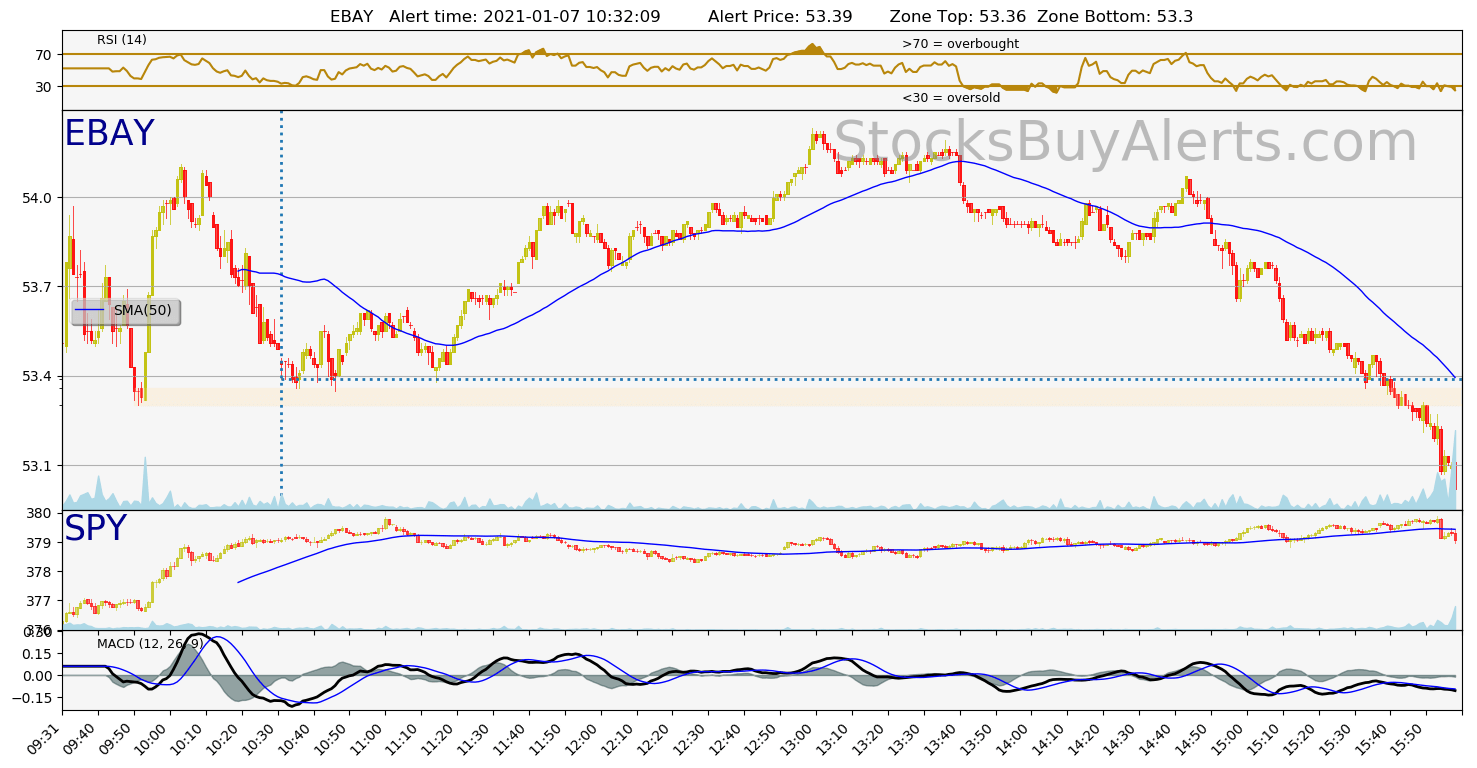

The world looks quite a bit different than it did at the beginning of last year, and we hope that we are on the verge of entering into a brighter period. Successful vaccines should lead to the end of social distancing and a return to normalcy.

US Equity Markets in Q1: The S&P 500 increased by +6.2% in the first quarter. The market reached another new all-time high on March 26th when the S&P closed at 3,975. After declining by nearly -34% during the pandemic selloff last year (2/19/20 to 3/23/20), the S&P 500 is up by over +80% from the low.

Our system generated multiple day trading alerts this quarter.

