zone time (when it formed): | 2023-10-23 10:58:00 |

| Peak price since zone was formed: | 50.64 (0.92% growth) |

| Day Range: | 49.69 – 50.63 |

| 52wk Range: | 48.57 – 85.18 |

| Prev Close: | 50.4 |

| Open: | 50.19 |

| Bid: | 50.17 |

| Ask: | 50.18 |

Open interactive stock chart for FIS

ALB on Wednesday, October 25, 2023

| Alert Time: | 2023-10-25 12:01:18 |

| Symbol | ALB |

| Alert price: | 135.48 |

| Demand zone range: | 135.35 – 135.43 |

| Demand zone time (when it formed): | 2023-10-25 10:58:00 |

| Peak price since zone was formed: | 138.11 (1.94% growth) |

| Day Range: | 133.22 – 137.97 |

| 52wk Range: | 133.22 – 334.55 |

| Prev Close: | 139.24 |

| Open: | 136.15 |

| Bid: | 135.35 |

| Ask: | 135.48 |

Open interactive stock chart for ALB

HAS on Thursday, October 26, 2023

| Alert Time: | 2023-10-26 13:33:23 |

| Symbol | HAS |

| Alert price: | 49.05 |

| Demand zone range: | 48.99 – 49 |

| Demand zone time (when it formed): | 2023-10-26 13:11:00 |

| Peak price since zone was formed: | 49.67 (1.26% growth) |

| Day Range: | 46.37 – 50.28 |

| 52wk Range: | 45.75 – 73.58 |

| Prev Close: | 54.75 |

| Open: | 46.48 |

| Bid: | 48.99 |

| Ask: | 49.05 |

Open interactive stock chart for HAS

LOW on Friday, October 27, 2023

| Alert Time: | 2023-10-27 12:07:00 |

| Symbol | LOW |

| Alert price: | 183.9 |

| Demand zone range: | 183.64 – 183.72 |

| Demand zone time (when it formed): | 2023-10-27 10:41:00 |

| Peak price since zone was formed: | 185.45 (0.84% growth) |

| Day Range: | 183.16 – 185.45 |

| 52wk Range: | 178.3 – 237.21 |

| Prev Close: | 184.73 |

| Open: | 184.81 |

| Bid: | 183.76 |

| Ask: | 183.9 |

Open interactive stock chart for LOW

PEAK on Monday, October 30, 2023

| Alert Time: | 2023-10-30 10:51:30 |

| Symbol | PEAK |

| Alert price: | 15.92 |

| Demand zone range: | 15.85 – 15.9 |

| Demand zone time (when it formed): | 2023-10-30 09:51:00 |

| Peak price since zone was formed: | 16.23 (1.95% growth) |

| Day Range: | 15.85 – 16.74 |

| 52wk Range: | 15.85 – 28.43 |

| Prev Close: | 16.42 |

| Open: | 16.61 |

| Bid: | 15.91 |

| Ask: | 15.92 |

Open interactive stock chart for PEAK

CCL on Tuesday, October 31, 2023

| Alert Time: | 2023-10-31 11:24:30 |

| Symbol | CCL |

| Alert price: | 11.21 |

| Demand zone range: | 11.17 – 11.2 |

| Demand zone time (when it formed): | 2023-10-31 10:34:00 |

| Peak price since zone was formed: | 11.38 (1.52% growth) |

| Day Range: | 11.1 – 11.45 |

| 52wk Range: | 7.53 – 19.55 |

| Prev Close: | 11.4 |

| Open: | 11.43 |

| Bid: | 11.2 |

| Ask: | 11.21 |

Open interactive stock chart for CCL

SNPS on Wednesday, November 01, 2023

| Alert Time: | 2023-11-01 11:21:07 |

| Symbol | SNPS |

| Alert price: | 472.21 |

| Demand zone range: | 471.52 – 471.52 |

| Demand zone time (when it formed): | 2023-11-01 10:10:00 |

