Supply and Demand are the key concepts of a market economy. Since market economy is based on exchange of goods and services for a value, for it to function there must be some goods and services to offer (supply) and people who are willing and able buy them (demand).

There is an important difference between classic Supply and Demand theory and Supply and Demand that applies to trading. In classic approach suppliers generally stay as suppliers in the process of exchange, however in trading we can’t identify certain participants as sellers or buyers. All participants in trading can be buyers or sellers at any point of time.

The concepts of Supply and Demand Zones in trading are mostly concerned with spotting where buyers and sellers are sitting on trading charts (price ranges). However, usually retail traders do not have access to the order flow, so it is not possible to precisely spot the buy and sell orders.

Supply and Demand Zones method helps to identify price intervals with, presumably, high concentration of sell and buy orders. When the price comes back to one of such areas, the exchange starts to fulfill those orders. If the total volume of orders is significant, the price will react by moving in an opposite direction. Using lagging Supply and Demand information, traders are making trading decisions based on historical data.

I focus my research specifically on Demand Zones, which are the stock price interval with, presumably, high number of unfulfilled “buy” orders. When the price comes to such an interval, the exchange starts to fulfill the “buy” orders, which, in turn, causes the price growth. The nature of a demand zone is best described by picture below:

Note that the price starts growing when it “touches” the demand zone.

Demand Zones’ nature is very similar to the one of Support Levels’. The key difference – the Demand Zone has wider range of prices. There are several ways for determining the width of a Demand Zone.

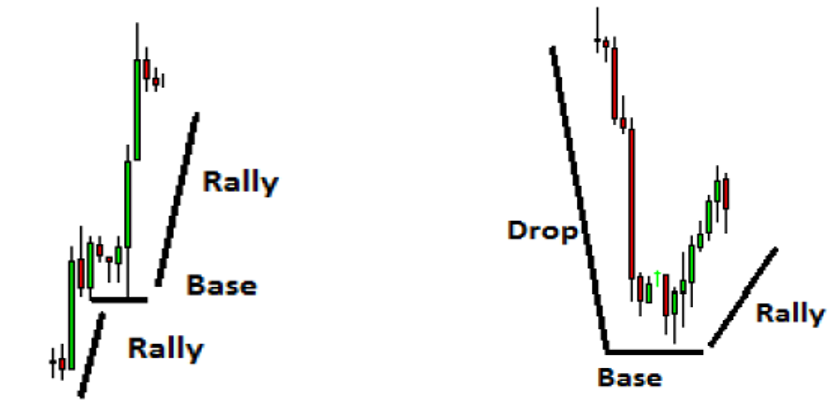

There are two types of Demand Zones formations: [1] Rally-Base-Rally (RBR) and Drop-Base-Rally (DBR).

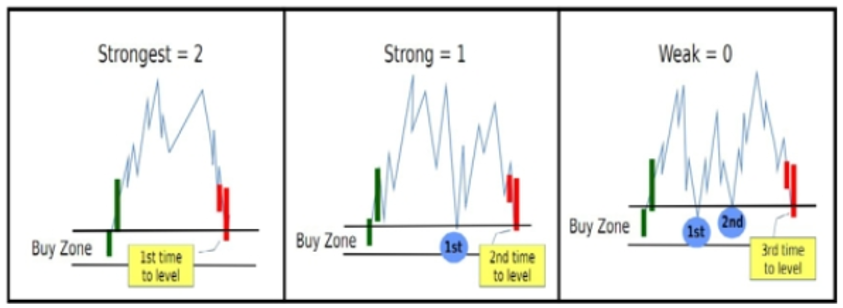

In general, the probability of price growth decreases when the Demand Zone was “visited” several times. Some sources refer to number of visits as “freshness”, other use the term “strength”. When a zone was visited one or more times it is considered less fresh or less strong (See the picture).

There is a similar concept of Supply Zones which are used as indicators of upcoming price decline.

In scope for my research I consider only “fresh” (unvisited) Demand Zones of Drop-Base-Rally type.

[1] Supply and Demand Zones – http://www.finanzaonline.com/forum/attachments/forex/2212736d1454155414-eur-usd-di-tutto-di-piu-149ma-ed-acegazettepriceaction-supplyanddemand-140117194309-phpapp01.pdf

https://www.investopedia.com/terms/z/zone-of-support.asp

https://www.tradingacademy.com/lessons/article/two-things-matter-trading/