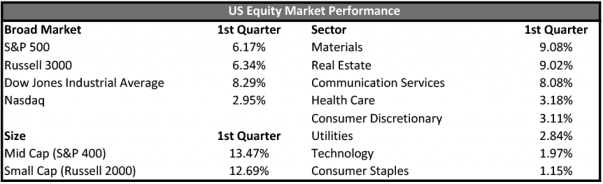

CCL on Tuesday, January 05, 2021

| Alert Time: | 2021-01-05 10:30:36 |

| Symbol | CCL |

| Alert price: | 20.26 |

| Demand zone range: | 20.21 – 20.25 |

| Demand zone time (when it formed): | 2021-01-05 10:16:00 |

| Peak price since zone was formed: | 20.38 (0.59% growth) |

| Day Range: | 20.15 – 20.74 |

| 52wk Range: | 7.8 – 51.94 |

| Prev Close: | 20.38 |

| Open: | 20.18 |

| Bid: | 20.25 |

| Ask: | 20.26 |

Open interactive stock chart for CCL

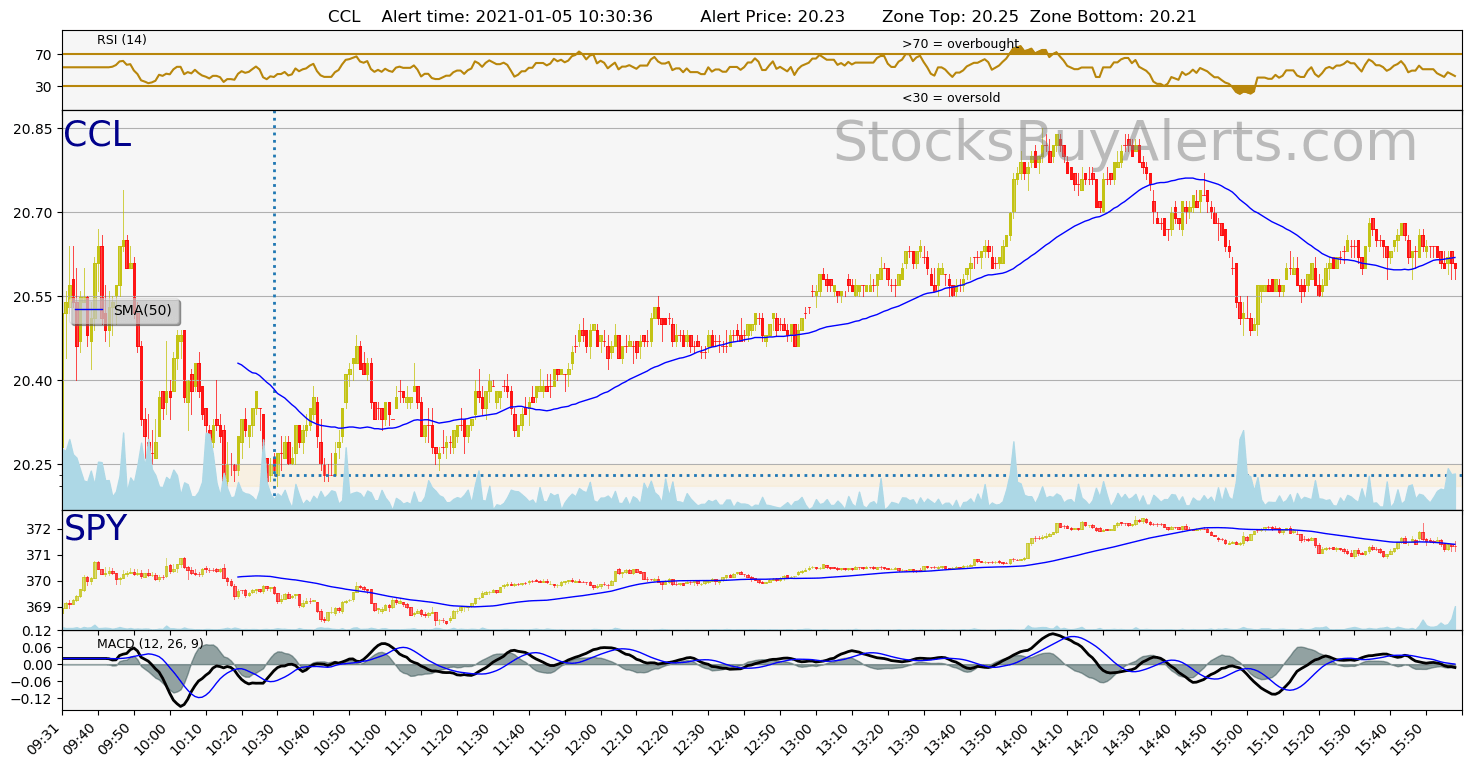

ISRG on Wednesday, January 06, 2021

| Alert Time: | 2021-01-06 12:24:06 |

| Symbol | ISRG |

| Alert price: | 792.11 |

| Demand zone range: | 790.86 – 791.01 |

| Demand zone time (when it formed): | 2021-01-06 10:21:00 |

| Peak price since zone was formed: | 799.58 (0.94% growth) |

| Day Range: | 786.86 – 800 |

| 52wk Range: | 360.5 – 826.81 |

| Prev Close: | 805.05 |

| Open: | 795.28 |

| Bid: | 791.27 |

| Ask: | 792.11 |

Open interactive stock chart for ISRG

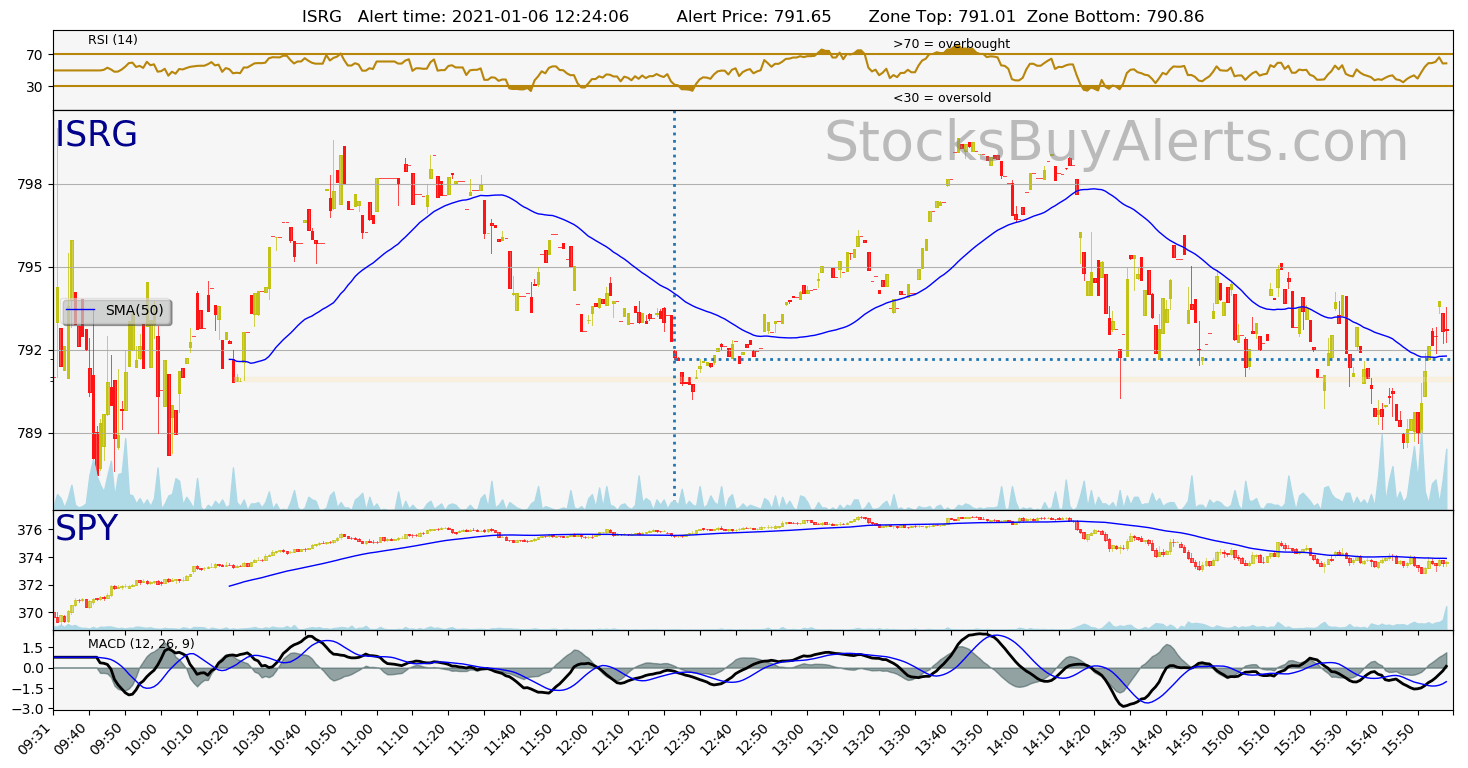

EBAY on Thursday, January 07, 2021

| Alert Time: | 2021-01-07 10:32:09 |

| Symbol | EBAY |

| Alert price: | 53.43 |

| Demand zone range: | 53.3 – 53.36 |

| Demand zone time (when it formed): | 2021-01-07 09:51:00 |

| Peak price since zone was formed: | 54.09 (1.24% growth) |

| Day Range: | 53.3 – 54.11 |

| 52wk Range: | 26.02 – 61.06 |

| Prev Close: | 53.22 |

| Open: | 53.42 |

| Bid: | 53.41 |

| Ask: | 53.43 |

Open interactive stock chart for EBAY

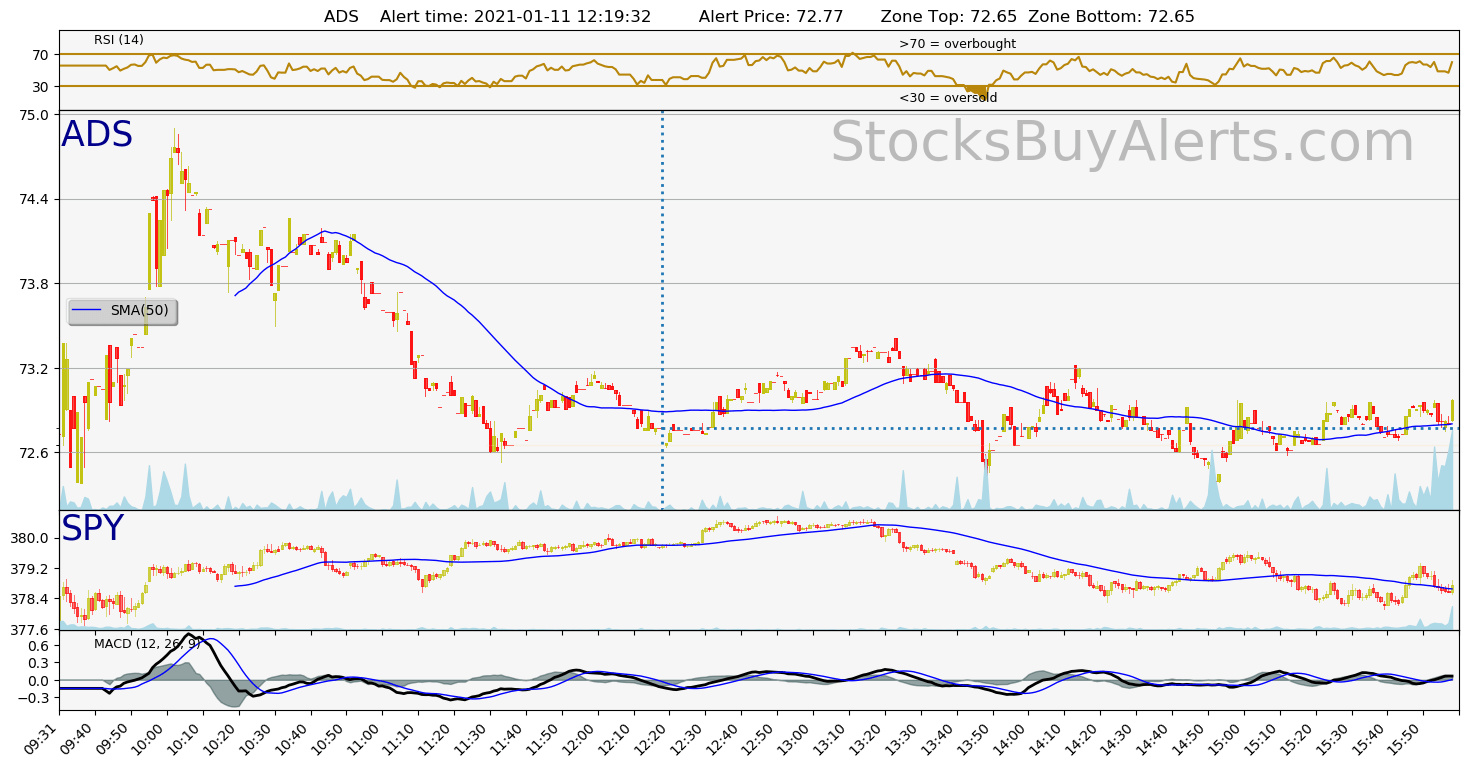

ADS on Monday, January 11, 2021

| Alert Time: | 2021-01-11 12:19:32 |

| Symbol | ADS |

| Alert price: | 72.7 |

| Demand zone range: | 72.65 – 72.65 |

| Demand zone time (when it formed): | 2021-01-11 11:30:00 |

| Peak price since zone was formed: | 73.16 (0.63% growth) |

| Day Range: | 72.25 – 74.9 |

| 52wk Range: | 20.51 – 115.62 |

| Prev Close: | 74.5 |

| Open: | 72.82 |

| Bid: | 72.61 |

| Ask: | 72.7 |

Open interactive stock chart for ADS

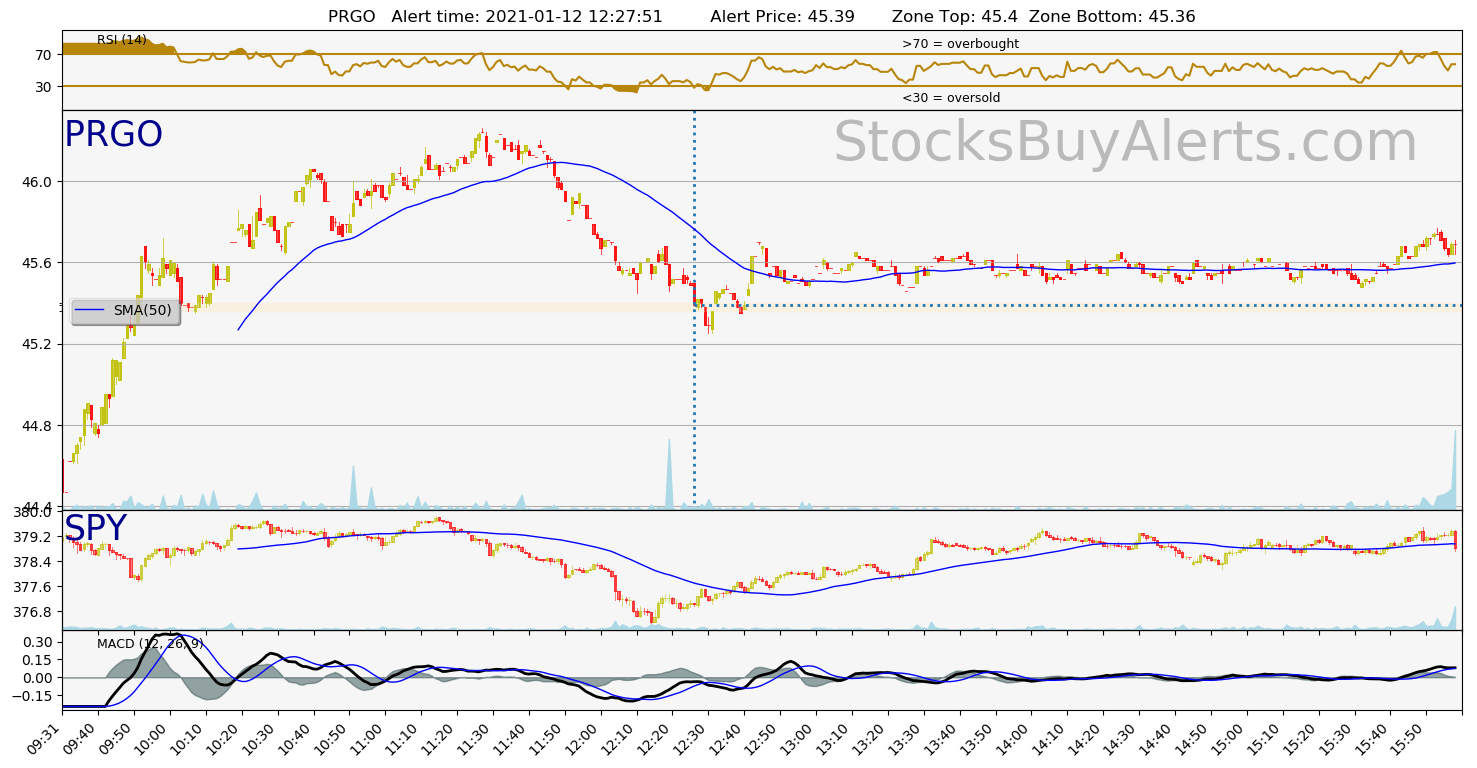

PRGO on Tuesday, January 12, 2021

| Alert Time: | 2021-01-12 12:27:51 |

| Symbol | PRGO |

| Alert price: | 45.45 |

| Demand zone range: | 45.36 – 45.4 |

| Demand zone time (when it formed): | 2021-01-12 10:04:00 |

| Peak price since zone was formed: | 46.24 (1.74% growth) |

| Day Range: | 44.47 – 46.26 |

| 52wk Range: | 40.01 – 63.86 |

| Prev Close: | 44.6 |

| Open: | 44.65 |

| Bid: | 45.39 |

| Ask: | 45.45 |

Open interactive stock chart for PRGO

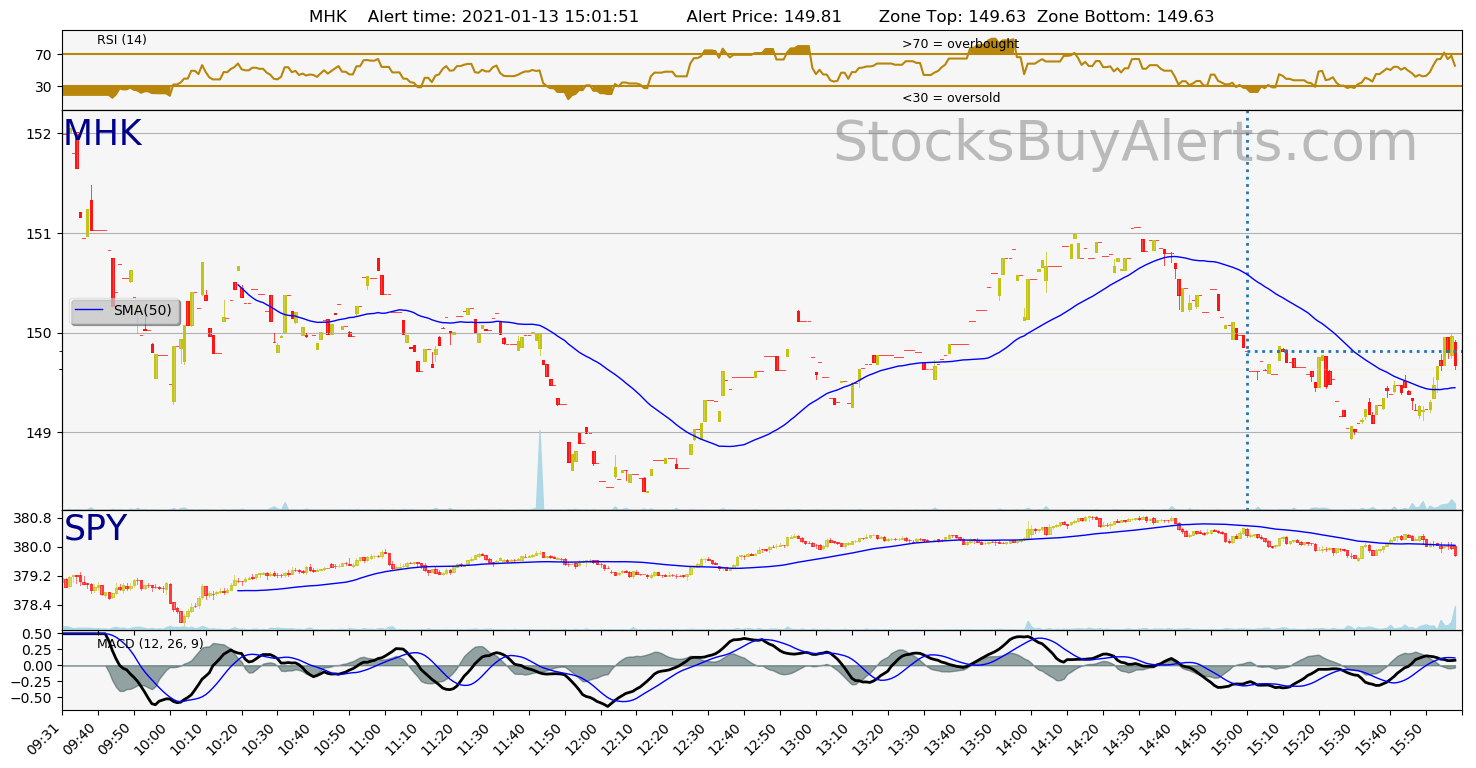

MHK on Wednesday, January 13, 2021

| Alert Time: | 2021-01-13 15:01:51 |

| Symbol | MHK |

| Alert price: | 149.81 |

| Demand zone range: | 149.63 – 149.63 |

| Demand zone time (when it formed): | 2021-01-13 13:31:00 |

| Peak price since zone was formed: | 151.06 (0.83% growth) |

| Day Range: | 148.4 – 152.05 |

| 52wk Range: | 56.62 – 152.05 |

| Prev Close: | 150.87 |

| Open: | 151.7 |

| Bid: | 149.61 |

| Ask: | 149.81 |

Open interactive stock chart for MHK

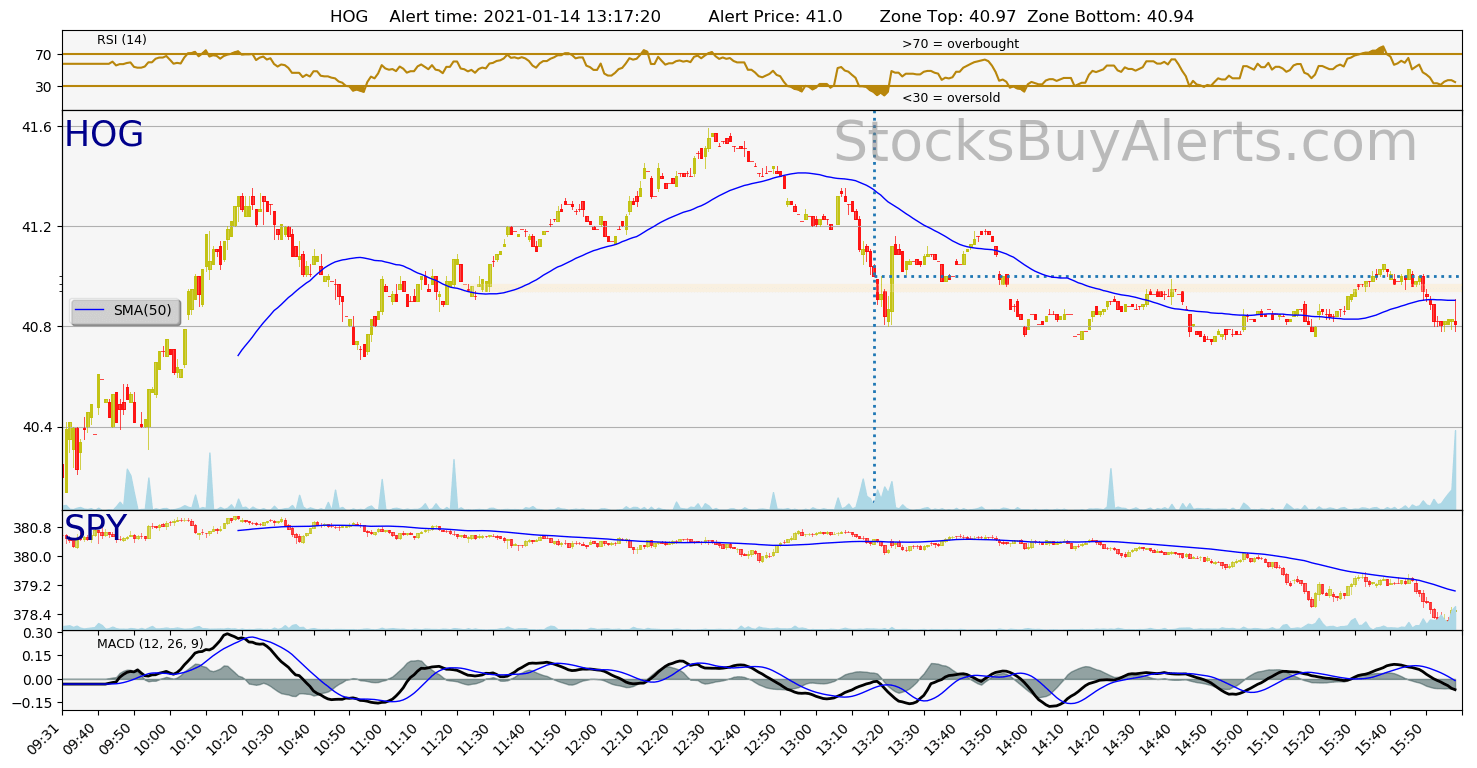

HOG on Thursday, January 14, 2021