| Peak price since zone was formed: | 477.8 (1.18% growth) |

| Day Range: | 470.7 – 477.8 |

| 52wk Range: | 269.88 – 502.66 |

| Prev Close: | 469.44 |

| Open: | 470.7 |

| Bid: | 471.85 |

| Ask: | 472.21 |

Open interactive stock chart for SNPS

FSLR on Friday, November 03, 2023

| Alert Time: | 2023-11-03 10:42:00 |

| Symbol | FSLR |

| Alert price: | 152.71 |

| Demand zone range: | 152.38 – 152.7 |

| Demand zone time (when it formed): | 2023-11-03 10:31:00 |

| Peak price since zone was formed: | 153.83 (0.73% growth) |

| Day Range: | 148.45 – 154.98 |

| 52wk Range: | 132.19 – 232 |

| Prev Close: | 147.59 |

| Open: | 151.74 |

| Bid: | 152.33 |

| Ask: | 152.71 |

Open interactive stock chart for FSLR

IDXX on Monday, November 06, 2023

| Alert Time: | 2023-11-06 10:05:47 |

| Symbol | IDXX |

| Alert price: | 423.34 |

| Demand zone range: | 422.67 – 423.63 |

| Demand zone time (when it formed): | 2023-11-06 09:42:00 |

| Peak price since zone was formed: | 427.93 (1.08% growth) |

| Day Range: | 423.09 – 431.21 |

| 52wk Range: | 372.5 – 564.74 |

| Prev Close: | 429.3 |

| Open: | 430.92 |

| Bid: | 422.85 |

| Ask: | 423.34 |

Open interactive stock chart for IDXX

CTLT on Wednesday, November 08, 2023

| Alert Time: | 2023-11-08 10:38:28 |

| Symbol | CTLT |

| Alert price: | 34.6 |

| Demand zone range: | 34.49 – 34.55 |

| Demand zone time (when it formed): | 2023-11-08 10:23:00 |

| Peak price since zone was formed: | 34.79 (0.55% growth) |

| Day Range: | 34.42 – 35.25 |

| 52wk Range: | 31.45 – 74.49 |

| Prev Close: | 34.82 |

| Open: | 35.01 |

| Bid: | 34.52 |

| Ask: | 34.6 |

Open interactive stock chart for CTLT

JBHT on Thursday, November 09, 2023

| Alert Time: | 2023-11-09 13:07:50 |

| Symbol | JBHT |

| Alert price: | 172.58 |

| Demand zone range: | 172.34 – 172.34 |

| Demand zone time (when it formed): | 2023-11-09 10:59:00 |

| Peak price since zone was formed: | 173.99 (0.82% growth) |

| Day Range: | 172.26 – 175.02 |

| 52wk Range: | 163.66 – 209.21 |

| Prev Close: | 174.58 |

| Open: | 175.02 |

| Bid: | 172.43 |

| Ask: | 172.58 |

Open interactive stock chart for JBHT

DVN on Friday, November 10, 2023

| Alert Time: | 2023-11-10 14:35:50 |

| Symbol | DVN |

| Alert price: | 45.54 |

| Demand zone range: | 45.45 – 45.48 |

| Demand zone time (when it formed): | 2023-11-10 12:38:00 |

| Peak price since zone was formed: | 45.96 (0.92% growth) |

| Day Range: | 44.53 – 45.96 |

| 52wk Range: | 42.59 – 73.98 |

| Prev Close: | 44.14 |

| Open: | 44.61 |

| Bid: | 45.53 |

| Ask: | 45.54 |

Open interactive stock chart for DVN

CFG on Monday, November 13, 2023

| Alert Time: | 2023-11-13 12:48:12 |

| Symbol | CFG |

| Alert price: | 25.01 |

| Demand zone range: | 24.97 – 24.99 |

| Demand zone time (when it formed): | 2023-11-13 11:37:00 |

| Peak price since zone was formed: | 25.25 (0.96% growth) |