| Alert Time: | 2021-01-14 13:17:20 |

| Symbol | HOG |

| Alert price: | 41.03 |

| Demand zone range: | 40.94 – 40.97 |

| Demand zone time (when it formed): | 2021-01-14 11:22:00 |

| Peak price since zone was formed: | 41.59 (1.36% growth) |

| Day Range: | 40.05 – 41.59 |

| 52wk Range: | 14.31 – 41.82 |

| Prev Close: | 39.68 |

| Open: | 40.21 |

| Bid: | 41.01 |

| Ask: | 41.03 |

Open interactive stock chart for HOG

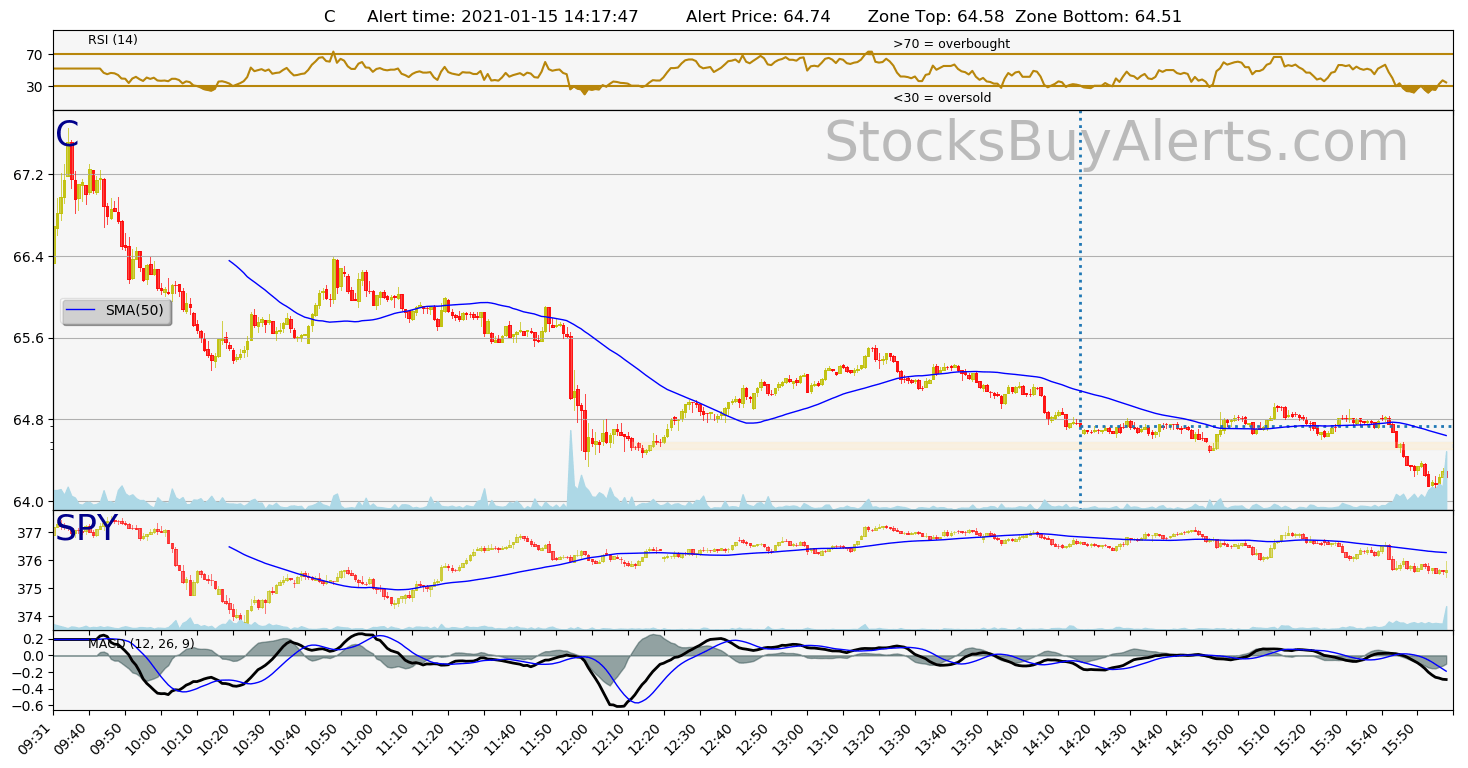

C on Friday, January 15, 2021

| Alert Time: | 2021-01-15 14:17:47 |

| Symbol | C |

| Alert price: | 64.67 |

| Demand zone range: | 64.51 – 64.58 |

| Demand zone time (when it formed): | 2021-01-15 12:12:00 |

| Peak price since zone was formed: | 65.51 (1.3% growth) |

| Day Range: | 64.34 – 67.65 |

| 52wk Range: | 32 – 82.13 |

| Prev Close: | 69.01 |

| Open: | 67.37 |

| Bid: | 64.66 |

| Ask: | 64.67 |

Open interactive stock chart for C

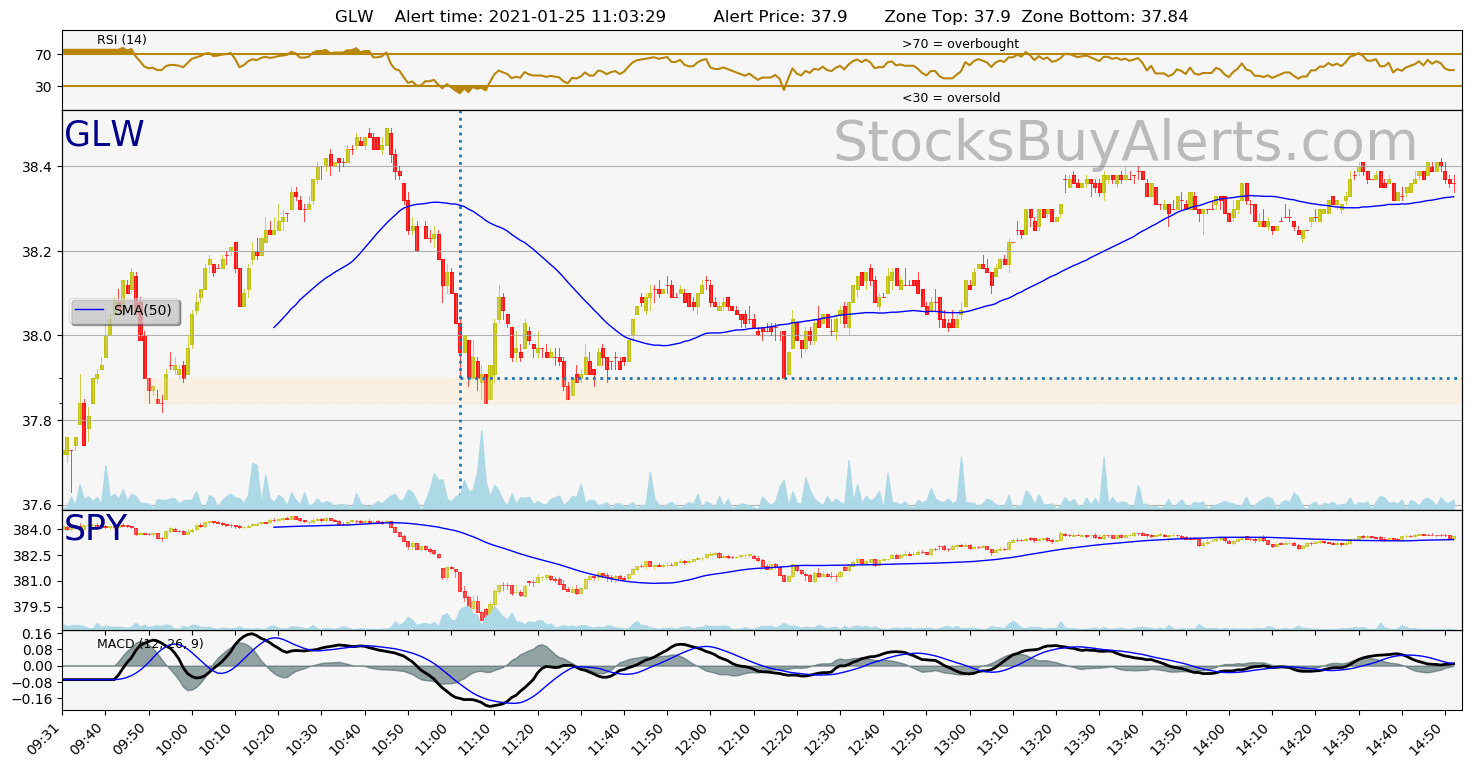

GLW on Monday, January 25, 2021

| Alert Time: | 2021-01-25 11:03:29 |

| Symbol | GLW |

| Alert price: | 37.95 |

| Demand zone range: | 37.84 – 37.9 |

| Demand zone time (when it formed): | 2021-01-25 09:50:00 |

| Peak price since zone was formed: | 38.49 (1.42% growth) |

| Day Range: | 37.55 – 38.49 |

| 52wk Range: | 17.44 – 38.84 |

| Prev Close: | 37.6 |

| Open: | 37.74 |

| Bid: | 37.94 |

| Ask: | 37.95 |

Open interactive stock chart for GLW

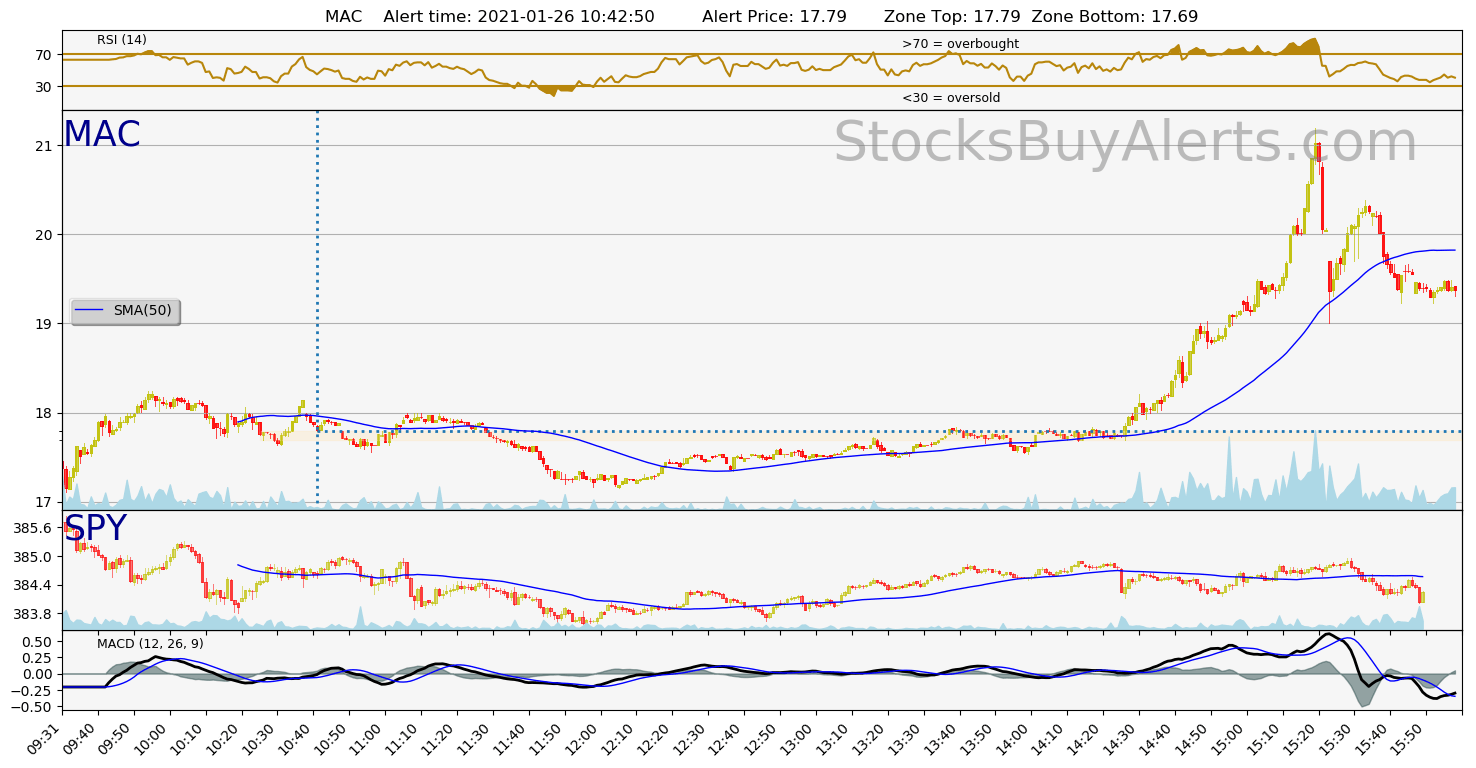

MAC on Tuesday, January 26, 2021

| Alert Time: | 2021-01-26 10:42:50 |

| Symbol | MAC |

| Alert price: | 17.81 |

| Demand zone range: | 17.69 – 17.79 |

| Demand zone time (when it formed): | 2021-01-26 10:26:00 |

| Peak price since zone was formed: | 18.14 (1.85% growth) |

| Day Range: | 17.11 – 18.24 |

| 52wk Range: | 4.56 – 25.01 |

| Prev Close: | 17.24 |

| Open: | 17.51 |

| Bid: | 17.79 |

| Ask: | 17.81 |

Open interactive stock chart for MAC

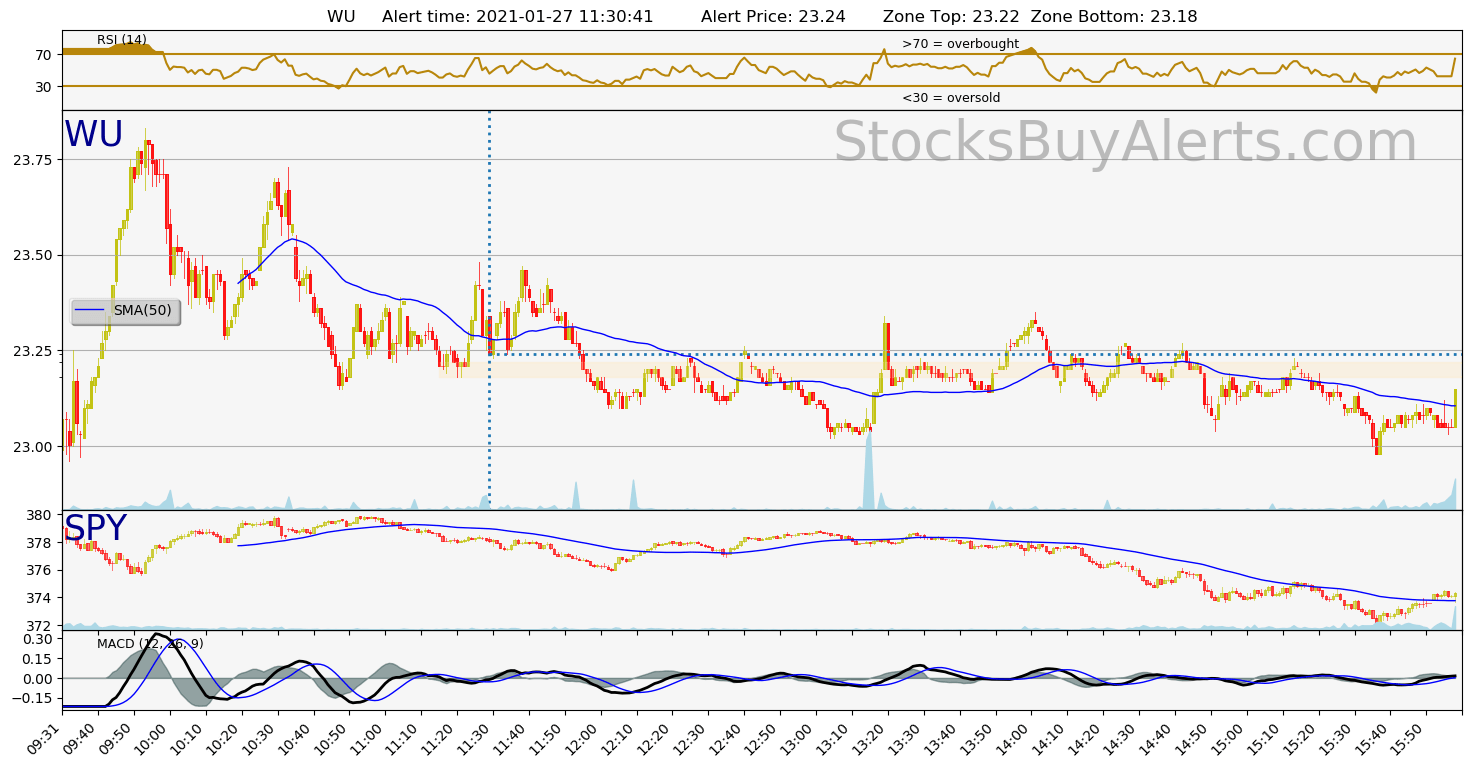

WU on Wednesday, January 27, 2021

| Alert Time: | 2021-01-27 11:30:41 |

| Symbol | WU |

| Alert price: | 23.25 |

| Demand zone range: | 23.18 – 23.22 |

| Demand zone time (when it formed): | 2021-01-27 11:16:00 |

| Peak price since zone was formed: | 23.43 (0.77% growth) |

| Day Range: | 22.74 – 23.83 |

| 52wk Range: | 17.39 – 28.45 |

| Prev Close: | 22.83 |

| Open: | 22.74 |

| Bid: | 23.24 |

| Ask: | 23.25 |

Open interactive stock chart for WU

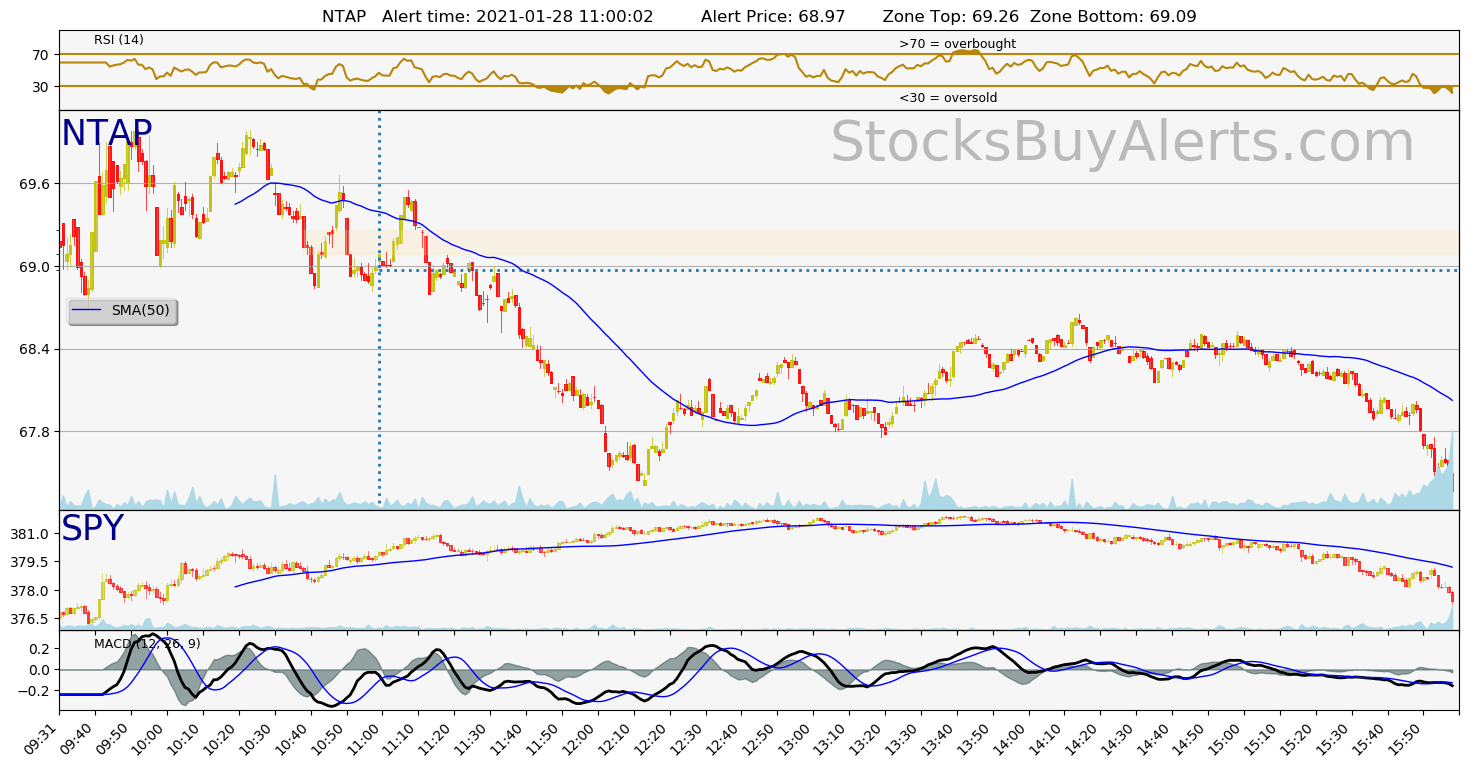

NTAP on Thursday, January 28, 2021

| Alert Time: | 2021-01-28 11:00:02 |

| Symbol | NTAP |

| Alert price: | 69.11 |

| Demand zone range: | 69.09 – 69.26 |

| Demand zone time (when it formed): | 2021-01-28 10:39:00 |

| Peak price since zone was formed: | 69.66 (0.8% growth) |

| Day Range: | 68.68 – 70 |

| 52wk Range: | 34.66 – 70.64 |

| Prev Close: | 68.89 |

| Open: | 68.77 |

| Bid: | 69.02 |

| Ask: | 69.11 |

Open interactive stock chart for NTAP

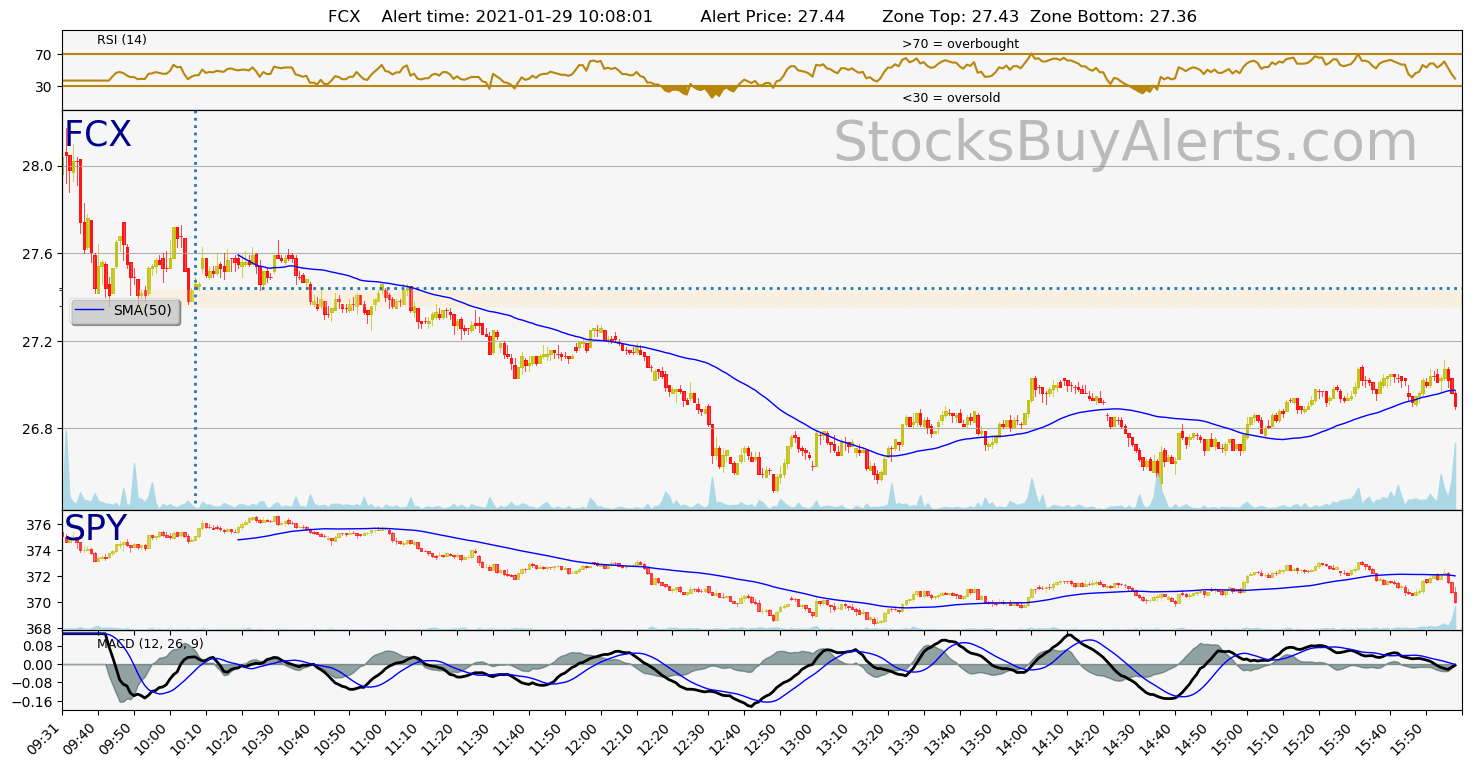

FCX on Friday, January 29, 2021

| Alert Time: | 2021-01-29 10:08:01 |

| Symbol | FCX |

| Alert price: | 27.44 |

| Demand zone range: | 27.36 – 27.43 |

| Demand zone time (when it formed): | 2021-01-29 09:52:00 |

| Peak price since zone was formed: | 27.59 (0.55% growth) |

| Day Range: | 27.36 – 28.17 |

| 52wk Range: | 4.82 – 32.49 |

| Prev Close: | 27.79 |

| Open: | 27.99 |

| Bid: | 27.43 |

| Ask: | 27.44 |

Open interactive stock chart for FCX

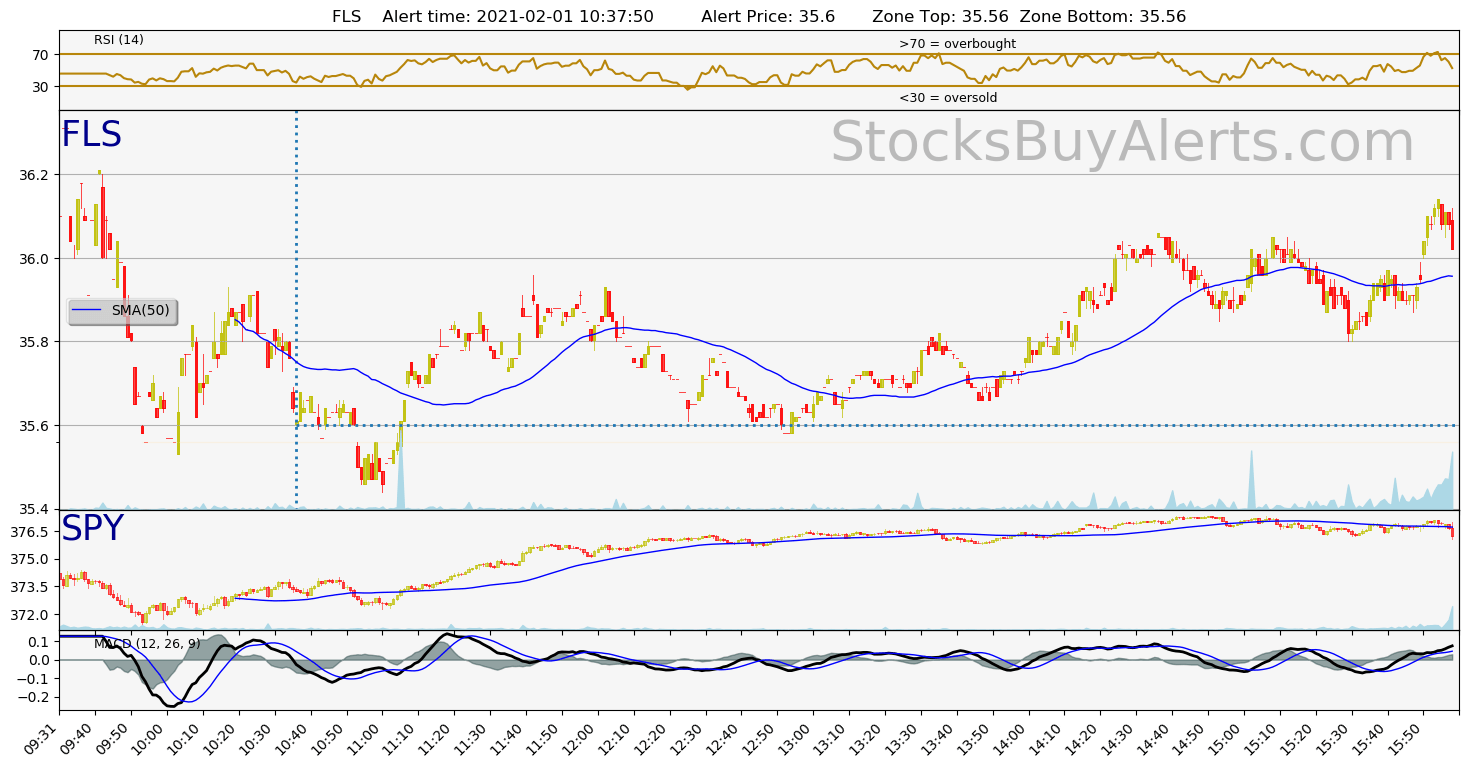

FLS on Monday, February 01, 2021

| Alert Time: | 2021-02-01 10:37:50 |

| Symbol | FLS |

| Alert price: | 35.61 |

| Demand zone range: | 35.56 – 35.56 |

| Demand zone time (when it formed): | 2021-02-01 09:54:00 |

| Peak price since zone was formed: | 35.93 (0.9% growth) |

| Day Range: | 35.53 – 36.31 |

| 52wk Range: | 18.98 – 49.41 |

| Prev Close: | 35.56 |

| Open: | 36.1 |

| Bid: | 35.59 |

| Ask: | 35.61 |

Open interactive stock chart for FLS

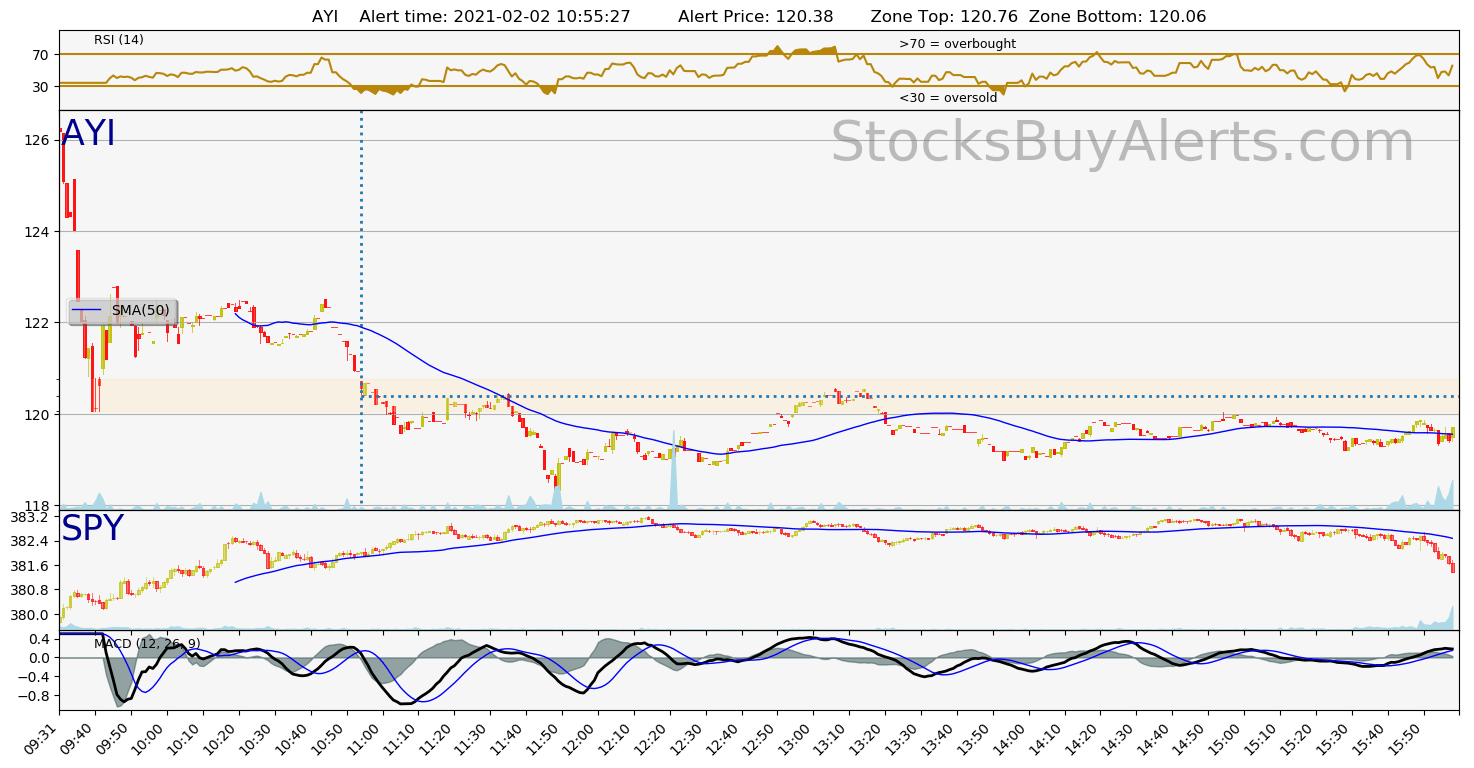

AYI on Tuesday, February 02, 2021

| Alert Time: | 2021-02-02 10:55:27 |

| Symbol | AYI |

| Alert price: | 120.94 |

| Demand zone range: | 120.06 – 120.76 |

| Demand zone time (when it formed): | 2021-02-02 09:40:00 |

| Peak price since zone was formed: | 122.51 (1.3% growth) |

| Day Range: | 120.06 – 127 |

| 52wk Range: | 67.46 – 135.59 |

| Prev Close: | 125.18 |

| Open: | 127 |

| Bid: | 120.51 |

| Ask: | 120.94 |

Open interactive stock chart for AYI

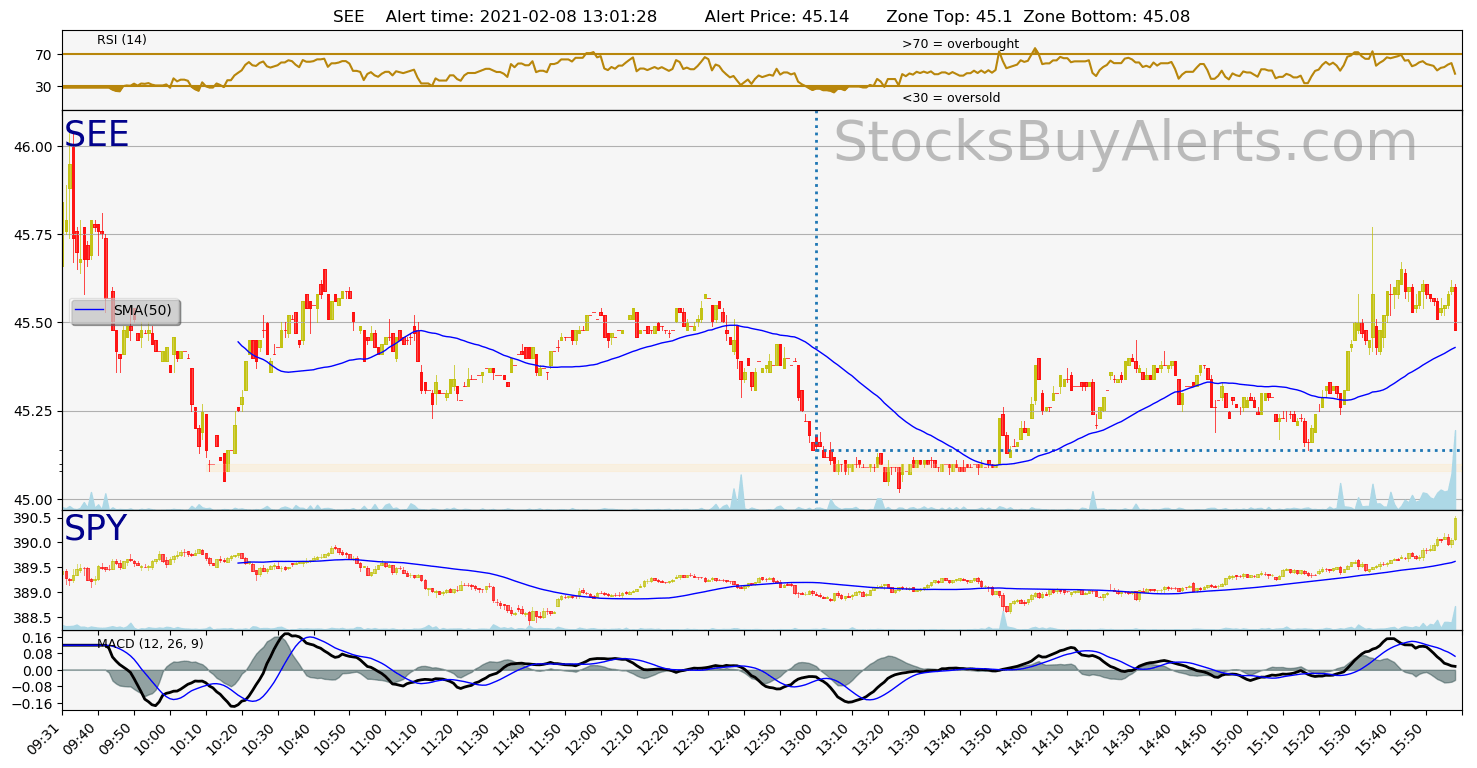

SEE on Monday, February 08, 2021

| Alert Time: | 2021-02-08 13:01:28 |

| Symbol | SEE |

| Alert price: | 45.16 |

| Demand zone range: | 45.08 – 45.1 |

| Demand zone time (when it formed): | 2021-02-08 10:11:00 |

| Peak price since zone was formed: | 45.65 (1.09% growth) |

| Day Range: | 45.05 – 46.05 |

| 52wk Range: | 17.06 – 47.9 |

| Prev Close: | 45.21 |

| Open: | 45.6 |

| Bid: | 45.14 |

| Ask: | 45.16 |

Open interactive stock chart for SEE

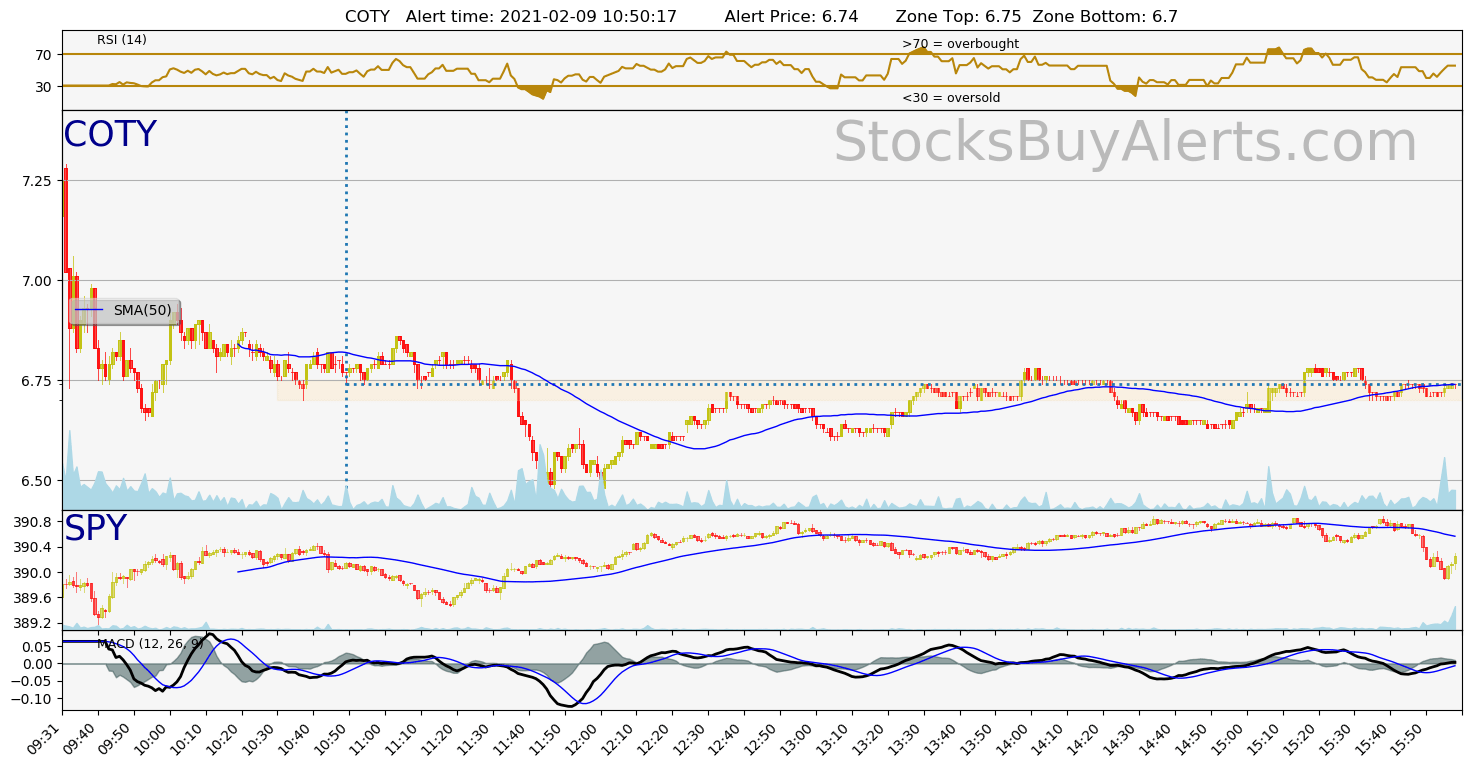

COTY on Tuesday, February 09, 2021

| Alert Time: | 2021-02-09 10:50:17 |

| Symbol | COTY |

| Alert price: | 6.75 |

| Demand zone range: | 6.7 – 6.75 |

| Demand zone time (when it formed): | 2021-02-09 10:31:00 |

| Peak price since zone was formed: | 6.82 (1.04% growth) |

| Day Range: | 6.65 – 7.38 |

| 52wk Range: | 2.65 – 12.26 |

| Prev Close: | 7.94 |

| Open: | 7 |

| Bid: | 6.74 |

| Ask: | 6.75 |

Open interactive stock chart for COTY

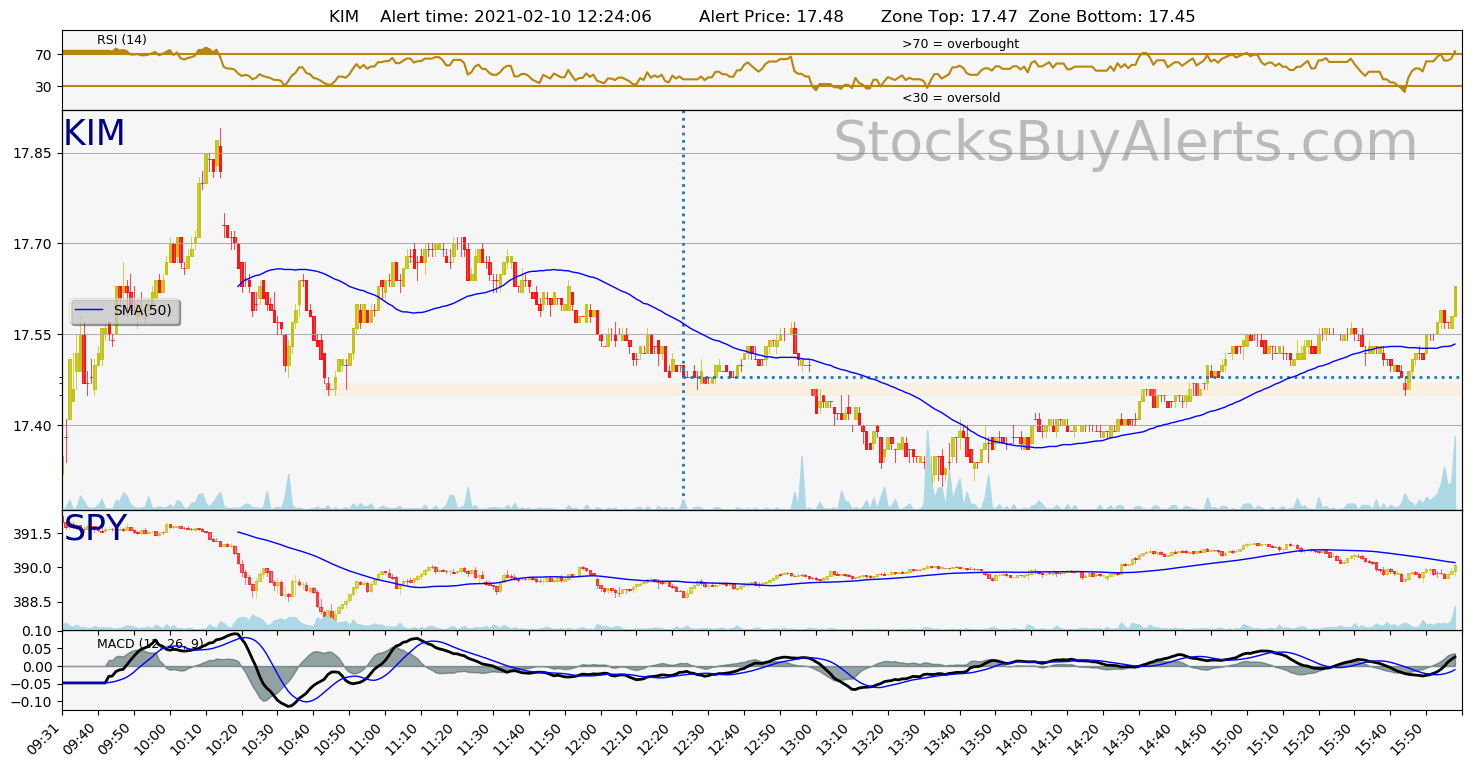

KIM on Wednesday, February 10, 2021

| Alert Time: | 2021-02-10 12:24:06 |

| Symbol | KIM |

| Alert price: | 17.49 |

| Demand zone range: | 17.45 – 17.47 |

| Demand zone time (when it formed): | 2021-02-10 10:44:00 |

| Peak price since zone was formed: | 17.71 (1.26% growth) |

| Day Range: | 17.32 – 17.89 |

| 52wk Range: | 7.45 – 19.84 |

| Prev Close: | 17.19 |

| Open: | 17.35 |

| Bid: | 17.48 |

| Ask: | 17.49 |

Open interactive stock chart for KIM

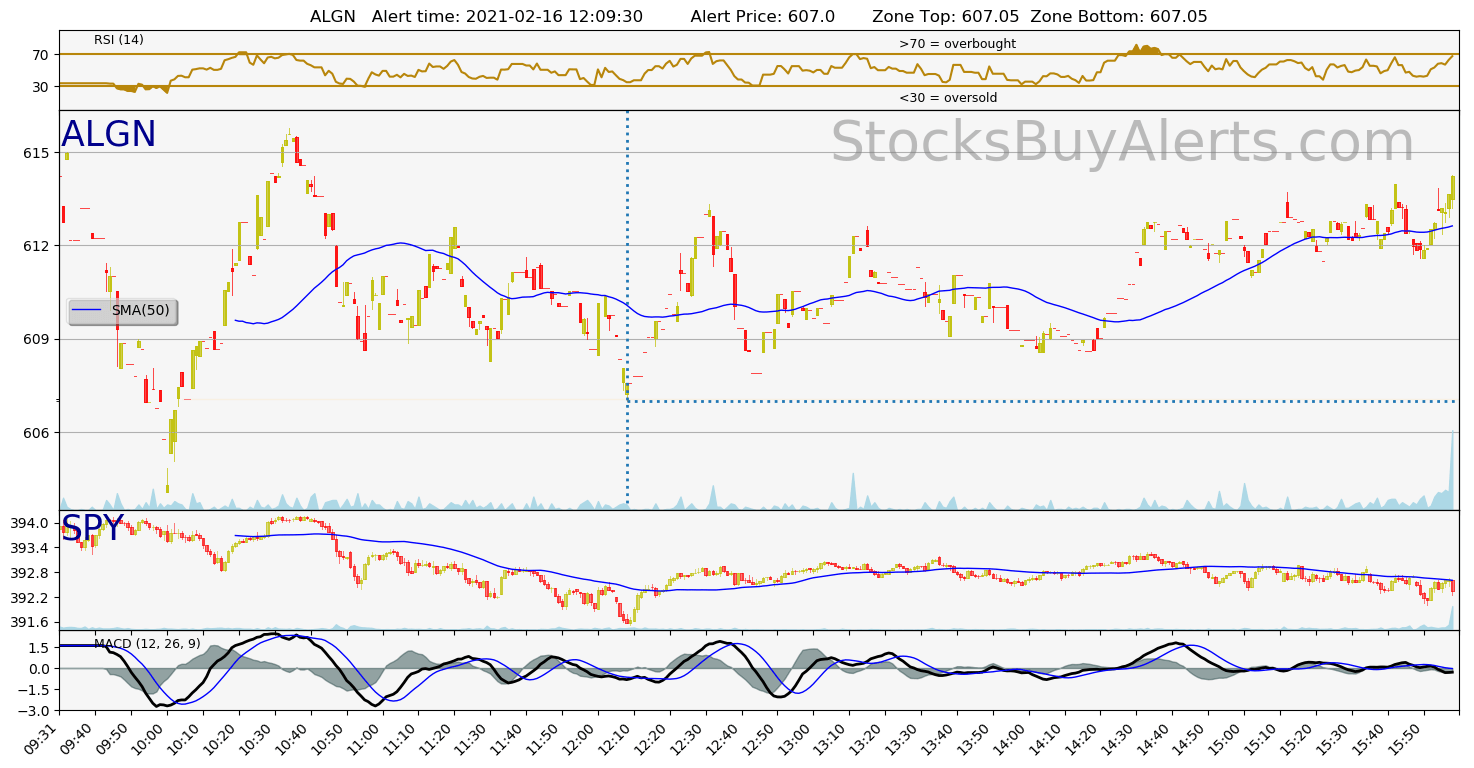

ALGN on Tuesday, February 16, 2021

| Alert Time: | 2021-02-16 12:09:30 |

| Symbol | ALGN |

| Alert price: | 607.64 |

| Demand zone range: | 607.05 – 607.05 |

| Demand zone time (when it formed): | 2021-02-16 10:05:00 |