| Day Range: | 24.73 – 25.25 |

| 52wk Range: | 22.77 – 44.82 |

| Prev Close: | 25.17 |

| Open: | 25.12 |

| Bid: | 25 |

| Ask: | 25.01 |

Open interactive stock chart for CFG

LUV on Tuesday, November 14, 2023

| Alert Time: | 2023-11-14 12:19:28 |

| Symbol | LUV |

| Alert price: | 23.8 |

| Demand zone range: | 23.76 – 23.78 |

| Demand zone time (when it formed): | 2023-11-14 10:56:00 |

| Peak price since zone was formed: | 24.06 (1.09% growth) |

| Day Range: | 23.47 – 24.05 |

| 52wk Range: | 21.91 – 40.38 |

| Prev Close: | 23.09 |

| Open: | 23.65 |

| Bid: | 23.79 |

| Ask: | 23.8 |

Open interactive stock chart for LUV

ODFL on Wednesday, November 15, 2023

| Alert Time: | 2023-11-15 11:40:12 |

| Symbol | ODFL |

| Alert price: | 407.1 |

| Demand zone range: | 406.5 – 406.5 |

| Demand zone time (when it formed): | 2023-11-15 10:30:00 |

| Peak price since zone was formed: | 410.48 (0.83% growth) |

| Day Range: | 405.5 – 411.32 |

| 52wk Range: | 277.49 – 438.05 |

| Prev Close: | 404.83 |

| Open: | 406.4 |

| Bid: | 406.8 |

| Ask: | 407.1 |

Open interactive stock chart for ODFL

SEE on Thursday, November 16, 2023

| Alert Time: | 2023-11-16 11:42:28 |

| Symbol | SEE |

| Alert price: | 33.17 |

| Demand zone range: | 33.12 – 33.13 |

| Demand zone time (when it formed): | 2023-11-16 10:20:00 |

| Peak price since zone was formed: | 33.59 (1.27% growth) |

| Day Range: | 33.09 – 33.69 |

| 52wk Range: | 28.5 – 56.43 |

| Prev Close: | 33.57 |

| Open: | 33.43 |

| Bid: | 33.14 |

| Ask: | 33.17 |

Open interactive stock chart for SEE

GPS on Monday, November 20, 2023

| Alert Time: | 2023-11-20 12:23:56 |

| Symbol | GPS |

| Alert price: | 18.23 |

| Demand zone range: | 18.17 – 18.21 |

| Demand zone time (when it formed): | 2023-11-20 11:11:00 |

| Peak price since zone was formed: | 18.52 (1.59% growth) |

| Day Range: | 17.51 – 18.52 |

| 52wk Range: | 7.22 – 18.52 |

| Prev Close: | 17.85 |

| Open: | 17.95 |

| Bid: | 18.22 |

| Ask: | 18.23 |

Open interactive stock chart for GPS

KSS on Tuesday, November 21, 2023

| Alert Time: | 2023-11-21 10:23:57 |

| Symbol | KSS |

| Alert price: | 21.62 |

| Demand zone range: | 21.57 – 21.64 |

| Demand zone time (when it formed): | 2023-11-21 10:16:00 |

| Peak price since zone was formed: | 21.86 (1.11% growth) |

| Day Range: | 21.51 – 23.51 |

| 52wk Range: | 17.68 – 35.77 |

| Prev Close: | 24.86 |

| Open: | 23.51 |

| Bid: | 21.61 |

| Ask: | 21.62 |

Open interactive stock chart for KSS

SRCL on Wednesday, November 22, 2023

| Alert Time: | 2023-11-22 12:43:41 |

| Symbol | SRCL |

| Alert price: | 44.87 |

| Demand zone range: | 44.81 – 44.82 |

| Demand zone time (when it formed): | 2023-11-22 11:01:00 |

| Peak price since zone was formed: | 45.25 (0.85% growth) |

| Day Range: | 44.52 – 45.25 |

| 52wk Range: | 37.78 – 56.12 |

| Prev Close: | 44.51 |