| Peak price since zone was formed: | 614.58 (1.14% growth) |

| Day Range: | 604.07 – 615.76 |

| 52wk Range: | 127.88 – 634.46 |

| Prev Close: | 609.58 |

| Open: | 612.69 |

| Bid: | 606.35 |

| Ask: | 607.64 |

Open interactive stock chart for ALGN

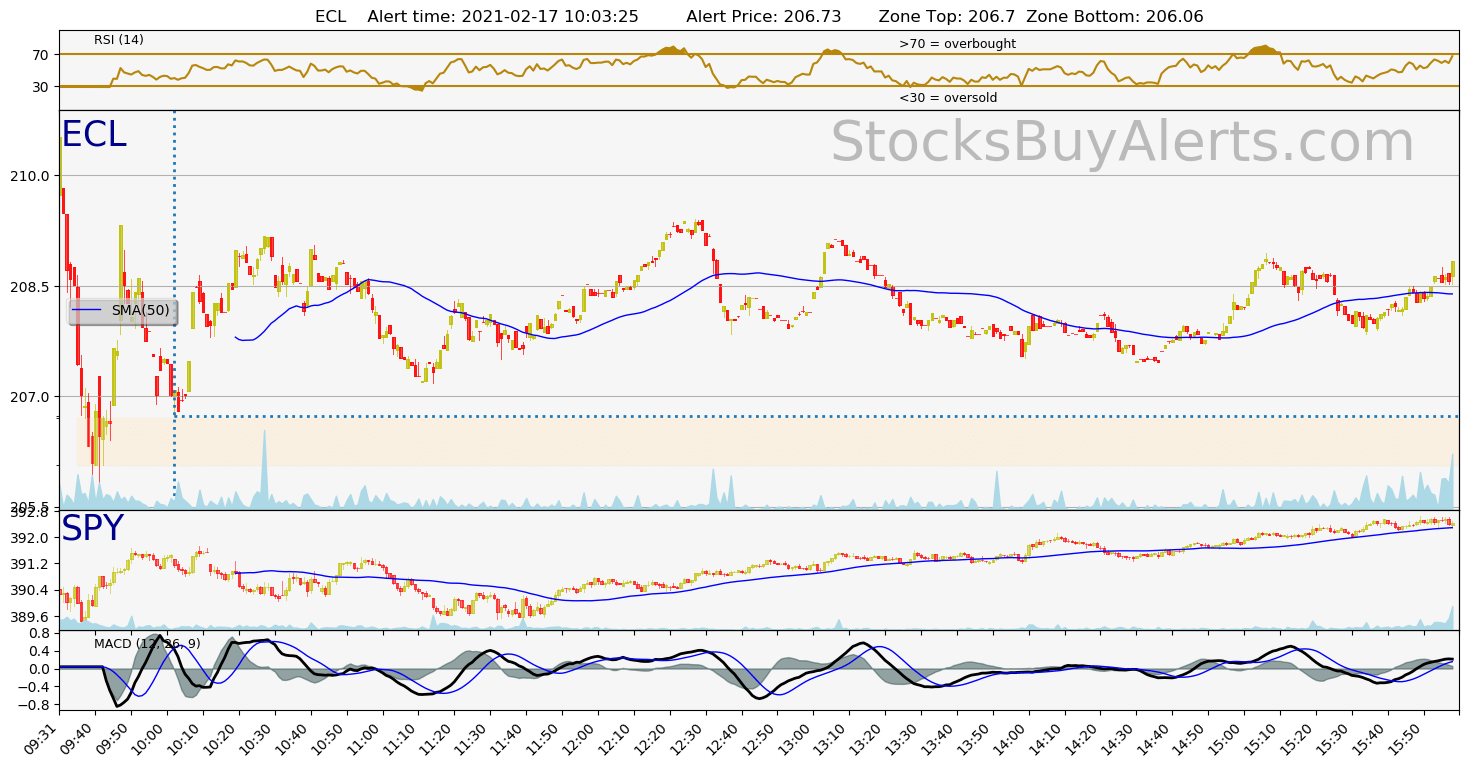

ECL on Wednesday, February 17, 2021

| Alert Time: | 2021-02-17 10:03:25 |

| Symbol | ECL |

| Alert price: | 207.01 |

| Demand zone range: | 206.06 – 206.7 |

| Demand zone time (when it formed): | 2021-02-17 09:36:00 |

| Peak price since zone was formed: | 208.61 (0.77% growth) |

| Day Range: | 205.7 – 210.64 |

| 52wk Range: | 124.6 – 231.36 |

| Prev Close: | 210.91 |

| Open: | 209.6 |

| Bid: | 206.71 |

| Ask: | 207.01 |

Open interactive stock chart for ECL

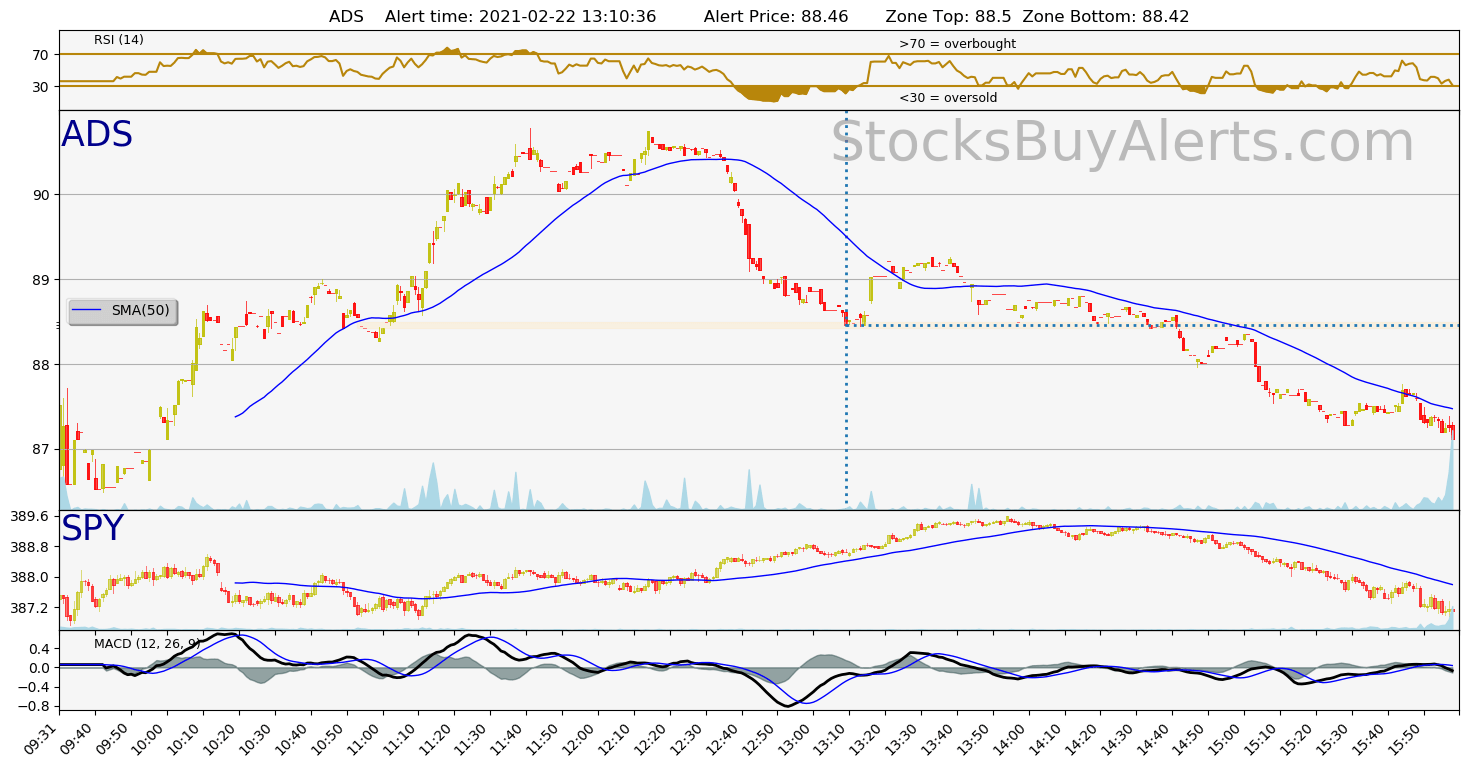

ADS on Monday, February 22, 2021

| Alert Time: | 2021-02-22 13:10:36 |

| Symbol | ADS |

| Alert price: | 88.61 |

| Demand zone range: | 88.42 – 88.5 |

| Demand zone time (when it formed): | 2021-02-22 10:54:00 |

| Peak price since zone was formed: | 90.75 (2.42% growth) |

| Day Range: | 86 – 90.78 |

| 52wk Range: | 20.51 – 99.36 |

| Prev Close: | 86.42 |

| Open: | 86.46 |

| Bid: | 88.49 |

| Ask: | 88.61 |

Open interactive stock chart for ADS

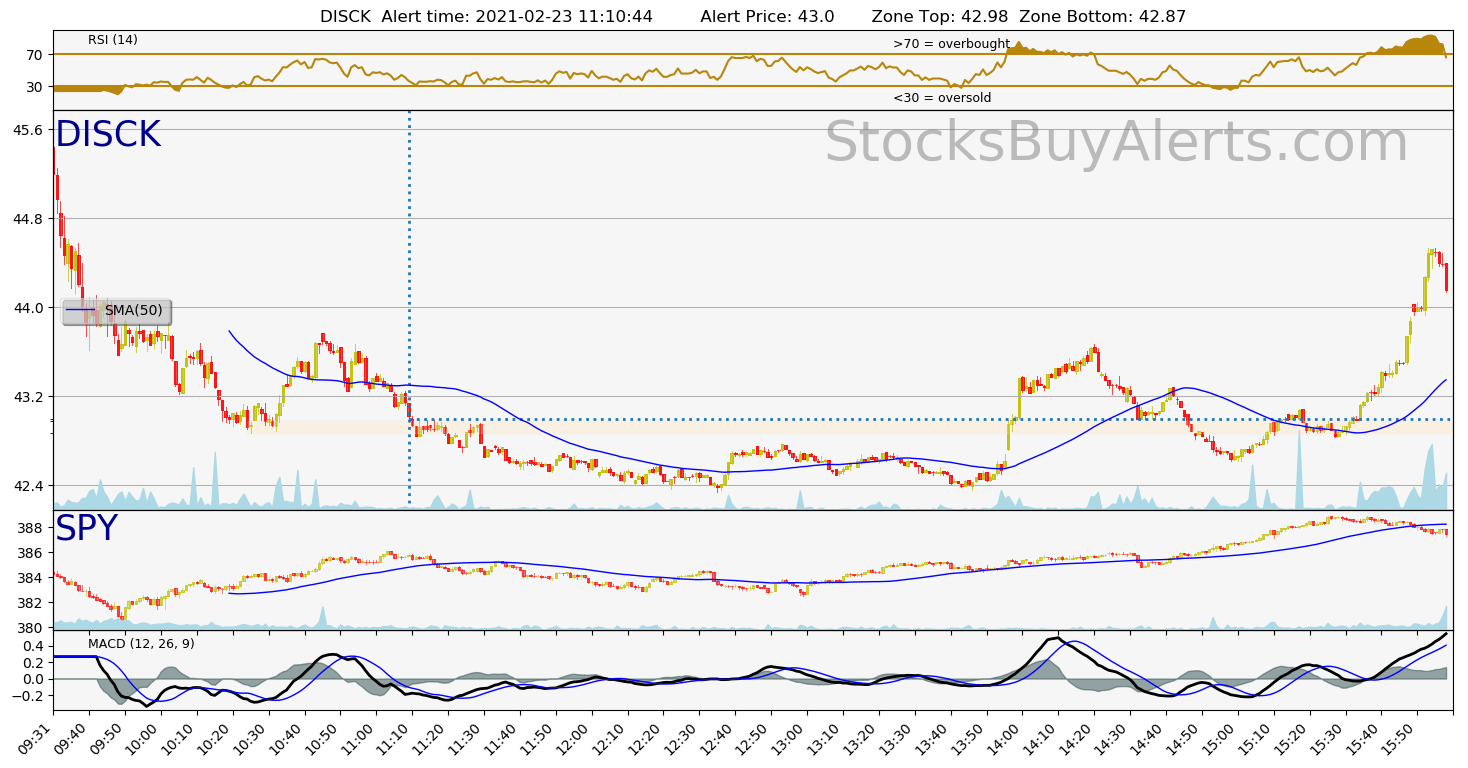

DISCK on Tuesday, February 23, 2021

| Alert Time: | 2021-02-23 11:10:44 |

| Symbol | DISCK |

| Alert price: | 43.04 |

| Demand zone range: | 42.87 – 42.98 |

| Demand zone time (when it formed): | 2021-02-23 10:25:00 |

| Peak price since zone was formed: | 43.69 (1.51% growth) |

| Day Range: | 42.85 – 45.61 |

| 52wk Range: | 15.43 – 46.59 |

| Prev Close: | 46 |

| Open: | 45.24 |

| Bid: | 43.03 |

| Ask: | 43.04 |

Open interactive stock chart for DISCK

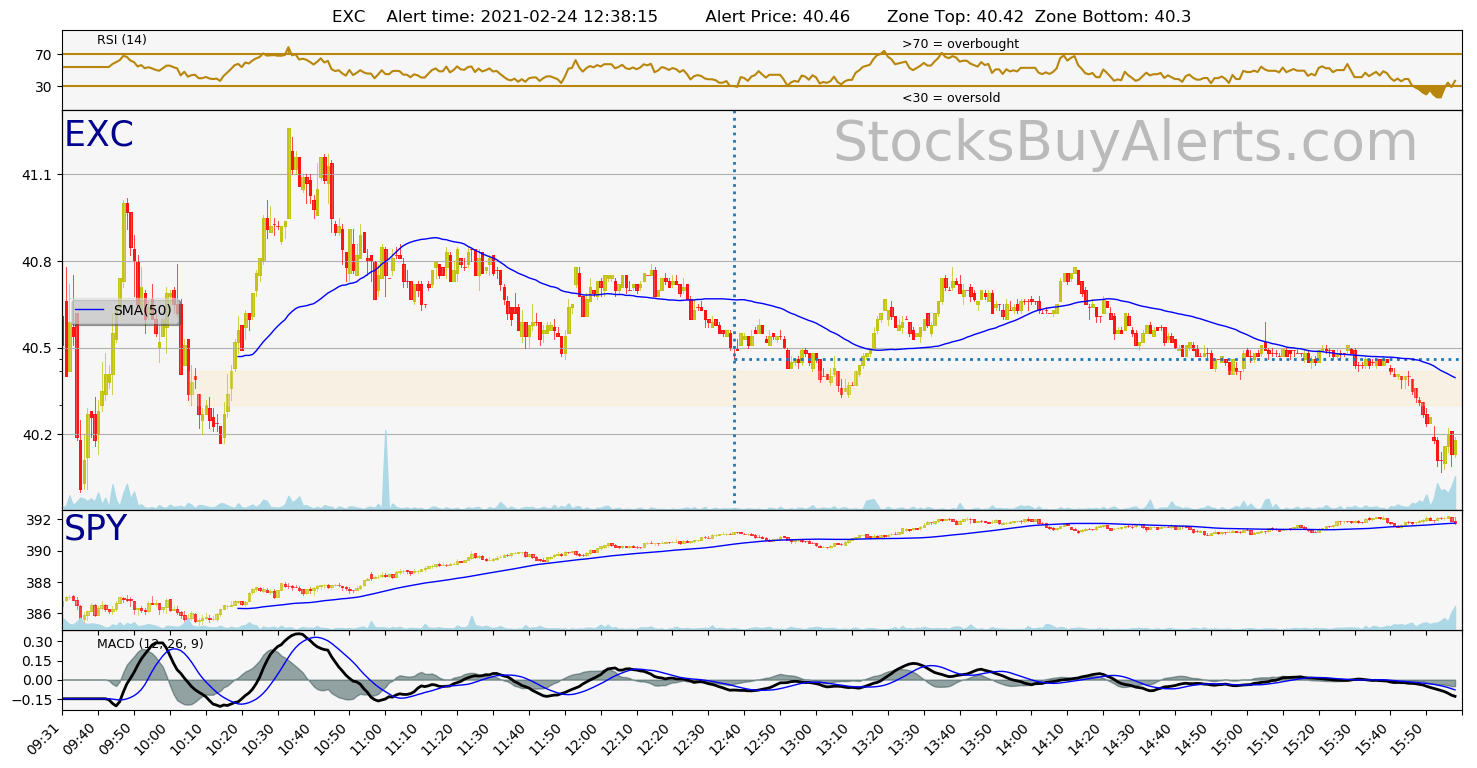

EXC on Wednesday, February 24, 2021

| Alert Time: | 2021-02-24 12:38:15 |

| Symbol | EXC |

| Alert price: | 40.48 |

| Demand zone range: | 40.3 – 40.42 |

| Demand zone time (when it formed): | 2021-02-24 10:06:00 |

| Peak price since zone was formed: | 41.1 (1.53% growth) |

| Day Range: | 40 – 41.26 |

| 52wk Range: | 29.28 – 50.47 |

| Prev Close: | 40.8 |

| Open: | 40.03 |

| Bid: | 40.47 |

| Ask: | 40.48 |

Open interactive stock chart for EXC

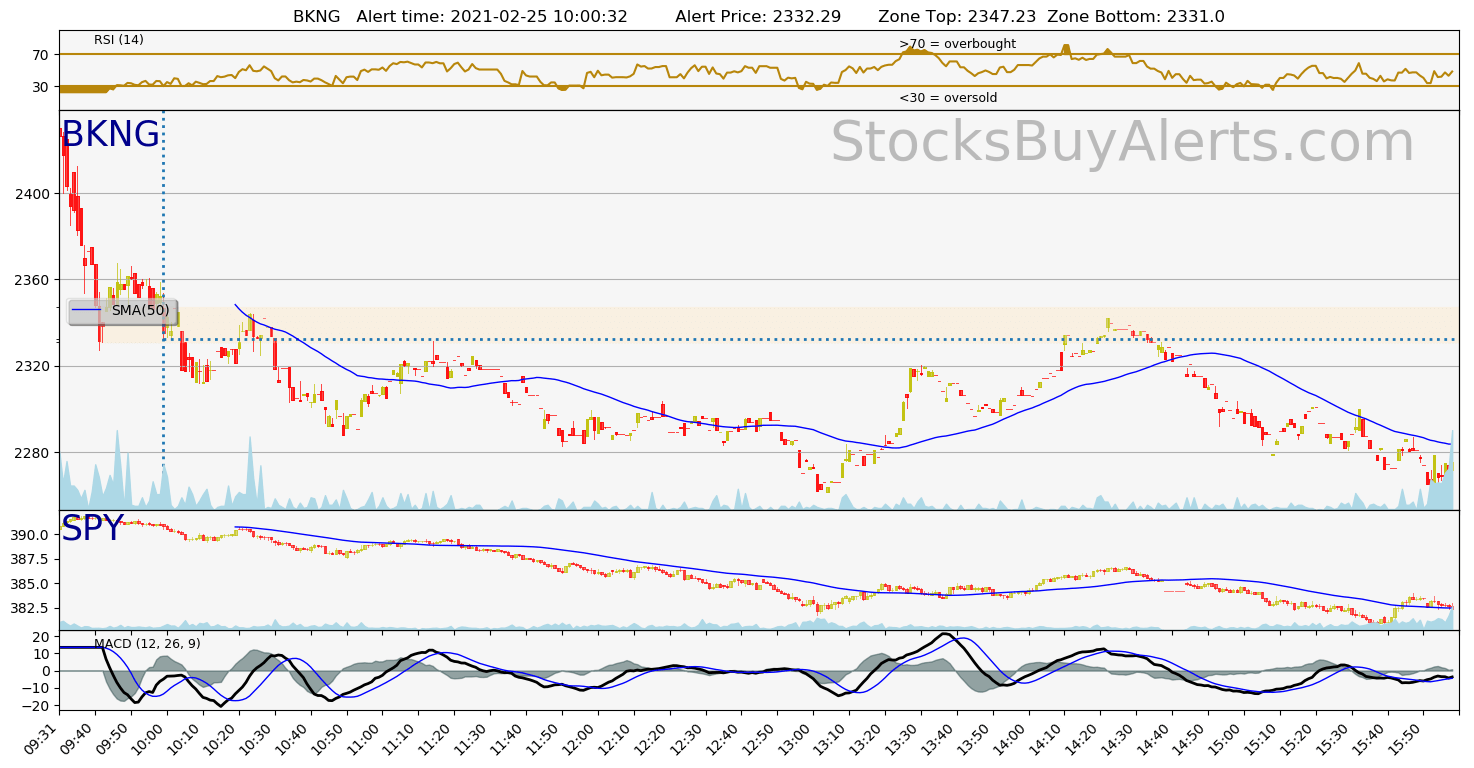

BKNG on Thursday, February 25, 2021

| Alert Time: | 2021-02-25 10:00:32 |

| Symbol | BKNG |

| Alert price: | 2343.45 |

| Demand zone range: | 2331 – 2347.23 |

| Demand zone time (when it formed): | 2021-02-25 09:42:00 |

| Peak price since zone was formed: | 2363.13 (0.84% growth) |

| Day Range: | 2327.36 – 2438.95 |

| 52wk Range: | 1107.29 – 2450.26 |

| Prev Close: | 2443.5 |

| Open: | 2419.93 |

| Bid: | 2332 |

| Ask: | 2343.45 |

Open interactive stock chart for BKNG

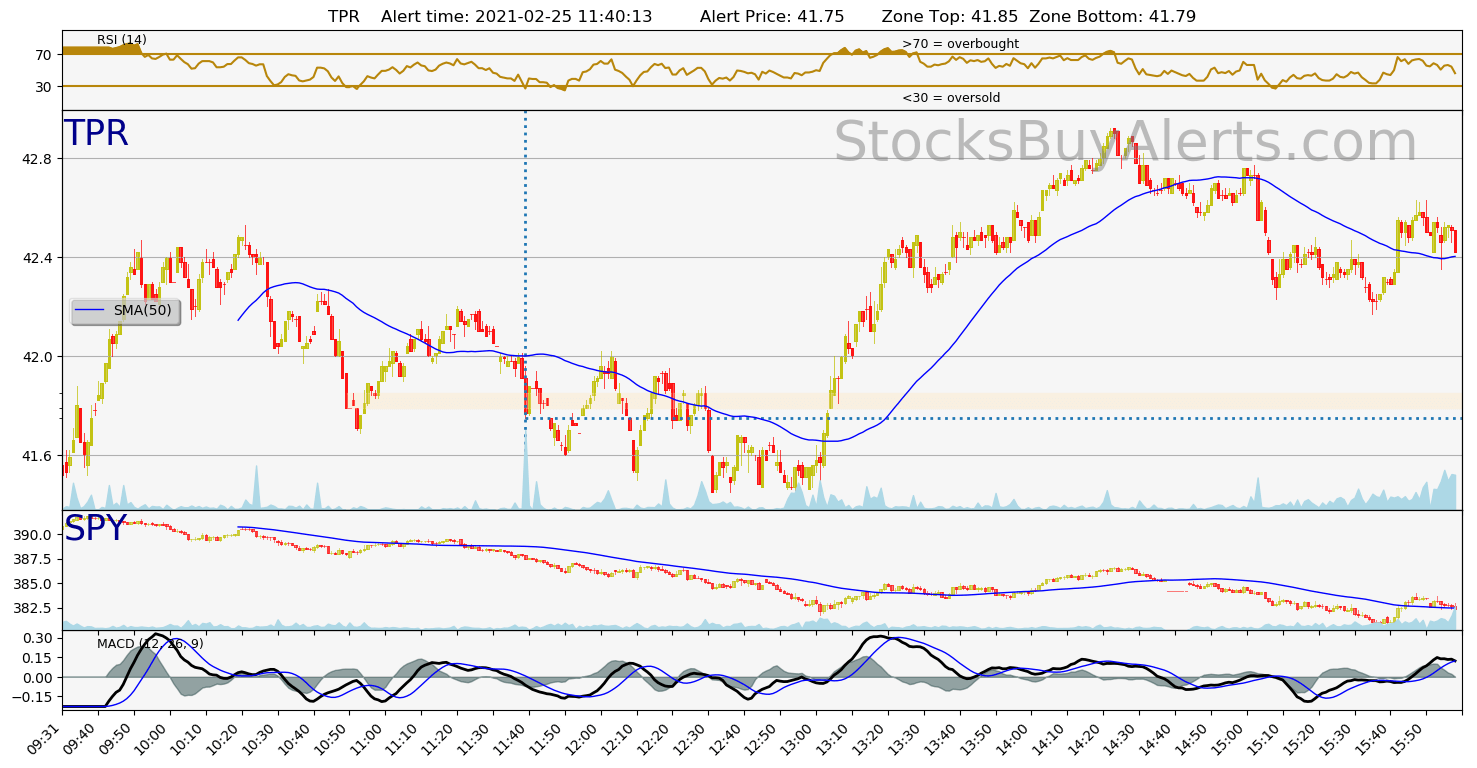

TPR on Thursday, February 25, 2021

| Alert Time: | 2021-02-25 11:40:13 |

| Symbol | TPR |

| Alert price: | 41.91 |

| Demand zone range: | 41.79 – 41.85 |

| Demand zone time (when it formed): | 2021-02-25 10:50:00 |

| Peak price since zone was formed: | 42.2 (0.69% growth) |

| Day Range: | 41.46 – 42.53 |

| 52wk Range: | 10.18 – 42.53 |

| Prev Close: | 41.69 |

| Open: | 41.46 |

| Bid: | 41.9 |

| Ask: | 41.91 |

Open interactive stock chart for TPR

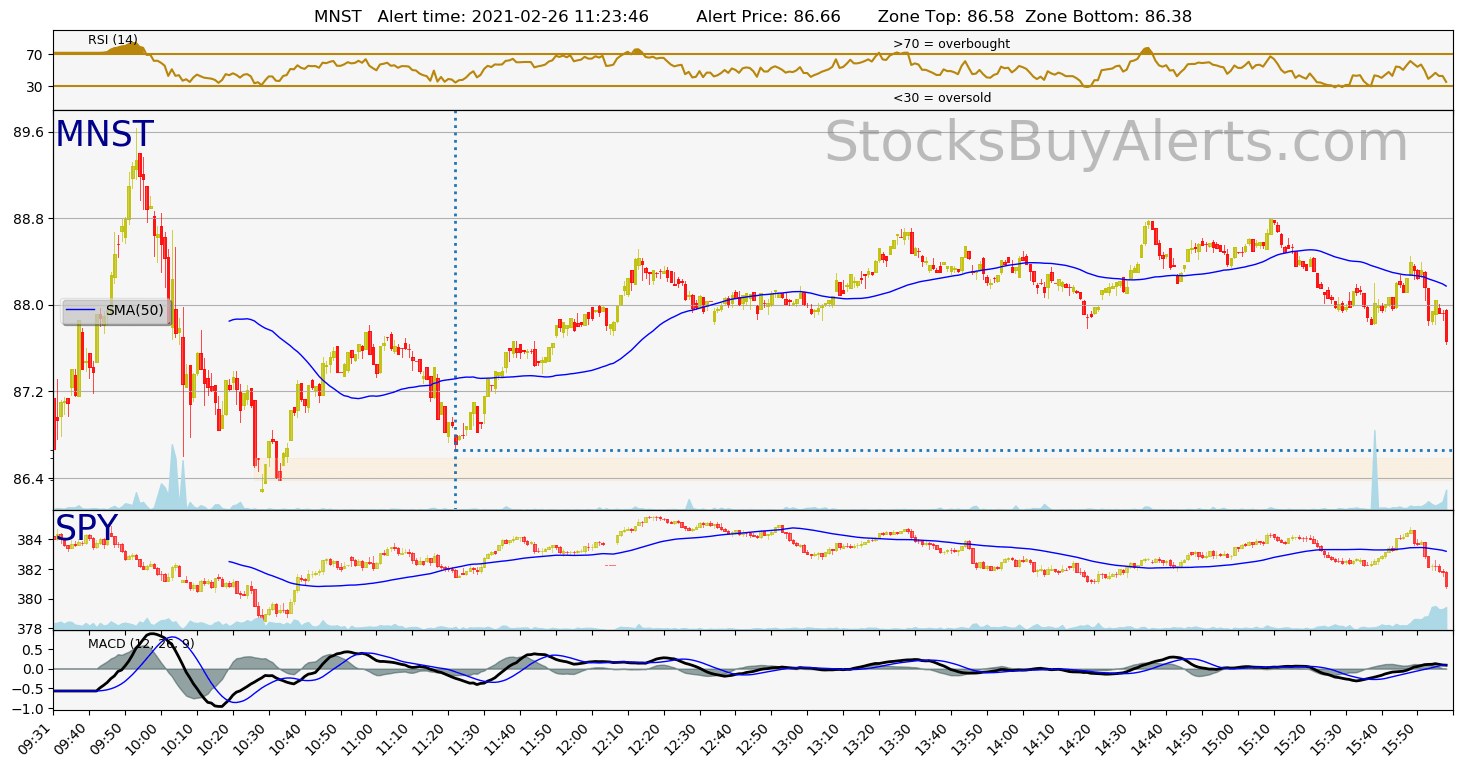

MNST on Friday, February 26, 2021

| Alert Time: | 2021-02-26 11:23:46 |

| Symbol | MNST |

| Alert price: | 86.7 |

| Demand zone range: | 86.38 – 86.58 |

| Demand zone time (when it formed): | 2021-02-26 10:27:00 |

| Peak price since zone was formed: | 87.81 (1.28% growth) |

| Day Range: | 86.22 – 89.63 |

| 52wk Range: | 50.06 – 95.11 |

| Prev Close: | 85.35 |

| Open: | 87.62 |

| Bid: | 86.61 |

| Ask: | 86.7 |

Open interactive stock chart for MNST

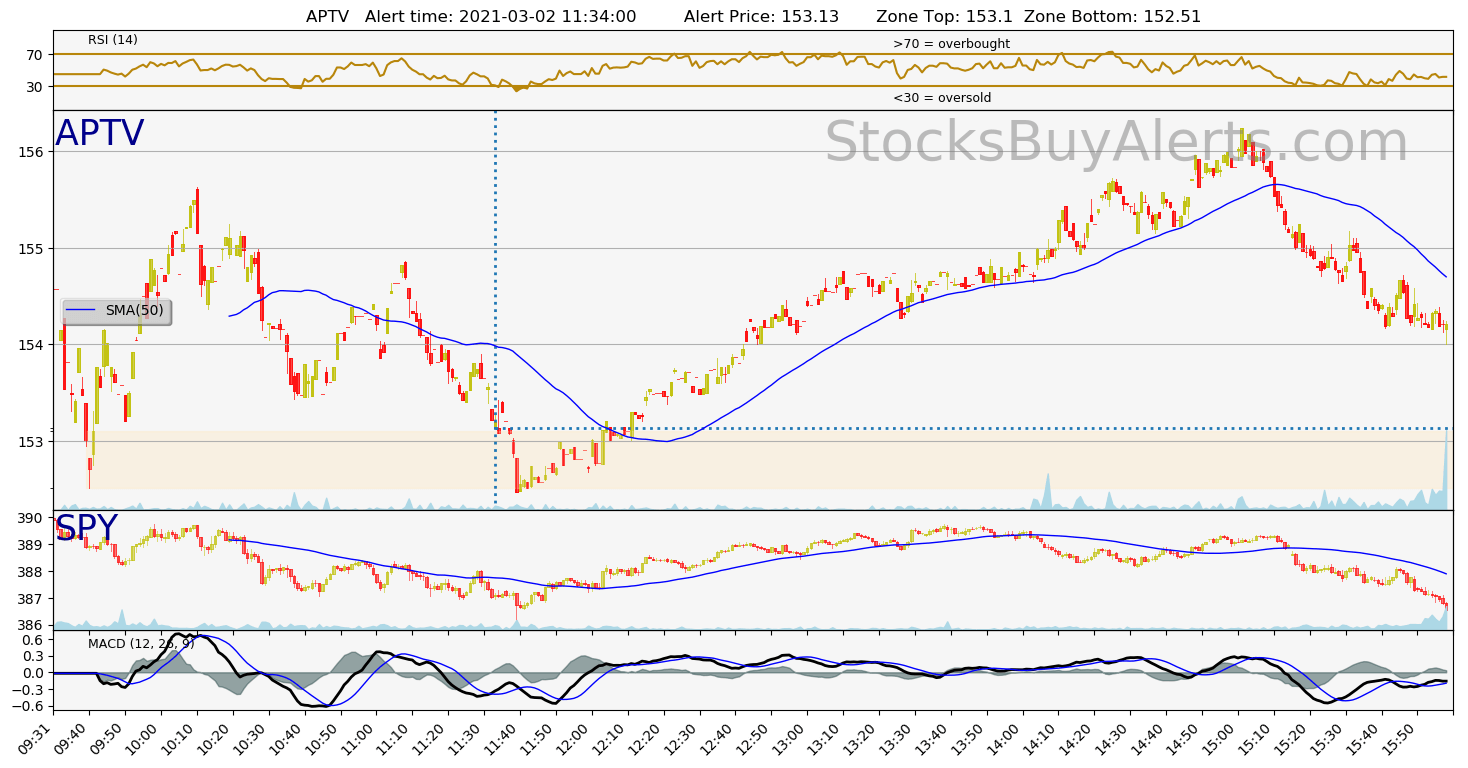

APTV on Tuesday, March 02, 2021

| Alert Time: | 2021-03-02 11:34:00 |

| Symbol | APTV |

| Alert price: | 153.29 |

| Demand zone range: | 152.51 – 153.1 |

| Demand zone time (when it formed): | 2021-03-02 09:40:00 |

| Peak price since zone was formed: | 155.63 (1.53% growth) |

| Day Range: | 152.51 – 155.63 |

| 52wk Range: | 29.22 – 159.5 |

| Prev Close: | 154.76 |

| Open: | 155 |

| Bid: | 153.13 |

| Ask: | 153.29 |

Open interactive stock chart for APTV

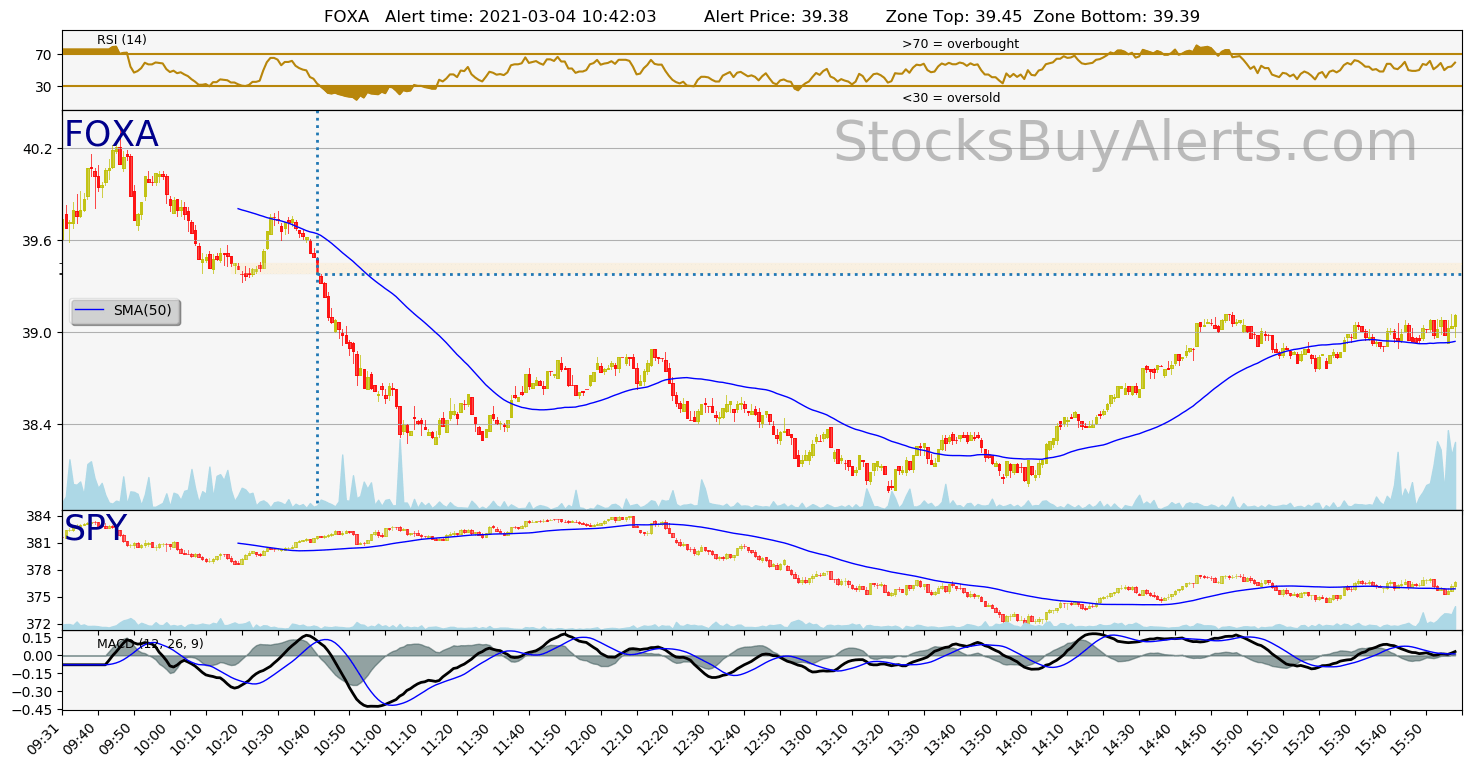

FOXA on Thursday, March 04, 2021

| Alert Time: | 2021-03-04 10:42:03 |

| Symbol | FOXA |

| Alert price: | 39.5 |

| Demand zone range: | 39.39 – 39.45 |

| Demand zone time (when it formed): | 2021-03-04 10:18:00 |

| Peak price since zone was formed: | 39.77 (0.68% growth) |

| Day Range: | 39.33 – 40.33 |

| 52wk Range: | 19.81 – 40.73 |

| Prev Close: | 39.33 |

| Open: | 39.66 |

| Bid: | 39.48 |

| Ask: | 39.5 |

Open interactive stock chart for FOXA

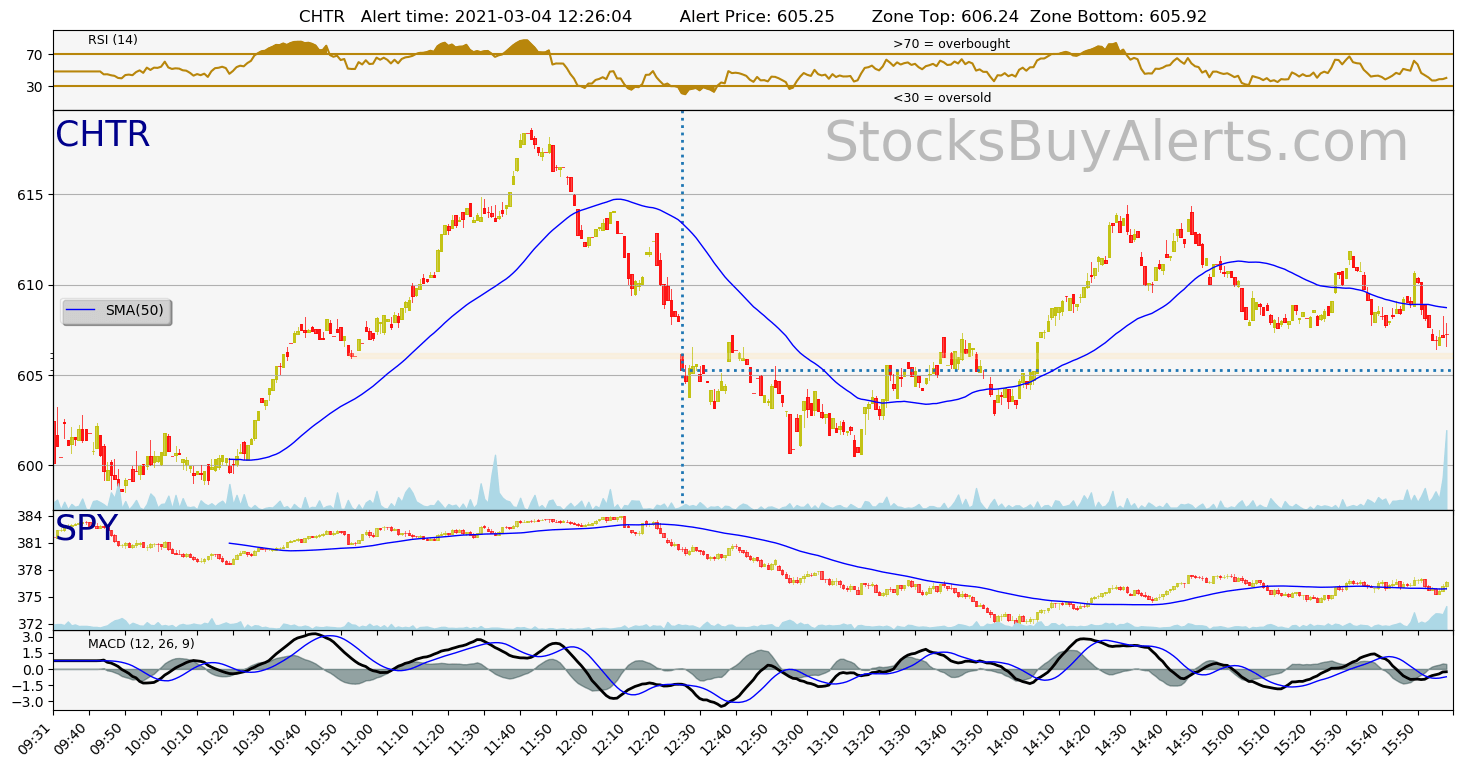

CHTR on Thursday, March 04, 2021

| Alert Time: | 2021-03-04 12:26:04 |

| Symbol | CHTR |

| Alert price: | 606.85 |

| Demand zone range: | 605.92 – 606.24 |

| Demand zone time (when it formed): | 2021-03-04 10:53:00 |

| Peak price since zone was formed: | 618.66 (1.95% growth) |

| Day Range: | 598.01 – 618.66 |

| 52wk Range: | 345.67 – 681.71 |

| Prev Close: | 601.02 |

| Open: | 599 |

| Bid: | 606.05 |

| Ask: | 606.85 |

Open interactive stock chart for CHTR

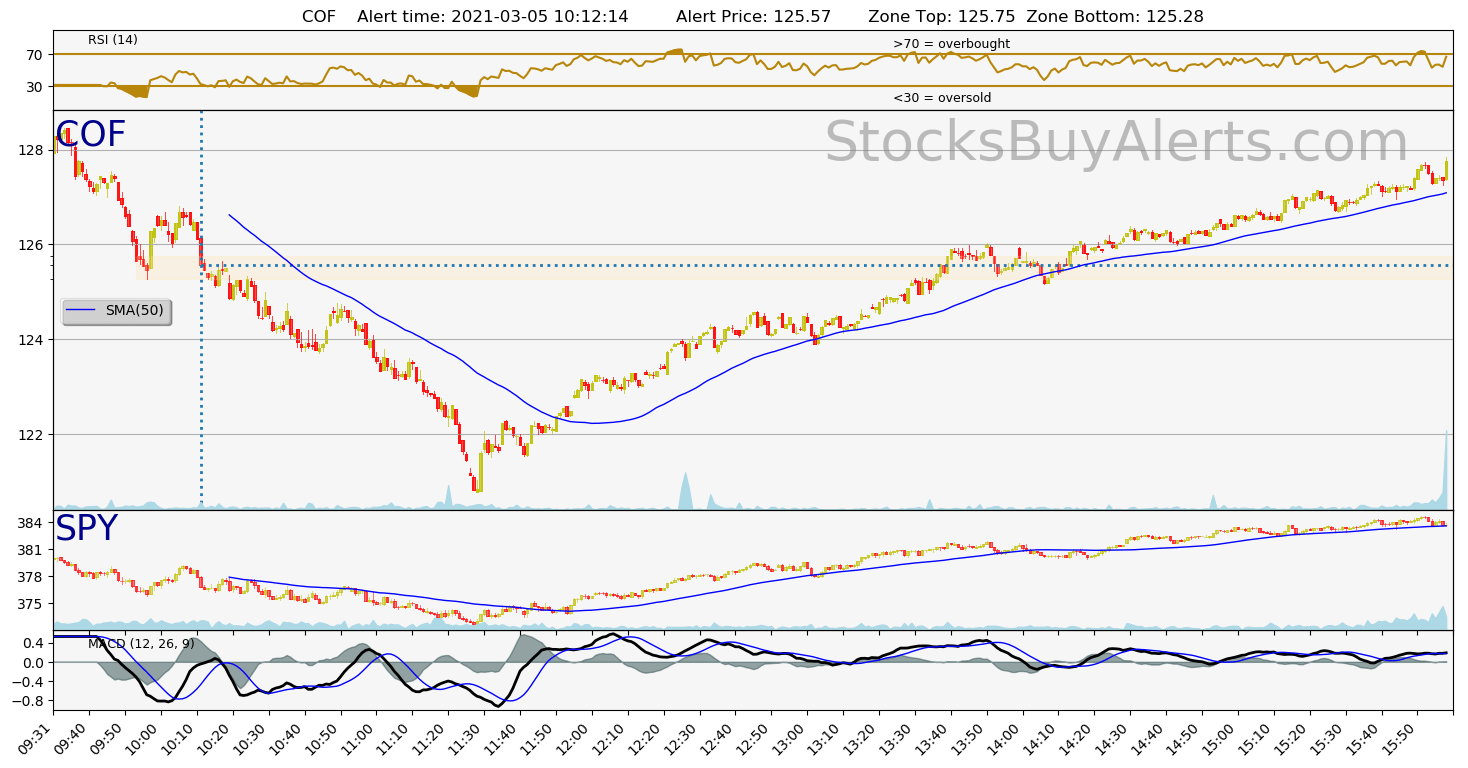

COF on Friday, March 05, 2021

| Alert Time: | 2021-03-05 10:12:14 |

| Symbol | COF |

| Alert price: | 125.93 |

| Demand zone range: | 125.28 – 125.75 |

| Demand zone time (when it formed): | 2021-03-05 09:54:00 |

| Peak price since zone was formed: | 126.82 (0.71% growth) |

| Day Range: | 125.28 – 128.45 |

| 52wk Range: | 38 – 128.45 |

| Prev Close: | 125.94 |

| Open: | 127.3 |

| Bid: | 125.86 |

| Ask: | 125.93 |

Open interactive stock chart for COF

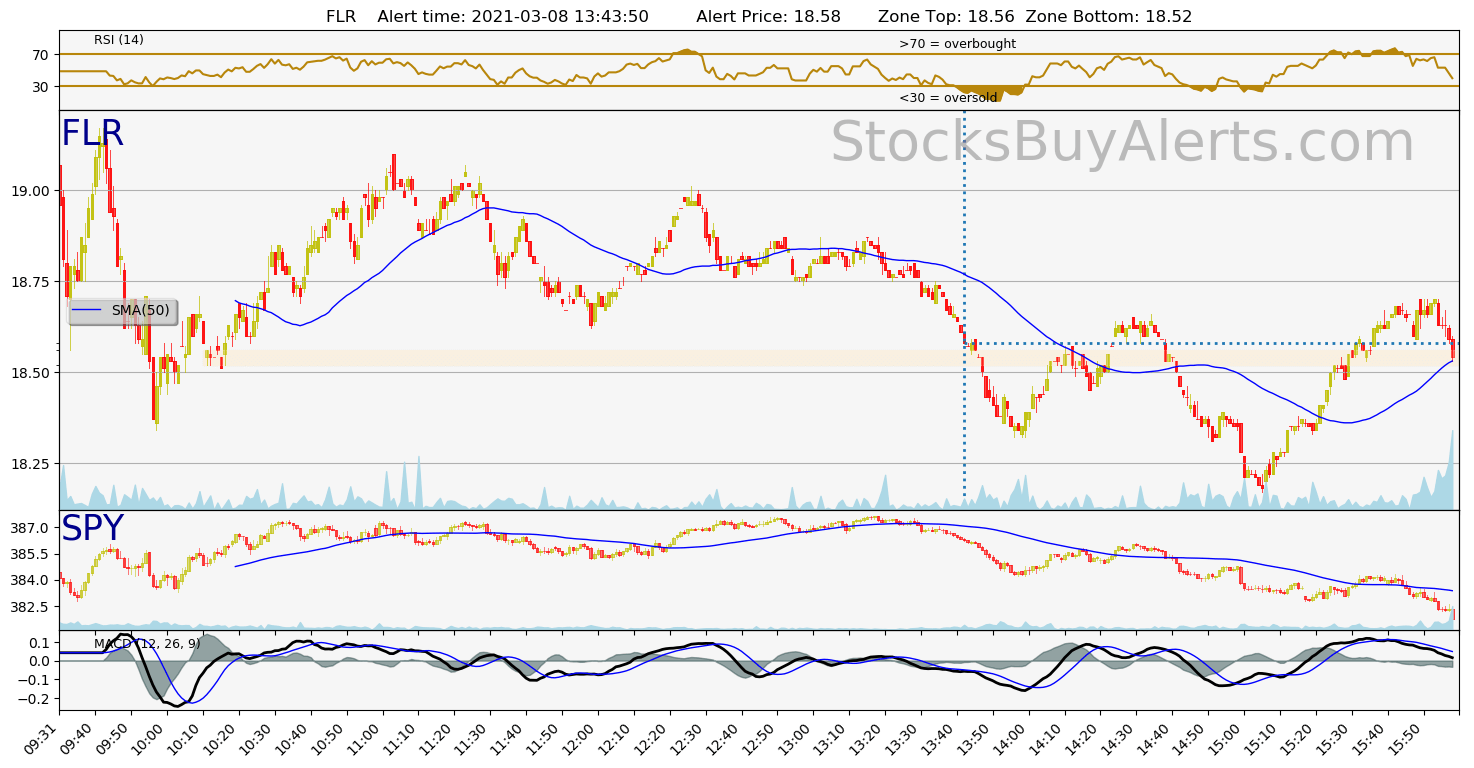

FLR on Monday, March 08, 2021

| Alert Time: | 2021-03-08 13:43:50 |

| Symbol | FLR |

| Alert price: | 18.58 |

| Demand zone range: | 18.52 – 18.56 |

| Demand zone time (when it formed): | 2021-03-08 10:11:00 |

| Peak price since zone was formed: | 19.07 (2.64% growth) |

| Day Range: | 18.34 – 19.17 |

| 52wk Range: | 2.85 – 21.5 |