| Open: | 44.78 |

| Bid: | 44.83 |

| Ask: | 44.87 |

Open interactive stock chart for SRCL

KSS on Monday, November 27, 2023

| Alert Time: | 2023-11-27 10:29:58 |

| Symbol | KSS |

| Alert price: | 22.45 |

| Demand zone range: | 22.36 – 22.42 |

| Demand zone time (when it formed): | 2023-11-27 09:59:00 |

| Peak price since zone was formed: | 22.84 (1.74% growth) |

| Day Range: | 22.21 – 22.95 |

| 52wk Range: | 17.68 – 35.77 |

| Prev Close: | 23.15 |

| Open: | 22.82 |

| Bid: | 22.43 |

| Ask: | 22.45 |

Open interactive stock chart for KSS

VFC on Tuesday, November 28, 2023

| Alert Time: | 2023-11-28 12:48:05 |

| Symbol | VFC |

| Alert price: | 16.77 |

| Demand zone range: | 16.74 – 16.75 |

| Demand zone time (when it formed): | 2023-11-28 11:27:00 |

| Peak price since zone was formed: | 16.93 (0.95% growth) |

| Day Range: | 16.37 – 16.94 |

| 52wk Range: | 12.85 – 34.44 |

| Prev Close: | 16.58 |

| Open: | 16.51 |

| Bid: | 16.75 |

| Ask: | 16.77 |

Open interactive stock chart for VFC

ETSY on Wednesday, November 29, 2023

| Alert Time: | 2023-11-29 13:53:27 |

| Symbol | ETSY |

| Alert price: | 77.77 |

| Demand zone range: | 77.56 – 77.68 |

| Demand zone time (when it formed): | 2023-11-29 12:01:00 |

| Peak price since zone was formed: | 78.58 (1.04% growth) |

| Day Range: | 76.29 – 78.58 |

| 52wk Range: | 58.2 – 149.91 |

| Prev Close: | 75.27 |

| Open: | 76.52 |

| Bid: | 77.75 |

| Ask: | 77.77 |

Open interactive stock chart for ETSY

FL on Monday, December 04, 2023

| Alert Time: | 2023-12-04 13:25:50 |

| Symbol | FL |

| Alert price: | 29.88 |

| Demand zone range: | 29.8 – 29.84 |

| Demand zone time (when it formed): | 2023-12-04 11:02:00 |

| Peak price since zone was formed: | 30.33 (1.51% growth) |

| Day Range: | 29.07 – 30.33 |

| 52wk Range: | 14.84 – 47.22 |

| Prev Close: | 29.71 |

| Open: | 29.51 |

| Bid: | 29.87 |

| Ask: | 29.88 |

Open interactive stock chart for FL

VRSN on Tuesday, December 05, 2023

| Alert Time: | 2023-12-05 12:23:20 |

| Symbol | VRSN |

| Alert price: | 217.06 |

| Demand zone range: | 216.77 – 216.77 |

| Demand zone time (when it formed): | 2023-12-05 10:16:00 |

| Peak price since zone was formed: | 218.79 (0.8% growth) |

| Day Range: | 216.07 – 218.75 |

| 52wk Range: | 188.44 – 229.72 |

| Prev Close: | 218.73 |

| Open: | 218.54 |

| Bid: | 216.99 |

| Ask: | 217.06 |

Open interactive stock chart for VRSN

M on Wednesday, December 06, 2023

| Alert Time: | 2023-12-06 10:55:58 |

| Symbol | M |

| Alert price: | 16.54 |

| Demand zone range: | 16.5 – 16.54 |

| Demand zone time (when it formed): | 2023-12-06 10:35:00 |

| Peak price since zone was formed: | 16.66 (0.73% growth) |

| Day Range: | 16.46 – 16.83 |

| 52wk Range: | 10.54 – 25.12 |

| Prev Close: | 16.46 |

| Open: | 16.6 |

| Bid: | 16.53 |

| Ask: | 16.54 |

Open interactive stock chart for M