| Prev Close: | 18.52 |

| Open: | 19.07 |

| Bid: | 18.57 |

| Ask: | 18.58 |

Open interactive stock chart for FLR

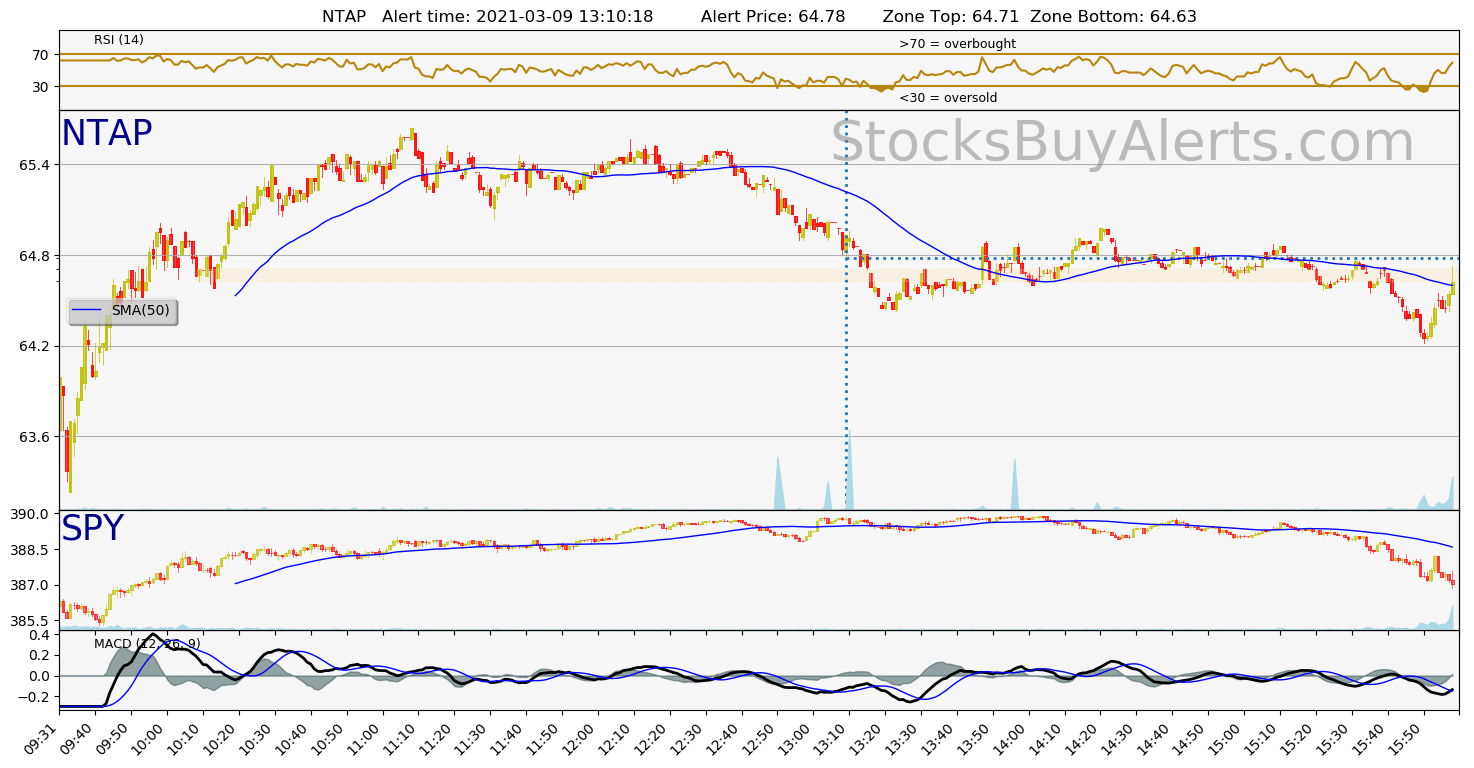

NTAP on Tuesday, March 09, 2021

| Alert Time: | 2021-03-09 13:10:18 |

| Symbol | NTAP |

| Alert price: | 64.8 |

| Demand zone range: | 64.63 – 64.71 |

| Demand zone time (when it formed): | 2021-03-09 10:09:00 |

| Peak price since zone was formed: | 65.6 (1.23% growth) |

| Day Range: | 63.23 – 65.65 |

| 52wk Range: | 34.66 – 71.68 |

| Prev Close: | 62.59 |

| Open: | 63.41 |

| Bid: | 64.75 |

| Ask: | 64.8 |

Open interactive stock chart for NTAP

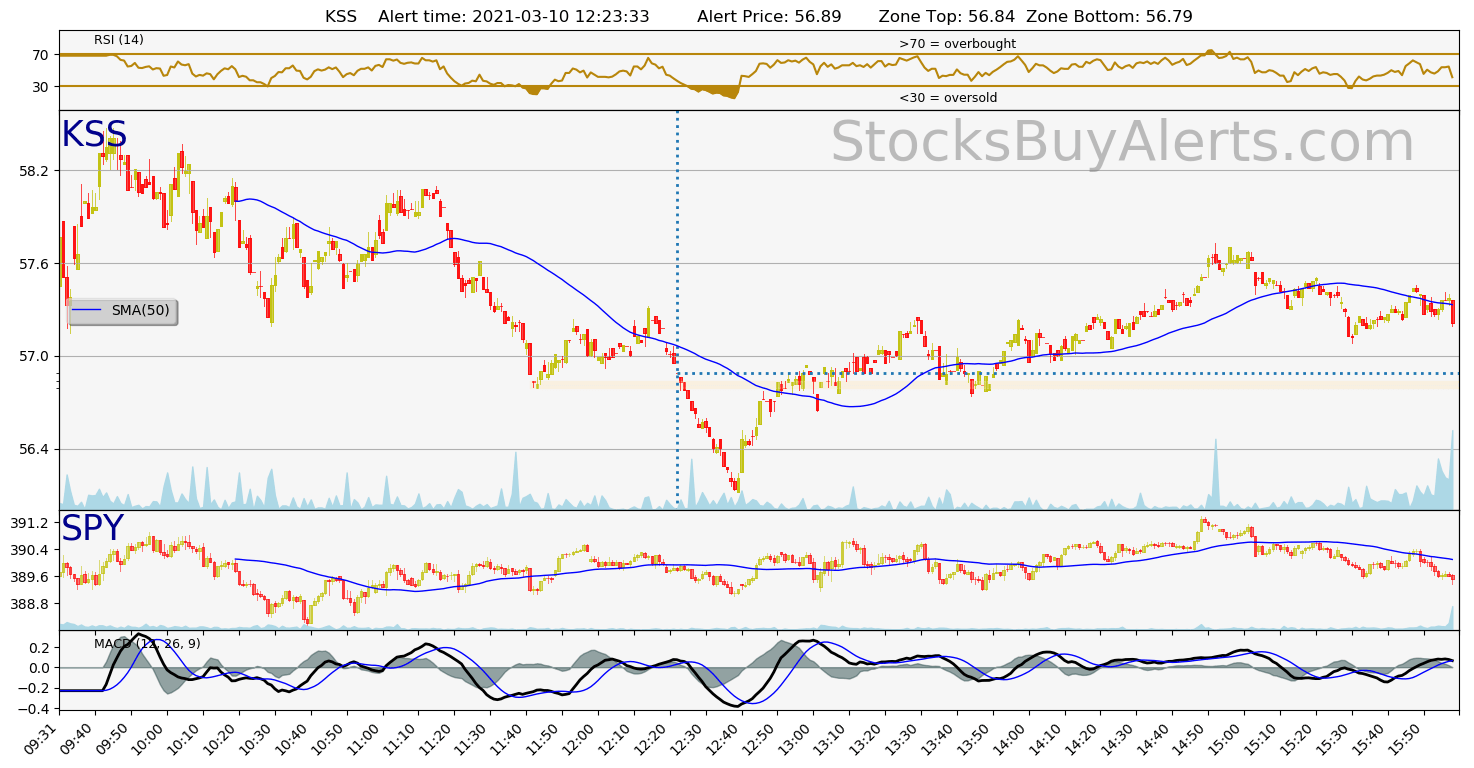

KSS on Wednesday, March 10, 2021

| Alert Time: | 2021-03-10 12:23:33 |

| Symbol | KSS |

| Alert price: | 56.92 |

| Demand zone range: | 56.79 – 56.84 |

| Demand zone time (when it formed): | 2021-03-10 11:42:00 |

| Peak price since zone was formed: | 57.32 (0.7% growth) |

| Day Range: | 56.79 – 58.47 |

| 52wk Range: | 10.89 – 58.74 |

| Prev Close: | 57.59 |

| Open: | 57.57 |

| Bid: | 56.86 |

| Ask: | 56.92 |

Open interactive stock chart for KSS

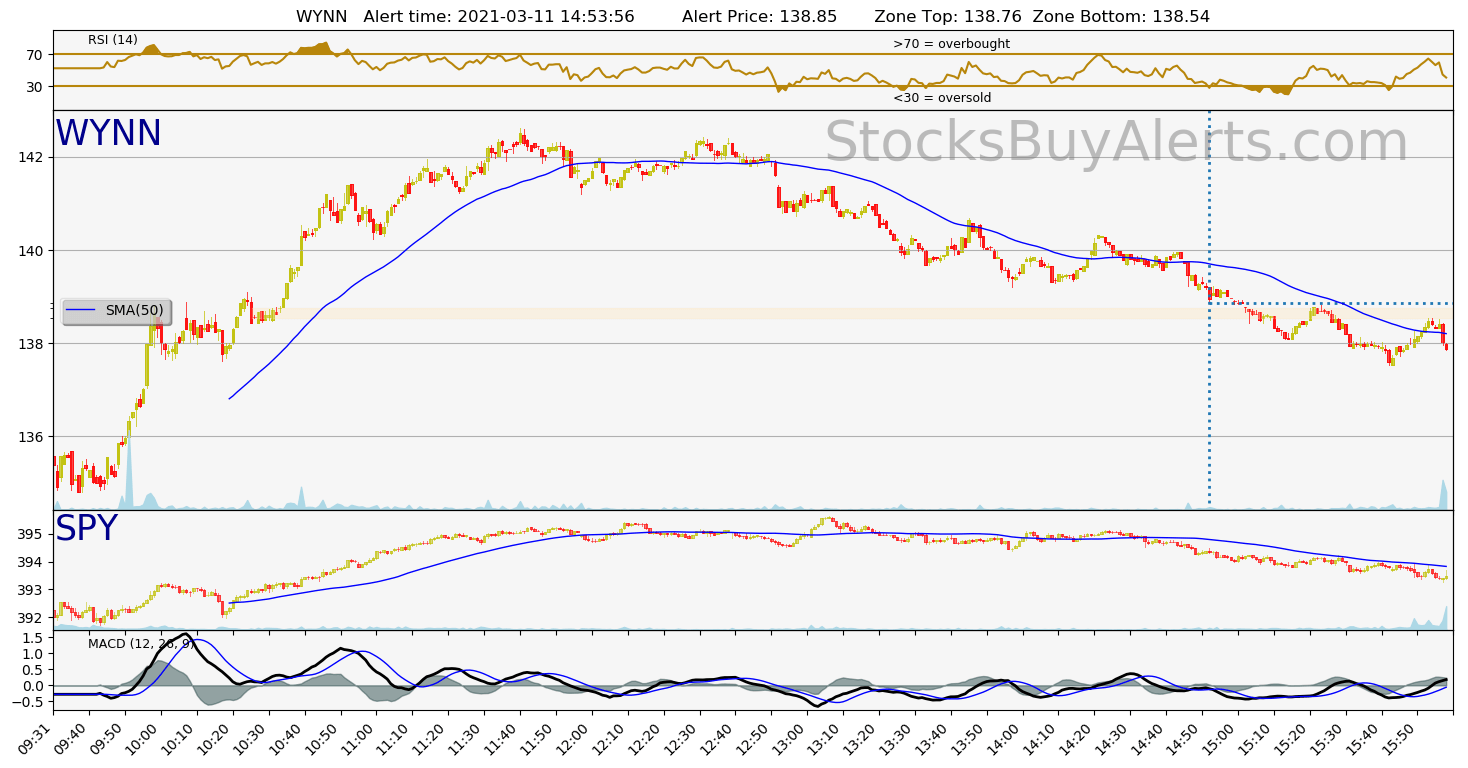

WYNN on Thursday, March 11, 2021

| Alert Time: | 2021-03-11 14:53:56 |

| Symbol | WYNN |

| Alert price: | 138.93 |

| Demand zone range: | 138.54 – 138.76 |

| Demand zone time (when it formed): | 2021-03-11 10:26:00 |

| Peak price since zone was formed: | 142.4 (2.5% growth) |

| Day Range: | 134.8 – 142.61 |

| 52wk Range: | 35.84 – 142.61 |

| Prev Close: | 134.84 |

| Open: | 135.95 |

| Bid: | 138.78 |

| Ask: | 138.93 |

Open interactive stock chart for WYNN

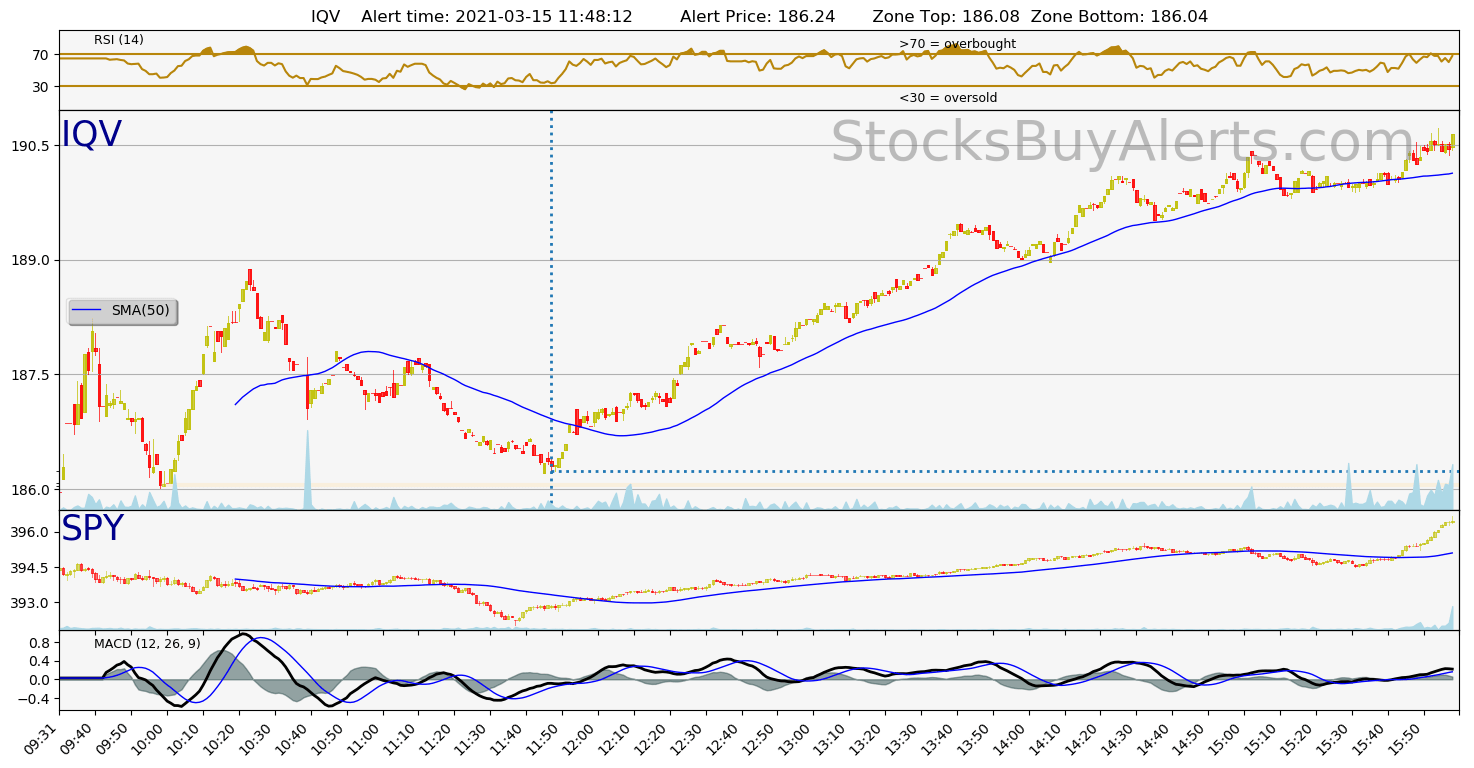

IQV on Monday, March 15, 2021

| Alert Time: | 2021-03-15 11:48:12 |

| Symbol | IQV |

| Alert price: | 186.35 |

| Demand zone range: | 186.04 – 186.08 |

| Demand zone time (when it formed): | 2021-03-15 09:59:00 |

| Peak price since zone was formed: | 188.72 (1.27% growth) |

| Day Range: | 185.84 – 188.88 |

| 52wk Range: | 81.79 – 199.99 |

| Prev Close: | 186.81 |

| Open: | 186.03 |

| Bid: | 186.25 |

| Ask: | 186.35 |

Open interactive stock chart for IQV

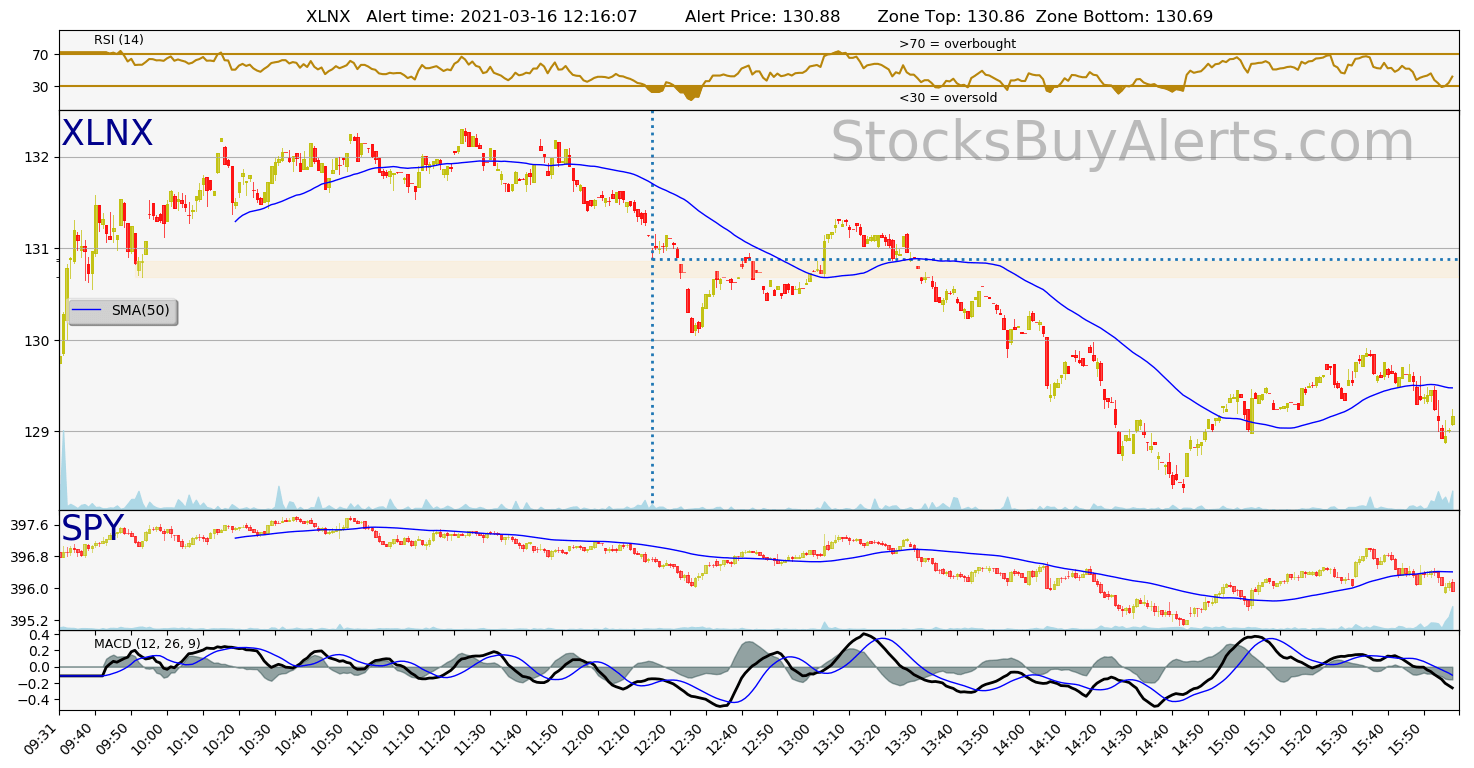

XLNX on Tuesday, March 16, 2021

| Alert Time: | 2021-03-16 12:16:07 |

| Symbol | XLNX |

| Alert price: | 131.03 |

| Demand zone range: | 130.69 – 130.86 |

| Demand zone time (when it formed): | 2021-03-16 09:52:00 |

| Peak price since zone was formed: | 132.3 (0.97% growth) |

| Day Range: | 129.73 – 132.32 |

| 52wk Range: | 68 – 154.93 |

| Prev Close: | 128.62 |

| Open: | 130.06 |

| Bid: | 130.93 |

| Ask: | 131.03 |

Open interactive stock chart for XLNX

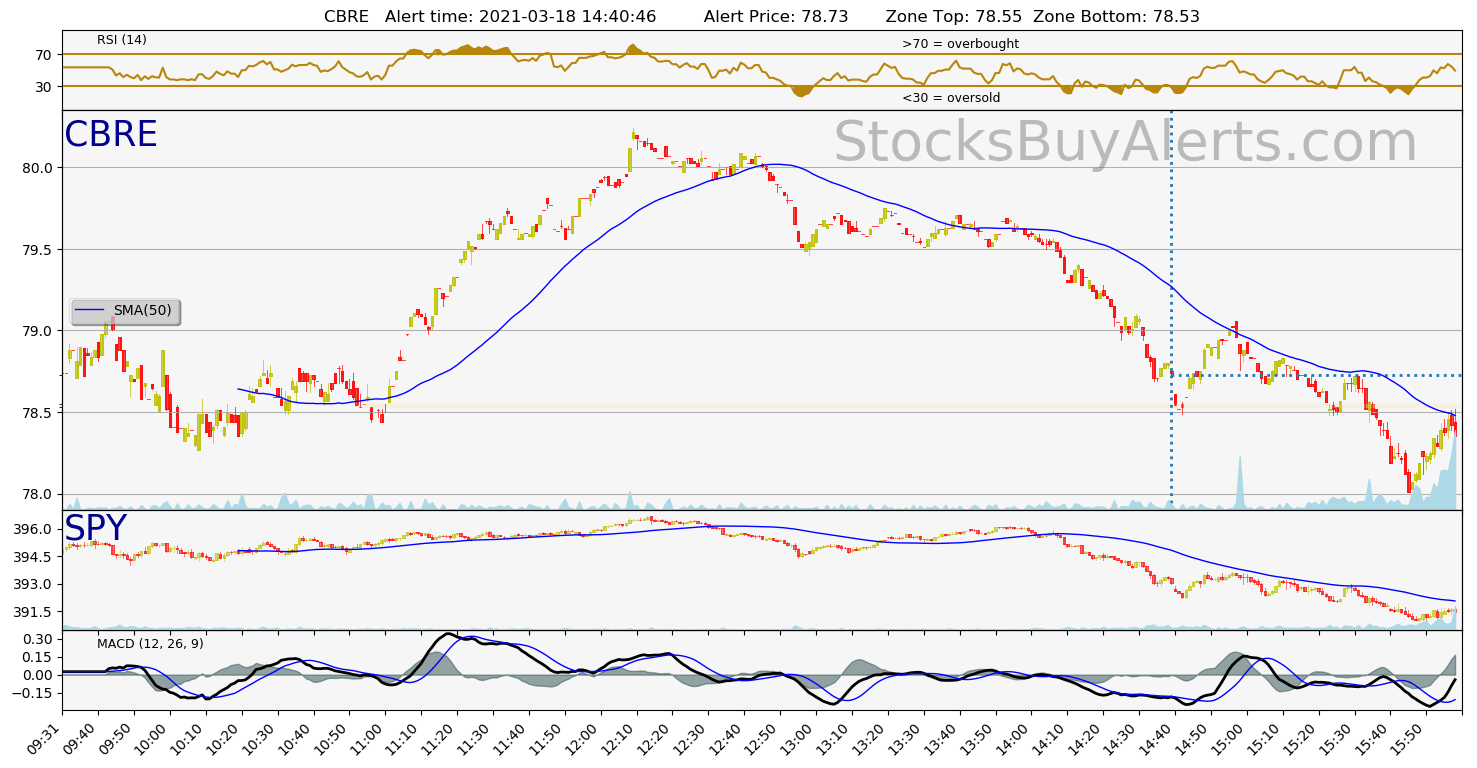

CBRE on Thursday, March 18, 2021

| Alert Time: | 2021-03-18 14:40:46 |

| Symbol | CBRE |

| Alert price: | 78.66 |

| Demand zone range: | 78.53 – 78.55 |

| Demand zone time (when it formed): | 2021-03-18 10:53:00 |

| Peak price since zone was formed: | 80.18 (1.93% growth) |

| Day Range: | 78.28 – 80.24 |

| 52wk Range: | 29.17 – 82.05 |

| Prev Close: | 79.32 |

| Open: | 78.82 |

| Bid: | 78.61 |

| Ask: | 78.66 |

Open interactive stock chart for CBRE

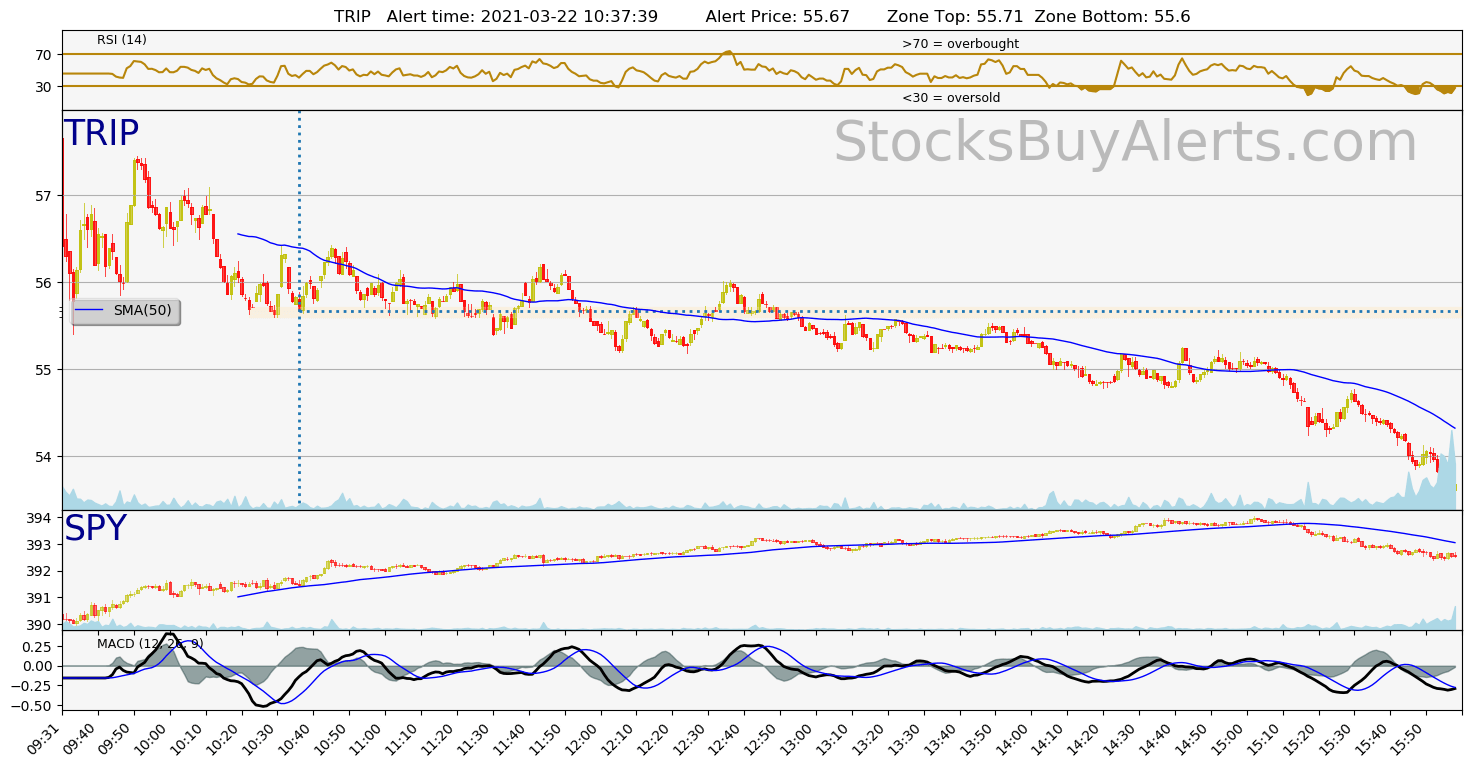

TRIP on Monday, March 22, 2021

| Alert Time: | 2021-03-22 10:37:39 |

| Symbol | TRIP |

| Alert price: | 55.78 |

| Demand zone range: | 55.6 – 55.71 |

| Demand zone time (when it formed): | 2021-03-22 10:23:00 |

| Peak price since zone was formed: | 56.42 (1.15% growth) |

| Day Range: | 55.4 – 58.19 |

| 52wk Range: | 14.53 – 64.95 |

| Prev Close: | 59.99 |

| Open: | 58 |

| Bid: | 55.69 |

| Ask: | 55.78 |

Open interactive stock chart for TRIP

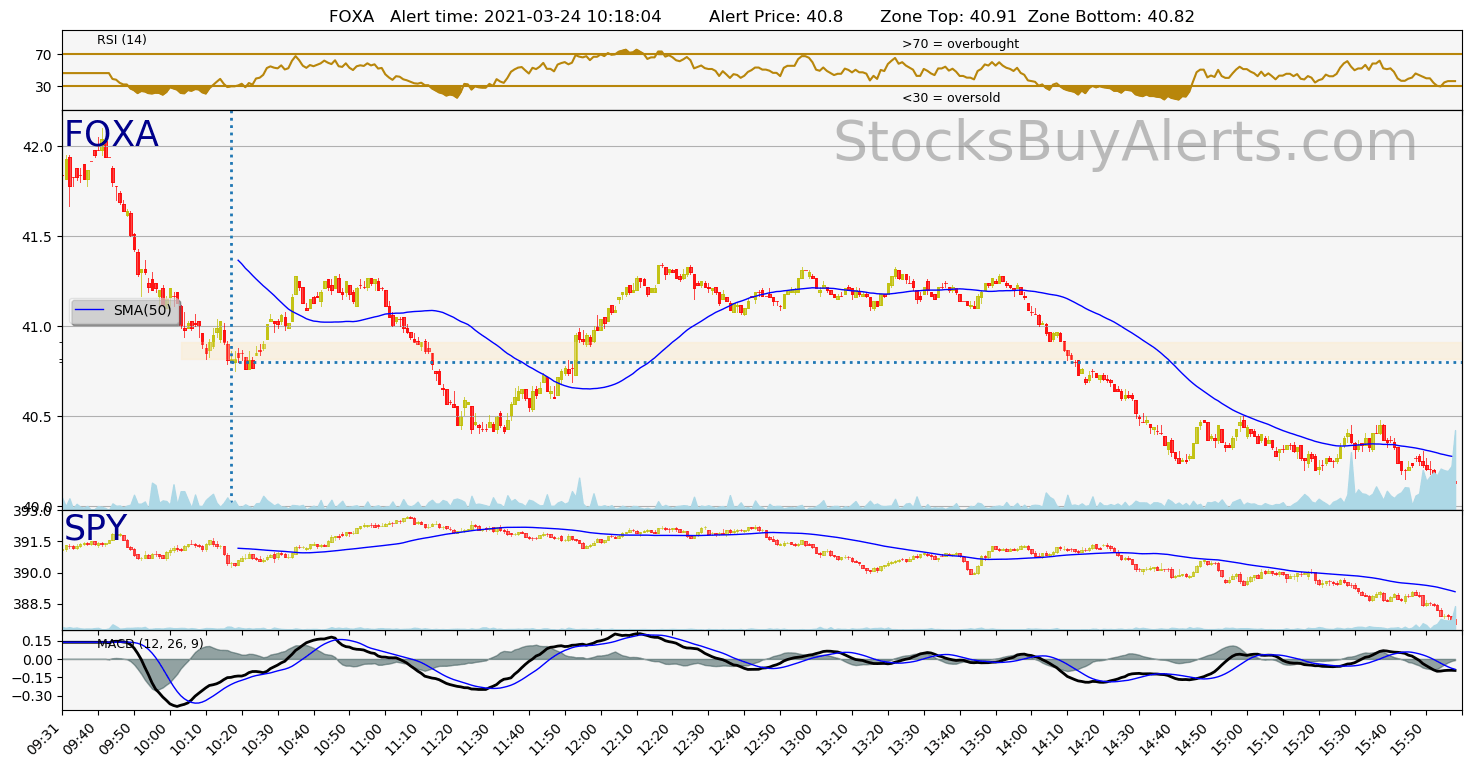

FOXA on Wednesday, March 24, 2021

| Alert Time: | 2021-03-24 10:18:04 |

| Symbol | FOXA |

| Alert price: | 40.83 |

| Demand zone range: | 40.82 – 40.91 |

| Demand zone time (when it formed): | 2021-03-24 10:04:00 |

| Peak price since zone was formed: | 41.04 (0.51% growth) |

| Day Range: | 40.79 – 42.1 |

| 52wk Range: | 20.55 – 44.8 |

| Prev Close: | 41.81 |

| Open: | 41.8 |

| Bid: | 40.78 |

| Ask: | 40.83 |

Open interactive stock chart for FOXA

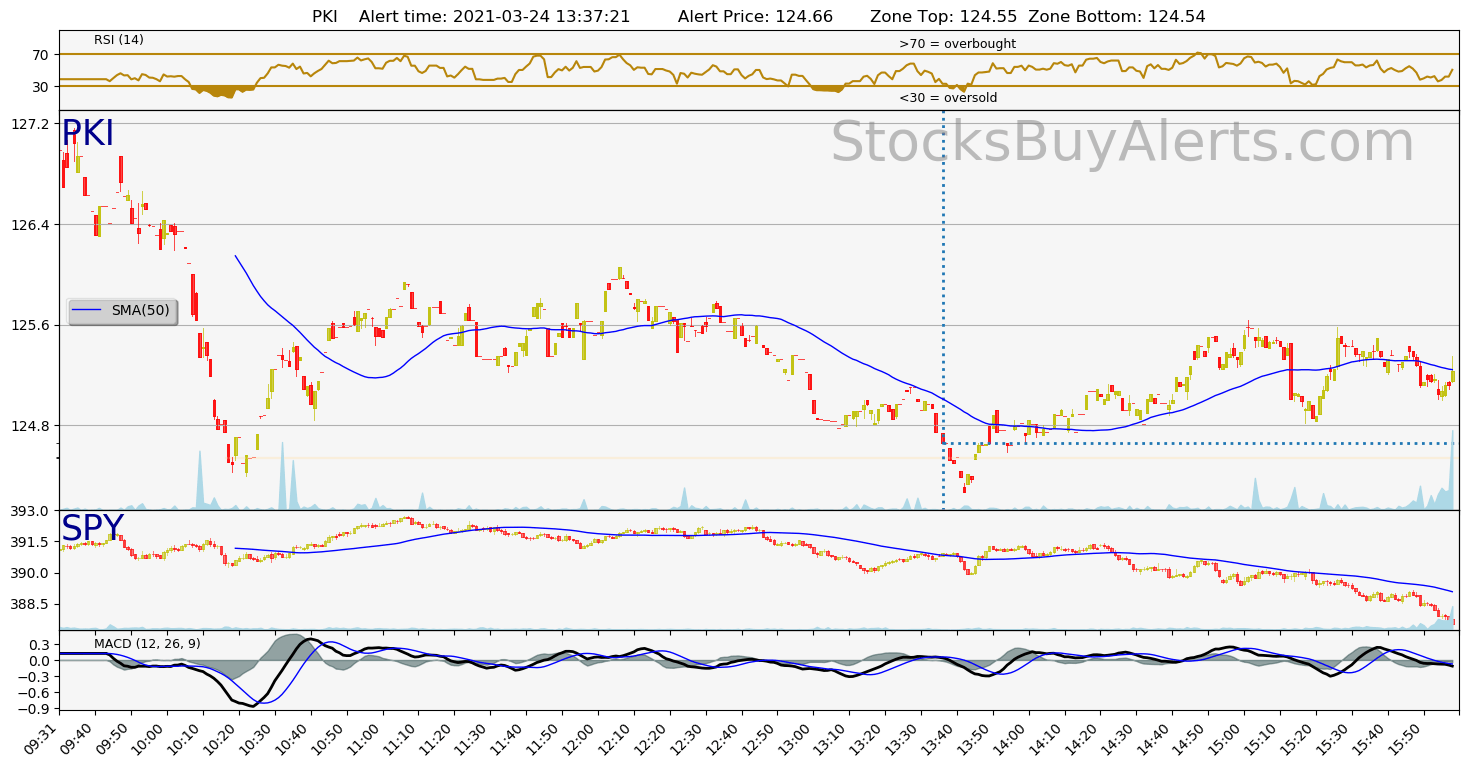

PKI on Wednesday, March 24, 2021

| Alert Time: | 2021-03-24 13:37:21 |

| Symbol | PKI |

| Alert price: | 124.72 |

| Demand zone range: | 124.54 – 124.55 |

| Demand zone time (when it formed): | 2021-03-24 10:17:00 |

| Peak price since zone was formed: | 126.06 (1.07% growth) |

| Day Range: | 124.4 – 127.15 |

| 52wk Range: | 69.6 – 162.7 |

| Prev Close: | 127.25 |

| Open: | 126.31 |

| Bid: | 124.61 |

| Ask: | 124.72 |

Open interactive stock chart for PKI

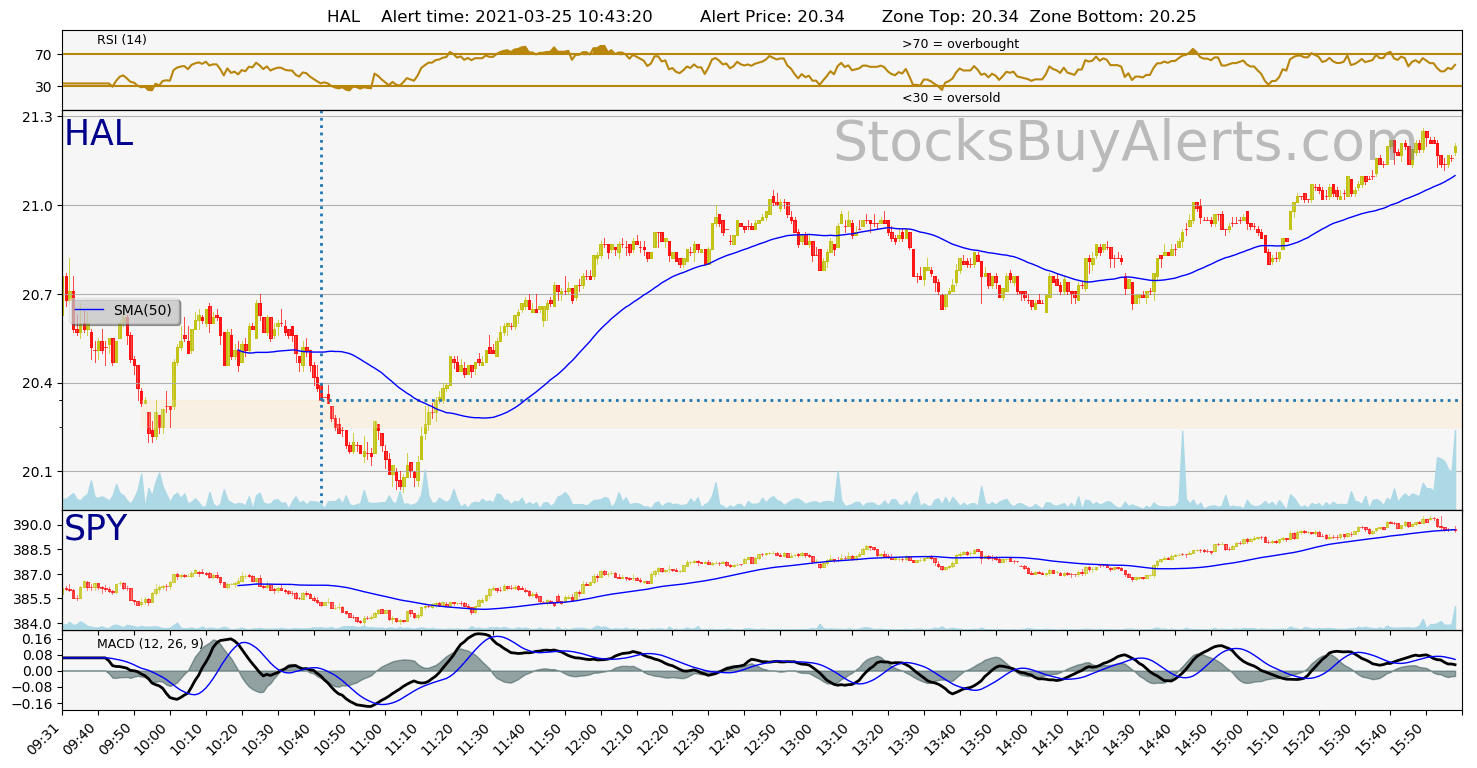

HAL on Thursday, March 25, 2021

| Alert Time: | 2021-03-25 10:43:20 |

| Symbol | HAL |

| Alert price: | 20.37 |

| Demand zone range: | 20.25 – 20.34 |

| Demand zone time (when it formed): | 2021-03-25 09:53:00 |

| Peak price since zone was formed: | 20.67 (1.47% growth) |

| Day Range: | 20.21 – 20.82 |

| 52wk Range: | 6.03 – 24.74 |

| Prev Close: | 21.3 |

| Open: | 20.71 |

| Bid: | 20.36 |

| Ask: | 20.37 |

Open interactive stock chart for HAL

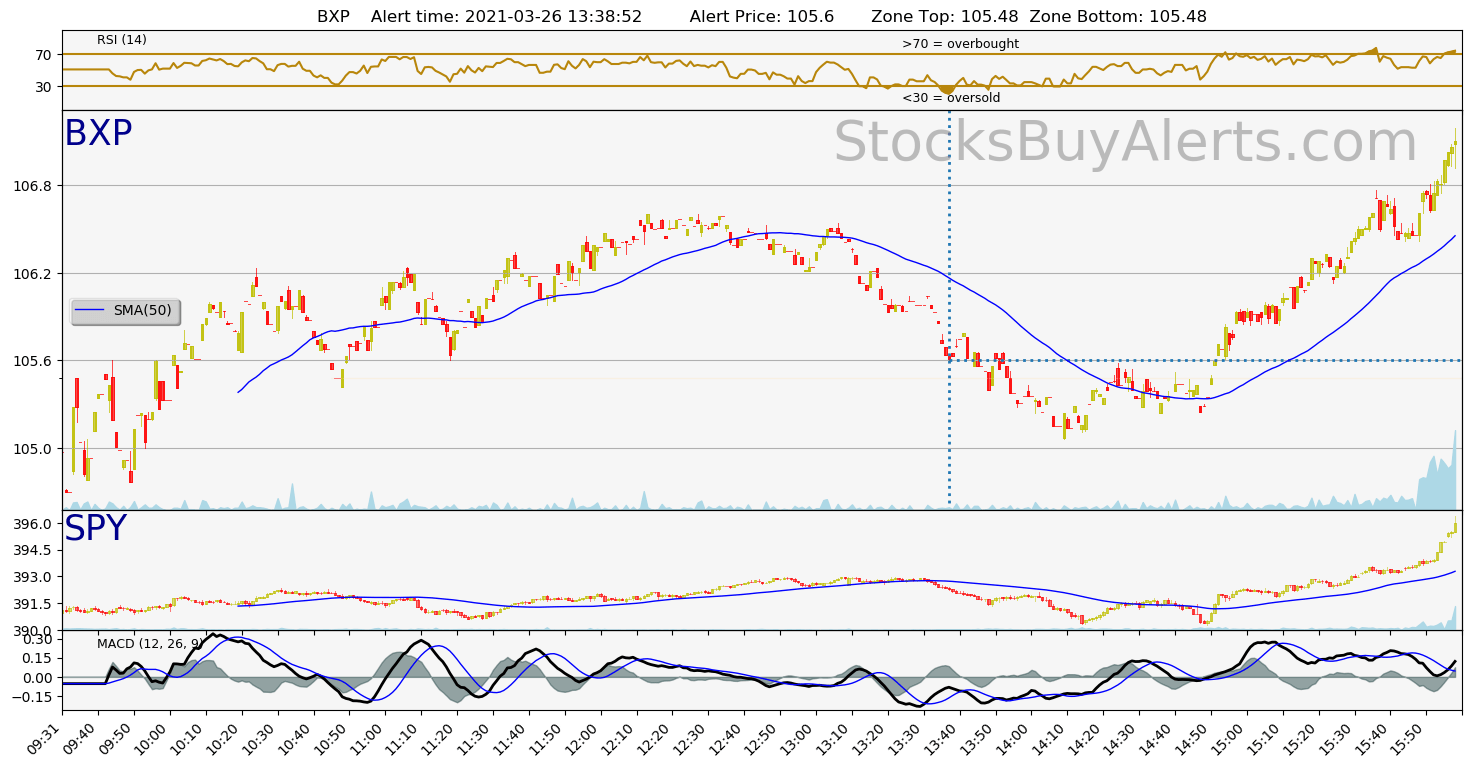

BXP on Friday, March 26, 2021

| Alert Time: | 2021-03-26 13:38:52 |

| Symbol | BXP |

| Alert price: | 105.63 |

| Demand zone range: | 105.48 – 105.48 |

| Demand zone time (when it formed): | 2021-03-26 10:46:00 |

| Peak price since zone was formed: | 106.6 (0.92% growth) |

| Day Range: | 104.7 – 106.6 |

| 52wk Range: | 69.69 – 110.36 |

| Prev Close: | 104.67 |

| Open: | 105.2 |

| Bid: | 105.53 |

| Ask: | 105.63 |

Open interactive stock chart for BXP

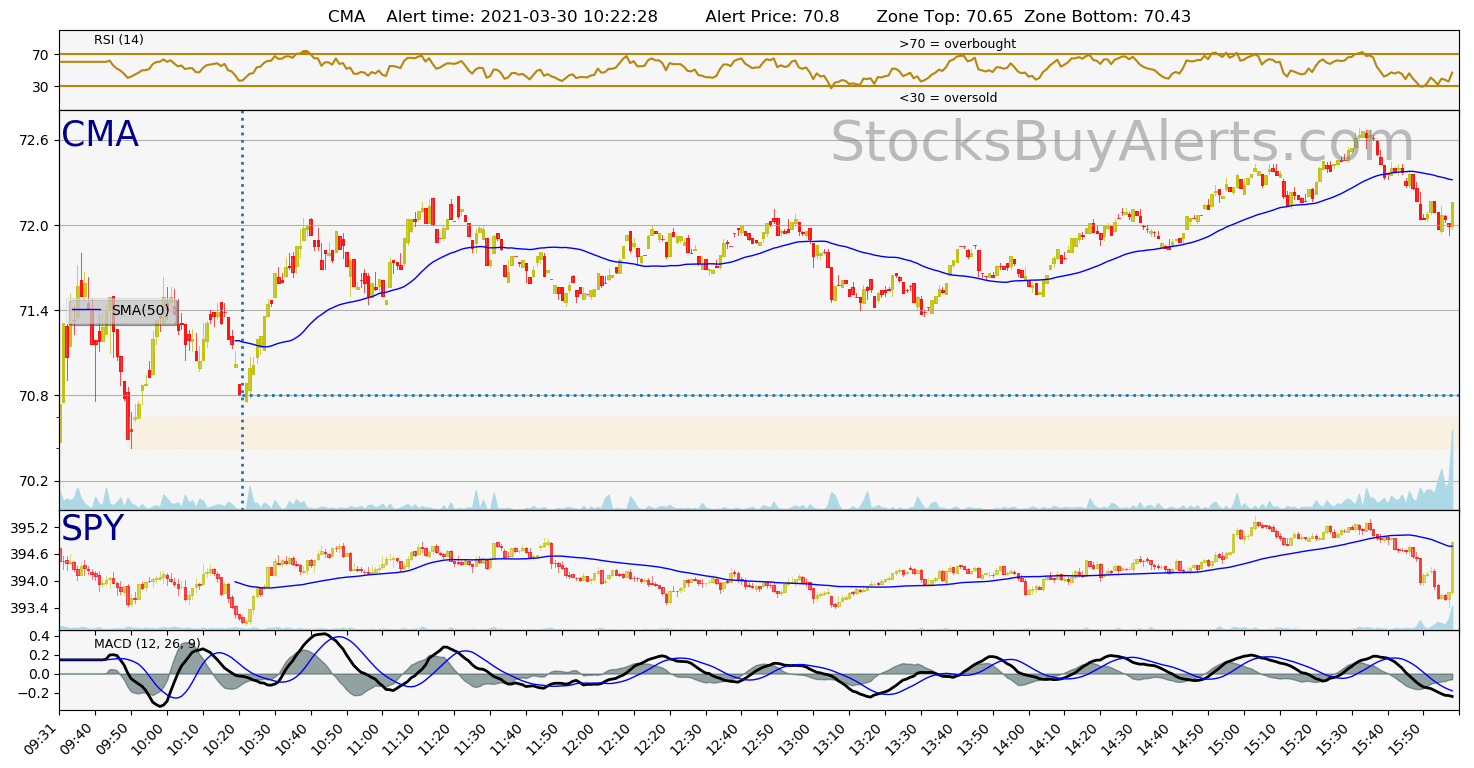

CMA on Tuesday, March 30, 2021

| Alert Time: | 2021-03-30 10:22:28 |

| Symbol | CMA |

| Alert price: | 70.74 |

| Demand zone range: | 70.43 – 70.65 |

| Demand zone time (when it formed): | 2021-03-30 09:50:00 |

| Peak price since zone was formed: | 71.63 (1.26% growth) |

| Day Range: | 69.57 – 71.8 |

| 52wk Range: | 25.8 – 73.73 |

| Prev Close: | 68.62 |

| Open: | 70.54 |

| Bid: | 70.61 |

| Ask: | 70.74 |

Open interactive stock chart for CMA

See also: Day Trading Alerts in Q4 2020